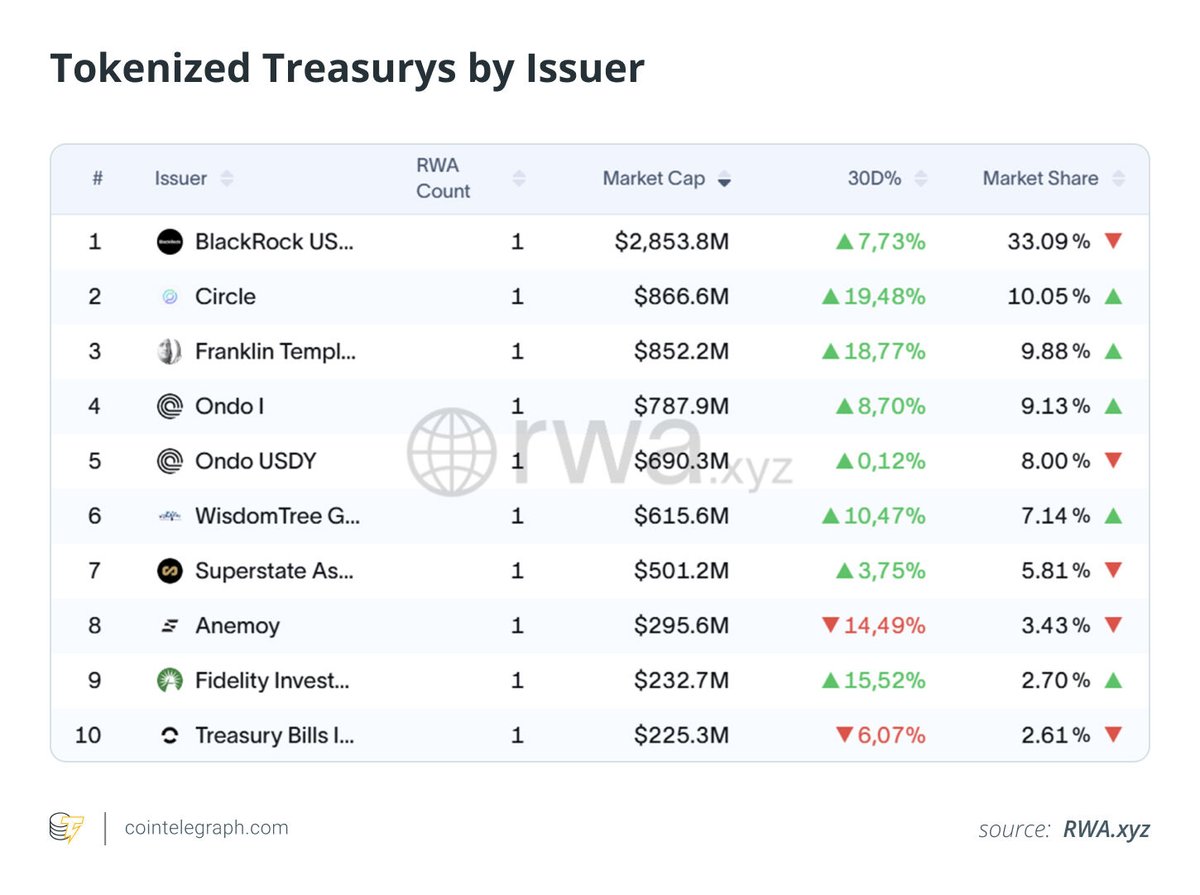

The tokenized U.S. Treasuries market is experiencing significant expansion, with BlackRock’s BUIDL fund currently holding a dominant 33% market share. However, other significant players such as Franklin Templeton, Circle, and Ondo Finance are demonstrating accelerated growth, indicating a potential shift towards greater diversification within this sector.

Market Overview

BlackRock’s BUIDL fund, valued at $2.85 billion, continues to lead the tokenized Treasury market, underscoring institutional trust in the asset manager’s on-chain investment strategy. Nevertheless, recent data indicates that other issuers are rapidly narrowing the gap in market share.

- •Circle has accumulated $866.6 million in tokenized Treasuries, marking a 19.5% increase over the past 30 days.

- •Franklin Templeton closely follows with $852.2 million, showing a growth of nearly 18.8% during the same period.

- •Ondo Finance’s combined offerings, Ondo I and Ondo USDY, collectively manage approximately $1.48 billion, further highlighting the increasing institutional adoption of tokenized assets.

The top 10 issuers also include WisdomTree, Superstate, Anemoy, Fidelity Investments, and Treasury Bills Ltd. This diverse group signifies active competition from both established financial institutions and crypto-native firms in the tokenized Treasury space.

Access Remains Restricted

Despite the impressive growth observed, access to tokenized Treasuries remains largely restricted. Direct investment is typically limited to Qualified Purchasers. Furthermore, secondary markets encounter structural barriers that include:

- •Collateralization haircuts of up to 10% when tokenized Treasuries are used as collateral, a rate considerably higher than the approximately 2% seen in traditional repo markets.

- •Redemption delays that align with legacy settlement cycles, which diminishes the real-time efficiency that tokenization aims to provide.

These current limitations make tokenized Treasuries less flexible when compared to their traditional counterparts. However, proponents believe that these inefficiencies will diminish as the underlying infrastructure matures.

The Bigger Picture

The tokenization of real-world assets, with a particular focus on U.S. Treasuries, is widely recognized as one of the most promising applications of blockchain technology. Throughout 2025, there has been a significant surge in global demand for yield-bearing, on-chain instruments, as institutions actively seek transparent and programmable fixed-income alternatives.

As the on-chain Treasury market approaches a total capitalization of $9 billion, analysts anticipate that increased accessibility and regulatory clarity will catalyze the next phase of growth. This development could potentially establish Real-World Assets (RWAs) as a new benchmark for digital asset-backed liquidity.