The cryptocurrency market is currently experiencing significant volatility, with Bitcoin recently dropping below the $100,000 mark, a level not seen since June. Despite this recent decline, industry experts are suggesting that the current sell-off may be nearing its conclusion. Optimistic analysts believe that once retail investors capitulate, a surge in institutional demand could propel Bitcoin towards new all-time highs within the coming months.

- •Bitcoin fell below $100,000, marking its lowest point since June, but experts remain optimistic about a potential rebound.

- •Market insiders view retail capitulation as a precursor to a bullish phase, with institutions expected to increase their involvement.

- •Former BitMEX CEO Arthur Hayes predicts that escalating US government debt will lead the Federal Reserve to implement "stealth QE," thereby boosting cryptocurrency markets.

- •Bitcoin has officially entered a bear market after experiencing a decline of over 20% from its October highs, raising concerns about further potential drops.

- •Analysts caution that if Bitcoin fails to maintain the $100,000 level, it could revisit lower support levels, including the $92,000 CME gap.

Bitcoin's recent dip below the $100,000 threshold, its lowest point since June, has understandably raised concerns among cryptocurrency investors regarding the market's future direction. However, prominent figures within the industry are offering a more positive perspective, suggesting that this correction is a natural part of a broader consolidation phase.

Expert Outlook on Market Bottom and Institutional Demand

Matt Hougan, CIO of Bitwise, attributes the recent market downturn to panic among retail investors, which he characterizes as "max desperation." Speaking to CNBC's Crypto World, Hougan noted that evidence of leverage blowouts and retail liquidation signals suggests that the market bottom might be approaching. "The market for crypto-native retail is just more depressed than I’ve ever seen," Hougan stated. Despite this, he also highlighted emerging signs of exhaustion and the continued strength of institutional interest.

Hougan emphasized that the capitulation of retail investors could pave the way for increased institutional demand, potentially driving prices higher. "Bitcoin could easily end the year at new all-time highs," Hougan predicted, projecting a target range of $125,000 to $130,000. This sentiment underscores a key belief: that the current period of volatility might be setting the stage for a renewed upward trend in the market.

Macroeconomic Factors and "Stealth QE"

In parallel, Arthur Hayes, the former CEO of BitMEX, has pointed to the increasing reliance of the US government on debt issuance as a potential catalyst for future cryptocurrency rallies. In a recent essay, Hayes argued that the Federal Reserve will likely be compelled to expand its balance sheet through "stealth QE," utilizing tools such as the Standing Repo Facility to support Treasury financing.

He explained that quantitative easing, a process where central banks purchase assets to increase the money supply, has historically led to higher asset prices. "If the Fed’s balance sheet grows, that is dollar liquidity positive, and ultimately Pumps the price of Bitcoin and other cryptos," Hayes stated. He views this ongoing process of government borrowing and liquidity creation as a significant factor that could reignite the Bitcoin bull market.

Bitcoin Enters Bear Market

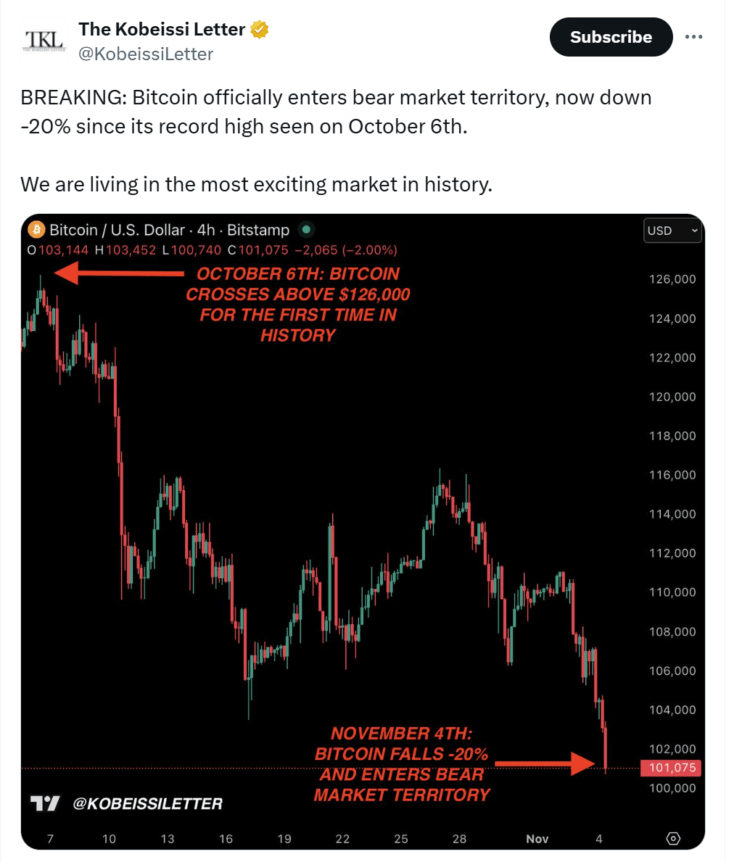

On Tuesday, the official Twitter account for The Kobeissi Letter announced that Bitcoin had officially entered a bear market. This classification follows a decline of over 20% from its record high, which was achieved on October 6. A chart accompanying the announcement visually illustrates this downward trend.

Additional warnings from traders suggest the possibility of further declines. Some analysts have indicated that Bitcoin could retest support levels around $92,000 if the critical price zone at $100,000 is not maintained. Investor Ted Pillows described the current market sentiment as "in free fall," emphasizing the potential for a retest of the CME gap down to $92,000. As this volatility continues, the cryptocurrency community remains cautious regarding the short-term outlook.

Despite the recent downturn, a significant number of analysts believe that broader macroeconomic trends, including increasing government debt and evolving central bank policies, could ultimately support a sustained recovery in the crypto markets, particularly for Bitcoin and Ethereum. As the market navigates these dynamics, investors are closely observing the next significant price movements that will shape the trajectory of these leading digital assets in the evolving financial landscape.