According to data shared by Quinten Francois and Bitcoin Magazine Pro, Bitcoin’s six-month volatility has fallen to record lows, below levels seen during 2018 and 2020 consolidations. Historically, such volatility compression periods have preceded explosive moves, either upward breakouts or deep corrections, but in every major cycle, these lows have marked accumulation zones.

The chart shows volatility now hovering around 2%, with Bitcoin trading just above $102,000. Despite recent price pressure, this reduction in volatility suggests traders are adopting a “wait-and-see” stance, while institutional positioning remains steady following ETF outflows earlier in the week.

Bitcoin 6 months volatility has NEVER been lower pic.twitter.com/OqhUTJMpdd

— Quinten | 048.eth (@QuintenFrancois) November 8, 2025

Periods of ultra-low volatility often reflect exhaustion among leveraged traders. As markets stabilize, this creates the perfect setup for a volatility expansion phase, historically resulting in strong price action once momentum returns.

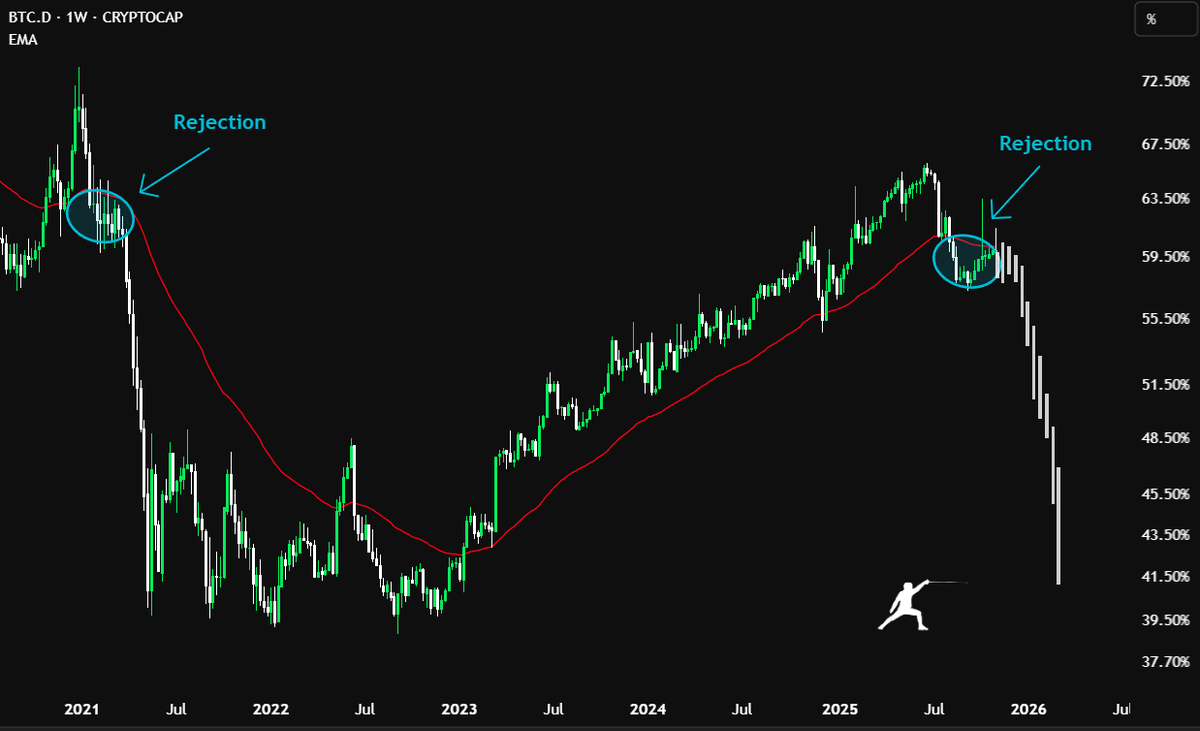

Dominance Rejection Mirrors 2021 Setup

Analyst Rekt Fencer highlighted that Bitcoin dominance, the measure of Bitcoin’s market share relative to all cryptocurrencies, has faced a technical rejection similar to the one that occurred in early 2021. Back then, the same structure preceded one of the most intense altseasons in crypto history, when tokens like Solana, Avalanche, and Cardano saw triple-digit surges.

This current rejection comes just as volatility hits historical lows, suggesting a brewing rotation. If dominance continues to decline from the 59–60% range, it could unlock liquidity for altcoins, which typically rally as traders shift from Bitcoin into higher-risk assets during consolidation phases.

The combination of low volatility and dominance rejection echoes classic pre-altseason patterns, where Bitcoin stabilizes while capital rotates into mid- and low-cap sectors.

“Max Fear” Often Marks Market Turning Points

Trader Merlijn pointed out that the market is once again in “Max Fear” territory, a condition that historically signals major bottoms rather than tops. His charts compare the current setup with previous cycle lows, such as April 2025, when Bitcoin rebounded from $75,000 to new highs above $110,000 shortly after reaching peak fear levels.

Merlijn noted that these periods don’t “look bullish” at first glance, but they tend to coincide with capitulation and the re-entry of smart money, long-term investors positioning ahead of the next major move. The structure suggests that Bitcoin could be in the final stages of its consolidation before a sharp reversal.

Altcoin Season Could Be Next

With volatility collapsing, dominance breaking down, and fear metrics flashing extreme lows, the setup for a potential altcoin season is forming. Analysts are watching for confirmation signals, particularly a rebound in total altcoin market cap and a sustained dominance rejection, to validate this transition.

If history repeats, a breakout could lift not only established altcoins like Ethereum, Solana, and XRP but also emerging sectors such as DePIN, AI tokens, and RWA projects, which have shown resilience in recent weeks despite broader market pressure.

In Summary

Bitcoin’s current calm could be deceptive. With six-month volatility at all-time lows, dominance rejection echoing 2021, and “Max Fear” sentiment taking hold, the stage may be set for the next explosive move, one that could usher in both a Bitcoin recovery and a renewed altcoin surge.