Bitcoin has concluded October with a decline, marking the first time in seven years that the cryptocurrency has finished the month in the red. This sets the stage for what is historically Bitcoin's most profitable month, November.

The recent dip in October defied expectations, as it marks only the third time since 2014 and 2018 that Bitcoin has experienced a monthly loss. This performance breaks a six-year streak where Bitcoin saw gains ranging from 5.56% to 39.93% in October since 2019.

A downturn in October can reset the market landscape, offering a fresh perspective for the fourth quarter of 2025. Based on historical monthly returns, November is poised for a positive trend, with the potential for significant gains if momentum drives Bitcoin above the $120,000 mark.

Several key factors appear to be aligning for a bullish fourth quarter. The Federal Reserve has implemented another 25-point tax rate cut, adoption rates continue to climb, and the competition with gold is intensifying this year.

Adding to the positive outlook is Bitcoin Hyper ($HYPER), a forthcoming Layer 2 solution designed to address the network's performance limitations.

November Price Prediction for Bitcoin

The most optimistic price predictions for Bitcoin suggest it could surpass $130,000 by the end of November. This target is considered plausible given Bitcoin's historical performance in Q4, particularly in the last two years when both October and November saw gains.

However, previous bullish forecasts for Bitcoin have not always materialized, raising questions about the likelihood of this prediction.

Analysts at TD Cowen share a similar sentiment, pointing to Bitcoin's resilience following the market crash on October 10th as a primary driver. They anticipate Bitcoin could reach $141,000 by December, setting a new all-time high.

The broader economic context also supports this potential outcome. Arthur Hayes expressed a strong "buy everything" sentiment following hints from Jerome Powell, the Federal Reserve Chair, about potentially ending Quantitative Tightening (QT) in the banking sector.

The reversal of QT, moving towards Quantitative Easing (QE), would inject more capital into the economy, directly benefiting the cryptocurrency market. Increased liquidity typically leads to higher investment in digital assets.

The potential end of QT could coincide with the resolution of the senate filibuster rule, which would prevent a governmental shutdown and allow the SEC to approve the numerous cryptocurrency ETFs awaiting clearance. Former President Donald Trump recently called for this in a post on Truth Social.

Furthermore, the presale of Bitcoin Hyper ($HYPER) is gaining traction. This project aims to enhance the Bitcoin network by making it faster, cheaper, and more scalable through innovative tools.

How Bitcoin Hyper Plans to Lift Bitcoin’s Performance Limitation

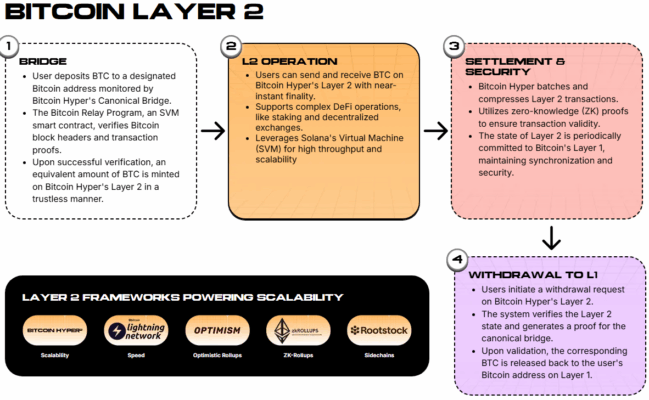

The native Bitcoin network is limited to approximately seven transactions per second (TPS), which affects its finality times, transaction costs, and overall scalability. Bitcoin Hyper ($HYPER) intends to address these limitations using technologies such as the Solana Virtual Machine (SVM) and the Canonical Bridge.

The integration of SVM is expected to bring Solana's high performance standards to the Bitcoin ecosystem, enabling the rapid execution of smart contracts and decentralized finance (DeFi) applications. This upgrade could significantly boost the network's performance to levels comparable to Solana.

The Canonical Bridge is designed to overcome Bitcoin's limited TPS, which currently places it below many other blockchains in terms of speed. This bridge will connect the Hyper ecosystem to the Bitcoin network, monitoring incoming transactions and minting users' BTC into the Hyper layer.

This process is designed to be swift, with the Bitcoin Relay Program confirming transaction details almost instantaneously. The wrapped bitcoins become immediately available for use within the Hyper layer and can be withdrawn back to the Bitcoin network at the user's discretion.

The Bitcoin Hyper presale has already raised $25.5 million, with the $HYPER token currently priced at $0.013205.

The project is attracting considerable investor interest, drawn by Hyper's ambitious goals, its comprehensive whitepaper detailing its roadmap, and the long-term potential of $HYPER.

With a planned release window between Q4 2025 and Q1 2026, the opportunity to invest is becoming more limited. Early investment is recommended for those interested in participating.