Key Insights

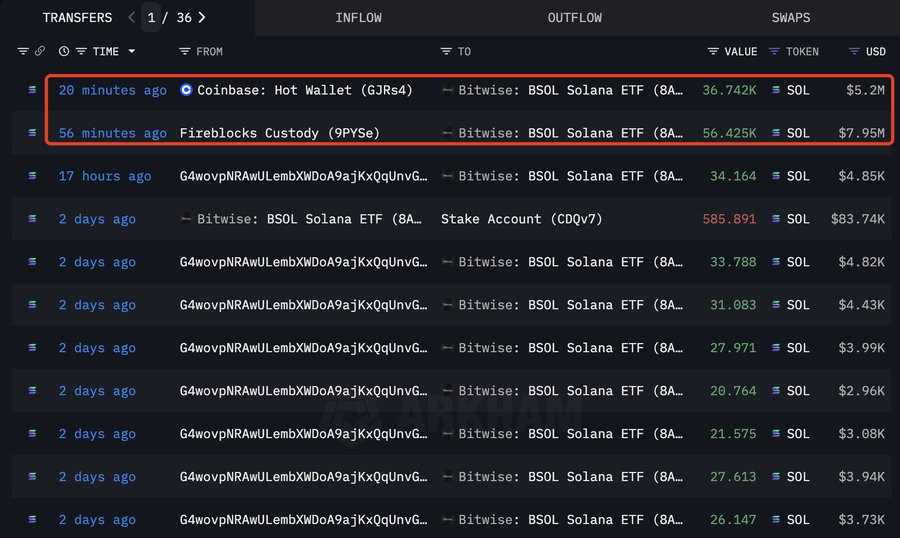

- •The Bitwise Solana Staking ETF acquired 93,167 SOL, valued at $13.15 million.

- •This transaction underscores significant interest from institutional investors in the BSOL ETF.

- •Following the purchase, the SOL price experienced an upward movement of over 1% within an hour, continuing its positive momentum.

Bitwise Adds $13.15 Million in SOL to its Solana ETF

Bitwise added another 93,167 SOL to its Solana Staking ETF on Friday, November 28. This purchase continues the trend of inflows into the ETF, indicating sustained interest from Wall Street investors.

The recent acquisition of SOL tokens was executed through Coinbase and Fireblocks and is valued at approximately $13.15 million. Data from Arkham shows that the Bitwise wallet still holds a substantial 3.95 million SOL tokens, currently worth $562.68 million.

This consistent institutional buying activity is expected to help mitigate retail-driven volatility, stabilize the price of SOL, and signal broader investor acceptance of the asset. Inflows into Solana ETFs generally contribute to a positive sentiment among institutional investors.

Total Inflows in Bitwise Solana Staking ETF

The Bitwise Solana Staking ETF (BSOL) has achieved net inflows totaling $527 million. On Wednesday, BSOL recorded inflows of $13.3 million.

It is worth noting that Solana ETFs experienced their first outflow of $8.2 million on Wednesday, a few weeks after commencing trading in early November. The 21Shares Solana ETF (TSOL) was the only ETF to record outflows, totaling $34.4 million.

Despite the introduction of multiple ETFs, the price of SOL has seen a decline of over 20%. Broader uncertainty within the cryptocurrency market, coupled with extreme fear sentiment, has also contributed to a significant drop in SOL's price.

According to Bitwise's official website, the BSOL ETF currently holds 4,411,732.99 SOL tokens, with a market value of $631 million. The issuer has announced a fee waiver until the Assets Under Management reach $1 billion.

SOL Price Jumps After Latest Buy

The price of SOL experienced an increase of over 1% in the past 24 hours, trading at $143.05 at the time of this report. The intraday trading range saw a low of $138.74 and a high of $143.30.

However, trading volume has decreased by 19% over the last 24 hours, suggesting a potential reduction in trader interest, especially considering the options expiry scheduled for today.

Market analysts have observed that Solana tends to find its bottom when investors capitulate, which subsequently attracts more participants to the ecosystem. Analyst Crypto Tony has indicated that a successful retest and hold of the $144 level would be a bullish signal for SOL's price.

A sustained price increase could potentially reach $150, supported by the ongoing inflows into the Bitwise Solana Staking ETF. Furthermore, a rebound to the 50-day Moving Average (DMA) level of $166 could trigger a substantial rally, potentially aiming for $200.

Data from CoinGlass indicates significant buying activity in the derivatives market. Currently, the total SOL futures open interest has risen by 3% to $7.53 billion over the last 24 hours.

The 4-hour SOL futures open interest on CME and Binance has increased by 0.36% and 0.38%, respectively. This trend suggests a growing bullish sentiment among derivatives traders.