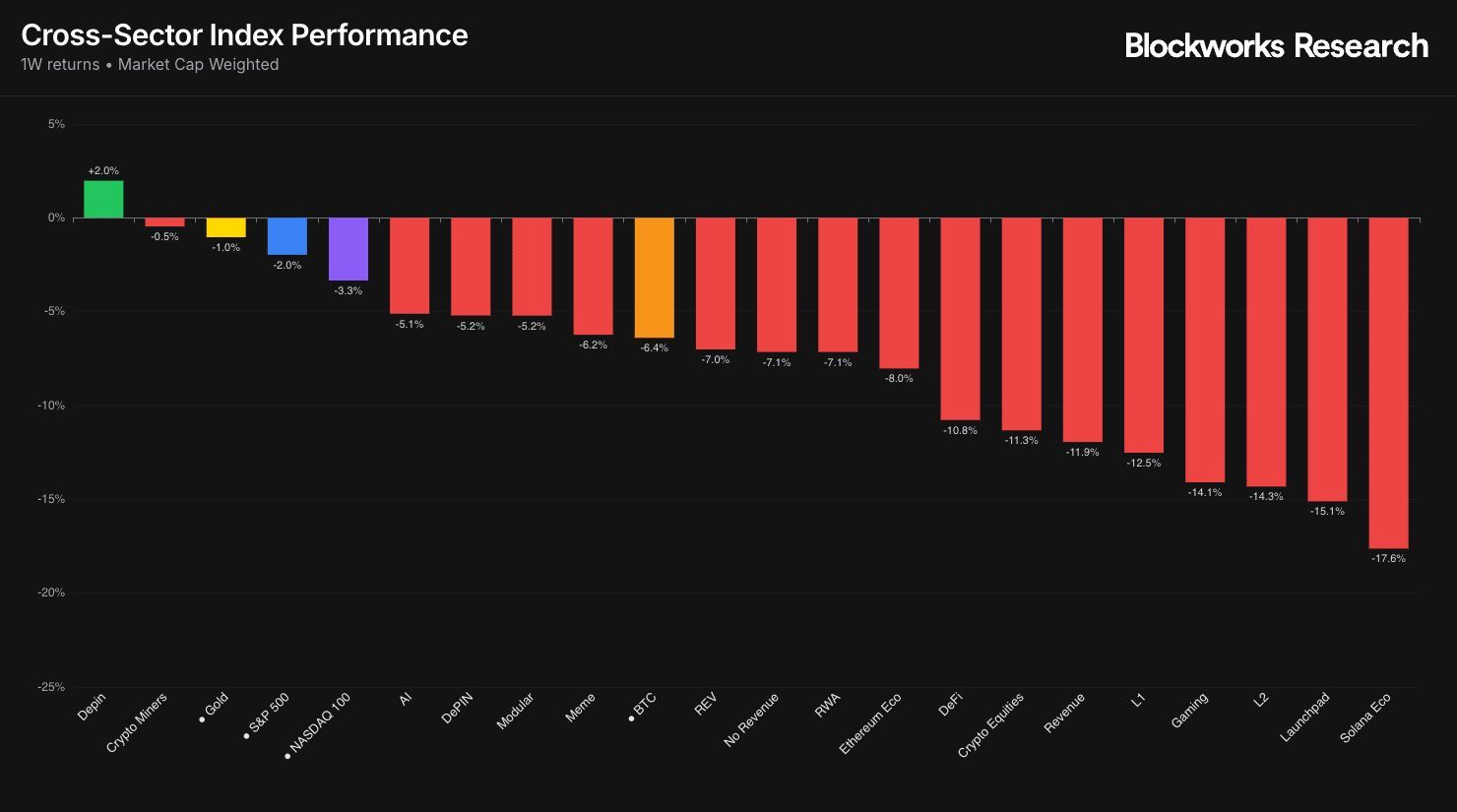

According to Blockworks Research, the Decentralized Physical Infrastructure Networks (DePIN) sector stood out as the only area of strength across the cryptocurrency market this week, rising 2% while nearly every other category posted losses. Despite Bitcoin and Ethereum trending lower, decentralized infrastructure projects demonstrated resilience amid broader market weakness.

