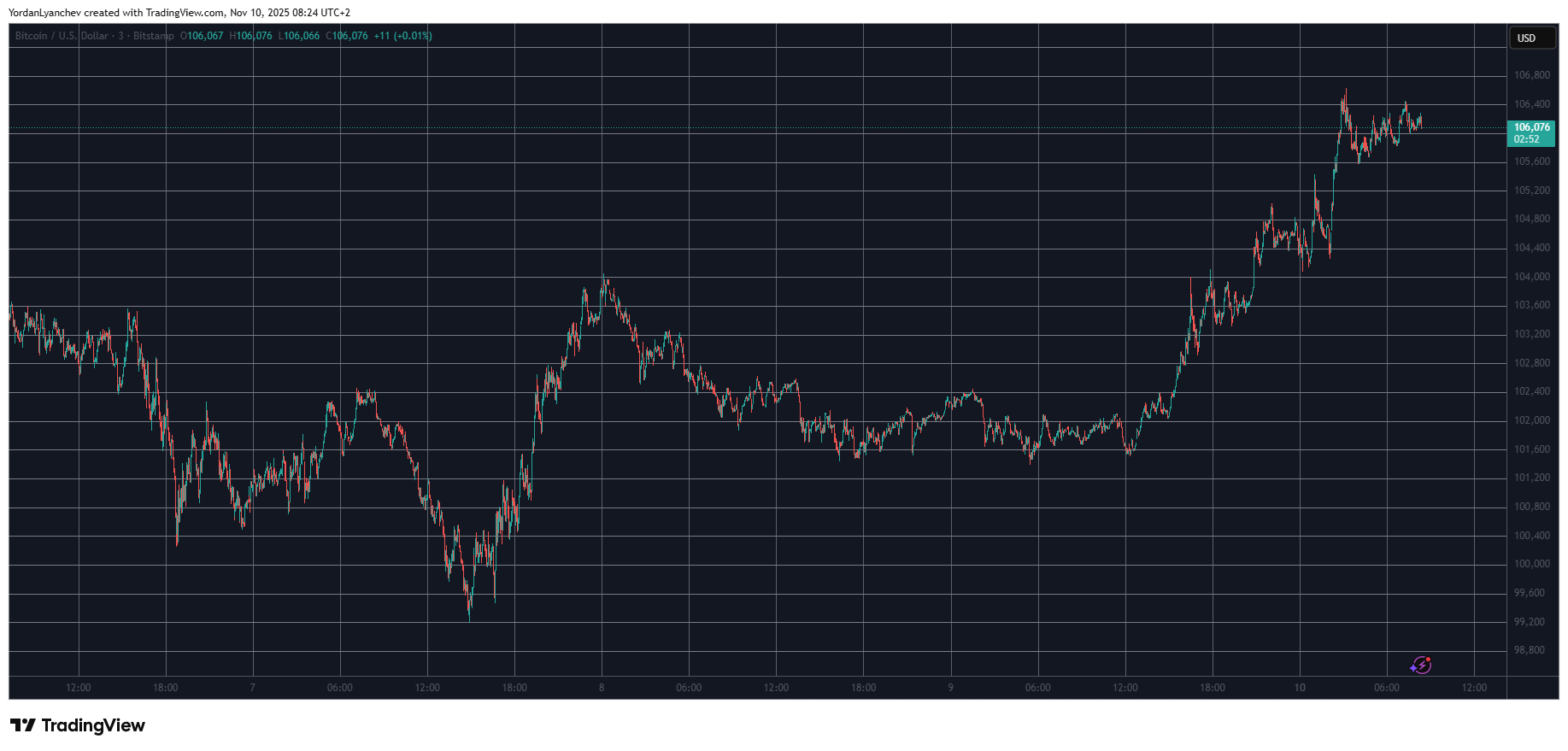

Bitcoin concluded the past calendar week with a notable price resurgence that continued into the new week, pushing the asset's value to nearly $107,000 for the first time since the previous Tuesday.

This rapid upward movement has significantly impacted over-leveraged traders. The popular trader known as James Wynn has once again made headlines after experiencing twelve liquidations within a 12-hour period, according to data compiled by Lookonchain.

Due to the market rebound, James Wynn(@JamesWynnReal) got liquidated 12 times again in the last 12 hours!

After suffering 45 liquidations over the past two months, James finally had one winning trade — but instead of taking profit, he kept adding to his position.

Ultimately, he… https://t.co/97dLldu5aSpic.twitter.com/5SVcU8ftns

— Lookonchain (@lookonchain) November 10, 2025

The analytics platform, Lookonchain, has been closely monitoring Wynn's trading activity. They reported that Wynn had been liquidated 45 times in the preceding 60 days. Despite finally experiencing a winning trade, Wynn chose to continue shorting Bitcoin over the weekend, a decision that proved detrimental as the market rebounded.

In less than a day, Wynn incurred total losses exceeding $85,410 through liquidations, leaving their account with a remaining balance of just $6,010.

Market Reaction and Altcoin Performance

This liquidation event occurred as Bitcoin's price experienced a significant jump. BTC rose from below $102,000 to a multi-day peak of nearly $107,000. This surge was reportedly influenced by a recent announcement from the US President. Donald Trump stated that numerous Americans, excluding high-income earners, would receive dividends of at least $2,000. Historical patterns suggest that such fiscal stimuli can lead to increased investment in cryptocurrencies.

The broader altcoin market also saw positive performance, with several cryptocurrencies registering impressive gains. WLFI led the pack, soaring by nearly 30%, followed by PUMP with a 16% increase, ZEC also gaining 16%, and UNI appreciating by 14%.

Overall Liquidation Data

Data from CoinGlass indicates that total liquidations across the market over the past 24 hours have reached $360 million. A substantial portion of this, over $260 million, came from short positions. Approximately 120,000 traders were liquidated during this period.