The Web3, blockchain, and crypto universe are no longer confined to abstract promises. A clear turning point is being witnessed: projects are grounding themselves in the real world, usages are diversifying, and the numbers reflect this evolution. Between the surge in onchain fees and increasing institutional adoption, the ecosystem is demonstrating its growing power. Speculation is diminishing, and revenue generation is taking precedence. In essence, blockchain has transitioned from a playground to a significant industry.

In Brief

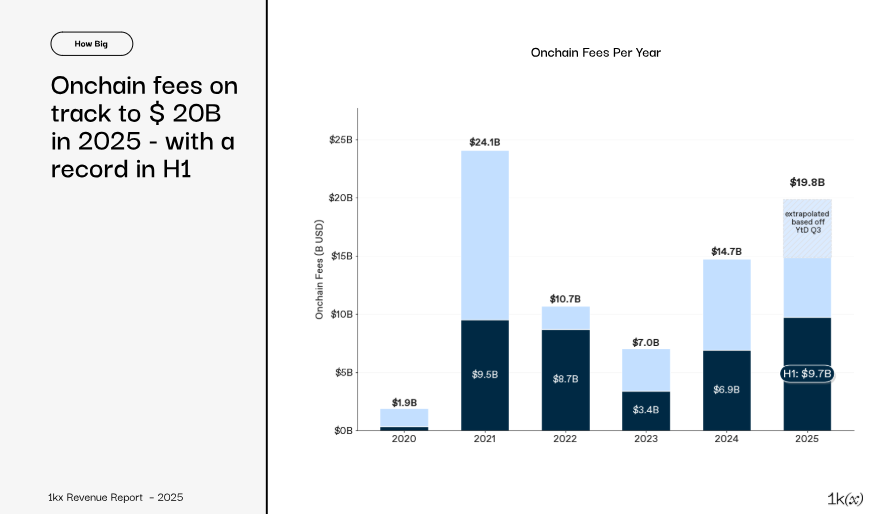

- •Onchain revenues are projected to reach $19.8 billion in 2025, according to the 1kx report.

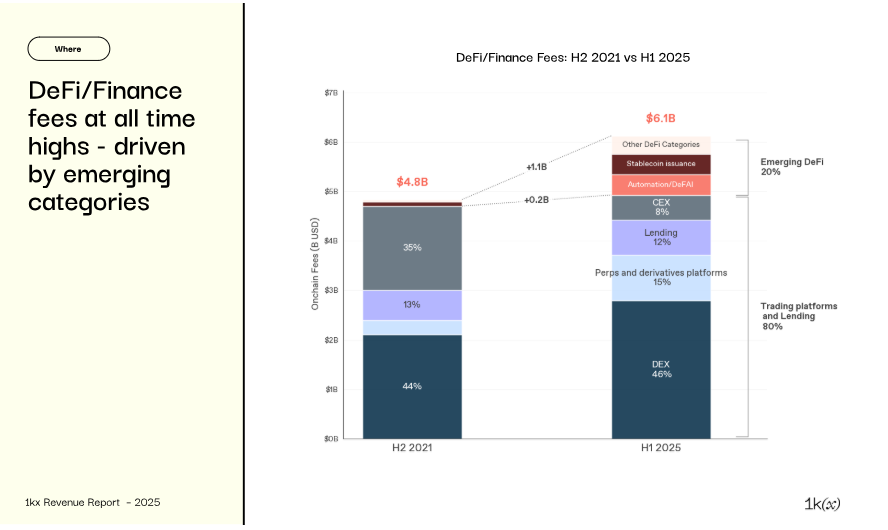

- •The DeFi sector now leads the crypto space, accounting for 63% of fees paid by users.

- •Decentralized applications and stablecoins are capturing the majority of value, impacting L1 blockchains.

- •Some protocols, such as Pump.fun, have rapidly generated millions, indicating swift leader rotation in the market.

A Strong Signal: Blockchain Moves from Gadget to Economic Lever

In 2025, onchain revenues from the blockchain are expected to peak at $19.8 billion, according to the 1kx report. The first half of the year already saw $9.7 billion generated, marking a 41% year-on-year increase. The report's authors emphasize:

We consider fees paid as the best indicator because they reflect recurring utility for which users and businesses are willing to spend. As protocols mature and regulation progresses, the ability to generate and distribute regular fee-based revenues will distinguish sustainable networks from simple emerging experiments.

Crypto is thus entering a new phase. The era of blockchains as mere speculation platforms is giving way to a more structured model based on real utility. Another indicator is the rise in protocols generating over $1 million in annual revenue, increasing from 125 in 2021 to nearly 400 today. Profitability is becoming a key criterion, and recurring cash flows are becoming the standard.

Following this trend, even the most popular blockchains like Ethereum, Solana, and Tron are experiencing stagnant fees. However, the economic activity is shifting towards upper layers, where users are paying for services rather than just validating transactions.

The Crypto Market Reorganizes: The Rush to Apps Finally Pays Off

Within the crypto industry, base blockchains are no longer the sole revenue generators. Applications are now capturing both attention and revenue. In 2025, 63% of onchain fees originate from sectors related to DeFi and financial services, while blockchains themselves capture only 22%. This represents a clear shift in market dynamics.

1kx data highlights a degree of centralization:

The top 5 protocols (Tron, Ethereum, Solana, Jito, Flashbots) captured about 80% of blockchain fees in the first half of 2025. Although this number remains high, it is an improvement from 2021, when Ethereum alone represented 86% of blockchain fees.

Despite this, emerging platforms like Pump.fun, Meteora, and Axiom have demonstrated remarkable growth, generating millions of dollars in revenue in exceptionally short periods.

The crypto market is becoming more agile. Stablecoins, DEXs, launchpads, and DeFAI bots are showing impressive momentum. This democratization is further fueled by an 86% reduction in fees since 2021, making applications accessible to hundreds of millions of wallets.

These New Blockchain Giants to Watch

In the blockchain ecosystem, the most striking developments are observed in the ratios. While established blockchains like Solana or Ethereum exhibit price-to-revenue (P/R) ratios exceeding 7,300x, some applications are priced between 8x and 17x. This disparity suggests potentially undervalued investment opportunities within the crypto space.

1kx analysts note that the top 20 protocols currently account for nearly 69% of onchain revenues. However, this dominance is not static. In 2024, a project like Meteora managed to surpass major players within a few weeks, illustrating the rapid disruption characteristic of the crypto market. This environment also serves as a testing ground for regulation. Frameworks like the European MiCA and American proposals such as the Genius Act are paving the way for institutional influx, thereby redefining the landscape.

Trends and Numbers Not to Miss

- •Nearly 400 protocols are generating over $1 million in ARR in 2025.

- •Onchain revenues have seen a 60% annual increase since 2020.

- •Tokenized assets now exceed $35 billion in onchain value.

- •DeFi accounts for more than 63% of blockchain revenues.

- •The average transaction cost has decreased by 86% over the past four years.

The crypto industry is breaking records and recovering over $4,000 billion, largely due to robust sub-sectors. DeFi and stablecoins are providing blockchain with essential elements it previously lacked: massive, visible, and measurable utility. Beyond tokens, there are now tangible uses. Behind the initial promises, reality is taking hold.