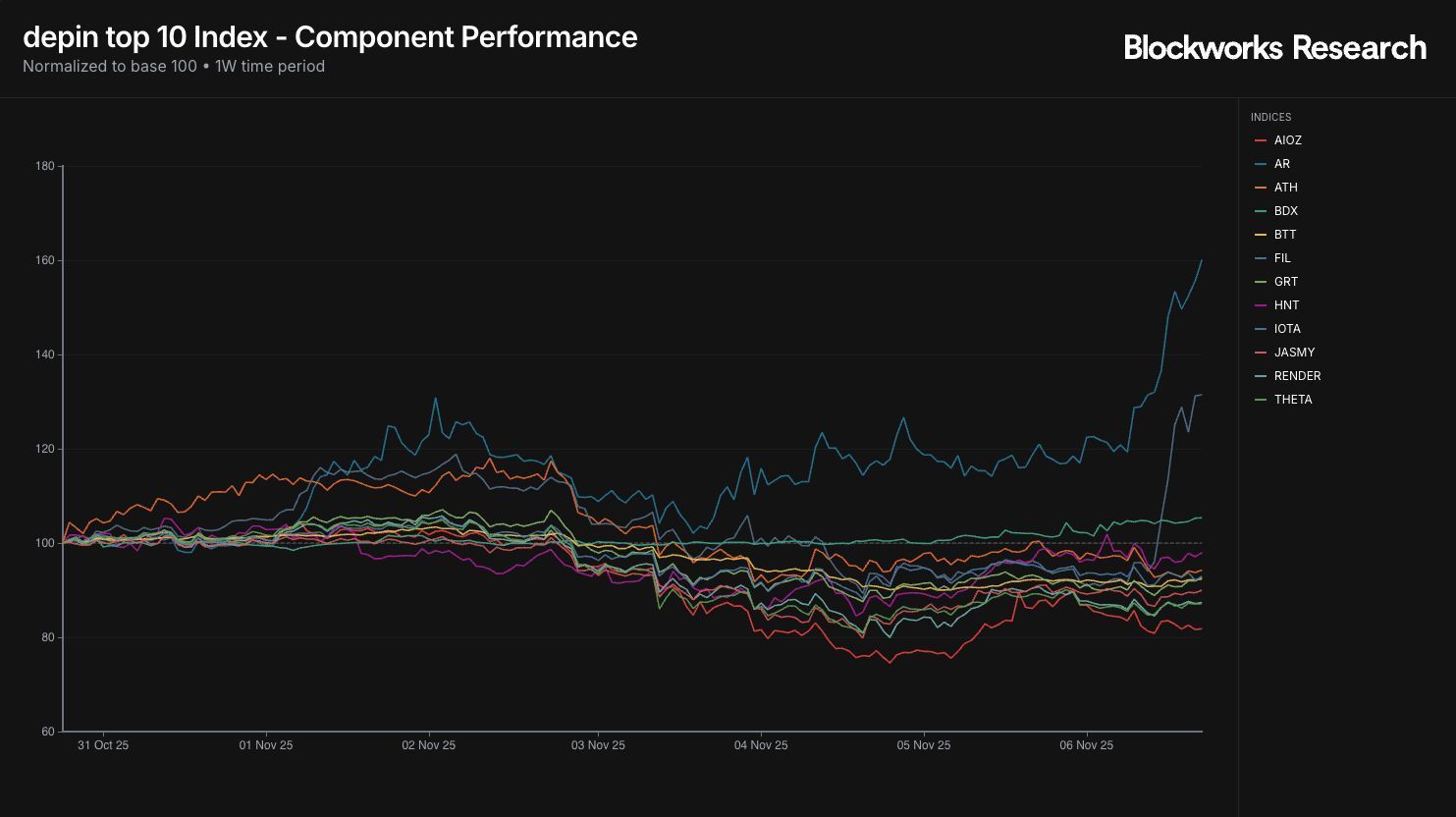

DePIN, a rapidly expanding category that merges blockchain technology with real-world infrastructure such as data storage, computing, and wireless connectivity, continues to attract significant investor interest. The standout performers in this sector were Arweave (AR), which saw a remarkable 60% increase, and Filecoin (FIL), which gained 31%, collectively accounting for the majority of the sector’s upward momentum.

Market Context: Broad Weakness Across Crypto Sectors

The latest Cross-Sector Index Performance chart from Blockworks highlights the isolated strength of the DePIN sector. Other major categories experienced significant declines:

- •Crypto Miners: -0.5%

- •AI Tokens: -5.1%

- •DeFi: -10.8%

- •Ethereum Ecosystem: -11.3%

- •Layer 1s: -12.5%

- •Layer 2s: -15.1%

- •Solana Ecosystem: -17.6% (representing the largest drop of the week)

This divergence in performance suggests a capital rotation toward infrastructure-based utility tokens as speculative altcoins continue to retrace their previous gains.

Why DePIN Stands Out

Analysts from Blockworks Research suggest that DePIN’s focus on real-world applications provides a more stable narrative in uncertain market conditions. The sector benefits from tangible use cases, including decentralized data hosting, storage, and computational power, making it less susceptible to hype-driven liquidity fluctuations.

“The DePIN sector’s outperformance while the rest of the market weakens is notable,” the report stated. “Projects like Arweave and Filecoin are benefiting from growing demand for decentralized storage and verifiable data solutions.”

Investor Takeaway: Rotation Toward Utility

With prevailing macro uncertainty and declining altcoin liquidity, investors are increasingly focusing on sectors that are demonstrating structural strength. As CryptoRUs noted, “It’s important to focus on sectors of strength or keep dry powder on the side for extremely oversold levels on strong projects.”

While DePIN remains a relatively niche category when compared to established ecosystems like DeFi or Layer-1 blockchains, its consistent growth during market downturns suggests a shifting narrative. This shift indicates that real-world utility and decentralized infrastructure may be poised to become crypto’s next major investment frontier.