Fresh data confirms that BlackRock has executed its largest single-day Bitcoin withdrawal since entering the spot ETF arena, redeeming approximately $473.7 million worth of BTC in a single session. The timing could hardly have been worse. Sentiment was already fragile after days of aggressive selling, and the sudden surge of redemptions from the world’s most influential ETF issuer intensified fears that deeper liquidity stress is spreading across the market.

A Record Exit With No Institutional Buyers in Sight

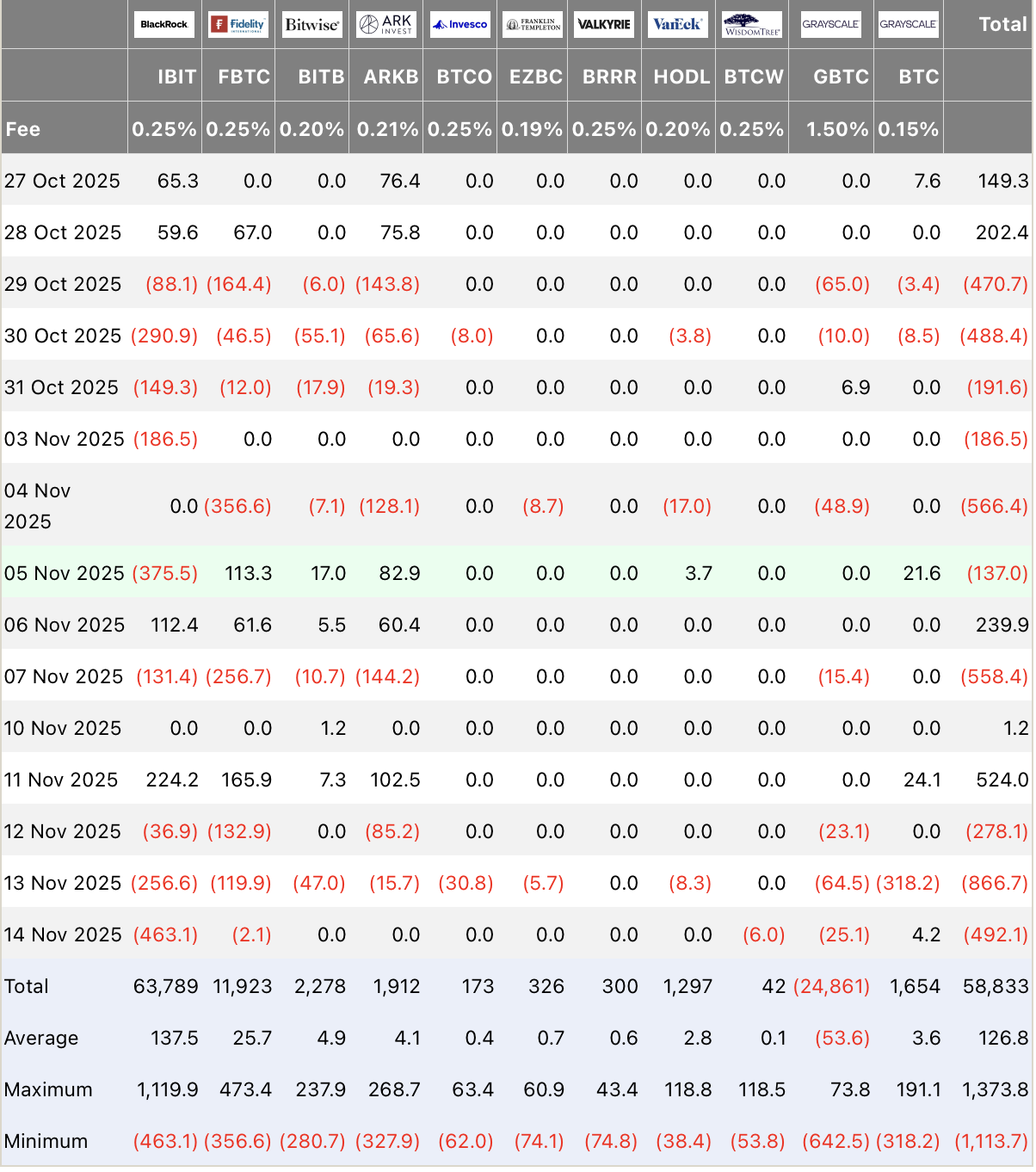

New figures from Farside Investors show that BlackRock’s flagship IBIT ETF accounted for $463.1 million of the total outflows, dwarfing activity from all other issuers. Fidelity’s FBTC saw a smaller $2 million drain, while Grayscale’s GBTC posted another $25.1 million in redemptions, continuing its long-running pattern of net-negative flows.

Across the board, there were no material inflows. Only a minor Grayscale product recorded a $4.17 million addition, a figure far too small to counter the near half-billion dollars leaving institutional products. Providers such as Ark 21Shares, Bitwise, VanEck, Invesco, Valkyrie, Franklin, and WisdomTree all reported zero inflows, underscoring a complete lack of dip-buying appetite among professional investors.

The blockbuster withdrawal comes only weeks after JPMorgan disclosed a $340 million position in IBIT, a reminder that even heavyweight allocators are now retreating to conserve liquidity rather than accumulate.

The Issue Isn’t Conviction – It’s Cash

Despite the alarming headlines, analysts stress that the outflows are not a referendum on Bitcoin’s long-term value. Instead, they point to something more systemic: investors running out of cash.

Funds under pressure often liquidate their most liquid assets first, and Bitcoin fits that category perfectly. Rather than risk selling illiquid traditional positions at steep losses, some institutions are tapping their crypto holdings to raise capital quickly. In stressed conditions, even high-conviction positions become collateral.

Liquidity Remains the Decisive Force

The combination of massive ETF redemptions and declining market-wide liquidity paints a clear picture: capital is exiting, and speculative demand is thinning out. Whether the downturn becomes a temporary reset or a deeper structural decline now depends on when fresh liquidity reenters the system.

If institutions continue redeeming ETFs to cover cash obligations elsewhere, Bitcoin may remain under sustained pressure, not due to waning belief in its future, but simply because there isn’t enough capital left to support the market.