Two of the most respected analysts in the crypto space, Egrag Crypto and Merlijn The Trader, are pointing to a powerful bullish setup that could define the next phase of Bitcoin and altcoin price action.

According to Egrag Crypto, Bitcoin’s long-term linear regression model (log scale) shows the asset sitting at the –1 standard deviation zone, its lowest level since the 2012 breakout. Historically, this zone has marked the early stages of massive bull runs, with BTC consolidating inside an ascending channel before surging to new highs. Egrag’s regression breakdown highlights key targets: a mean reversion level around $175,000, an upper channel near $250,000, and a potential upper regression target of $750,000. He argues that Bitcoin’s position suggests it is "just warming up for the next explosive leg."

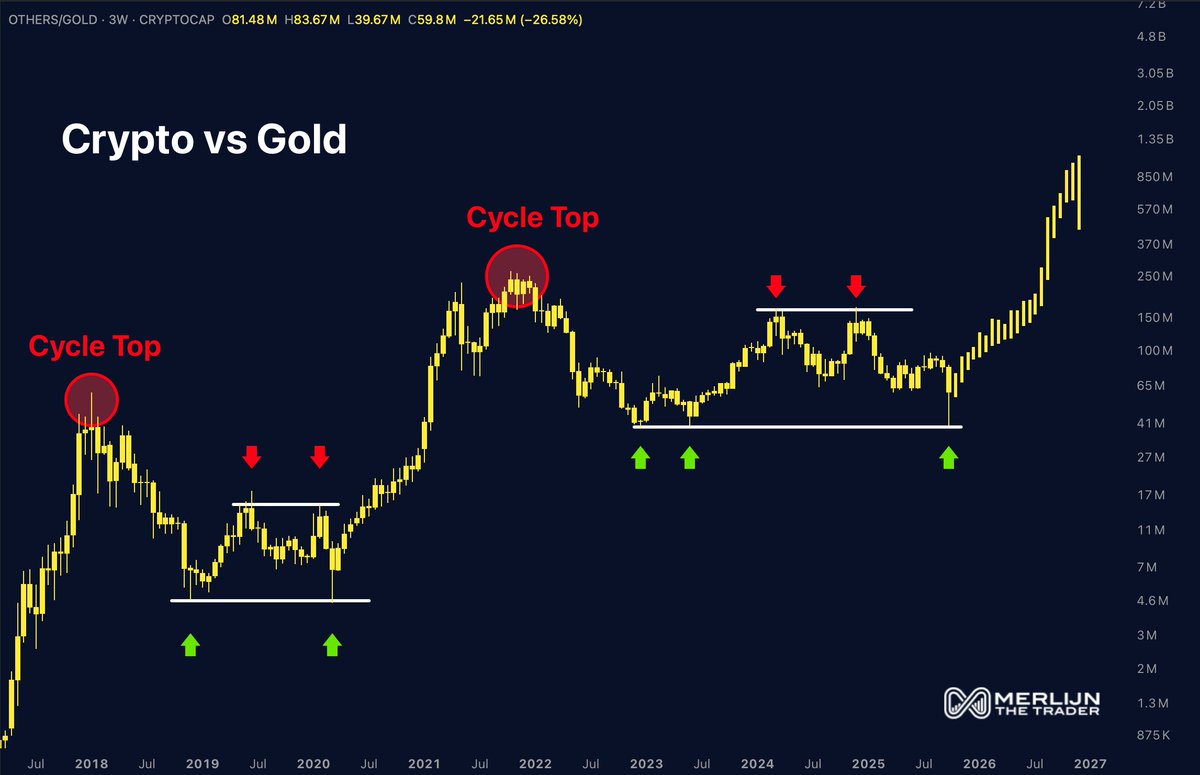

Meanwhile, Merlijn The Trader highlighted another major signal: the Crypto vs Gold ratio has flipped bullish for the first time since previous cycle tops. "Every time this ratio breaks out, altcoins go vertical," he said, noting that "smart money moves early, not during the breakout." His chart shows a macro reversal similar to the setups seen before historic altcoin rallies in 2017 and 2021.

Together, their analyses point to a broader narrative: Bitcoin’s structure remains strong, and the crypto market could be gearing up for a multi-year bull phase, with altcoins potentially leading the next wave once capital rotation begins.