Market Overview and Fear Index

The Crypto Fear & Greed Index has fallen to 16, indicating extreme fear in the market. This level is approaching historic lows, which in a bull market often signals a potential recovery point. However, in a bear market, prolonged periods of fear are possible.

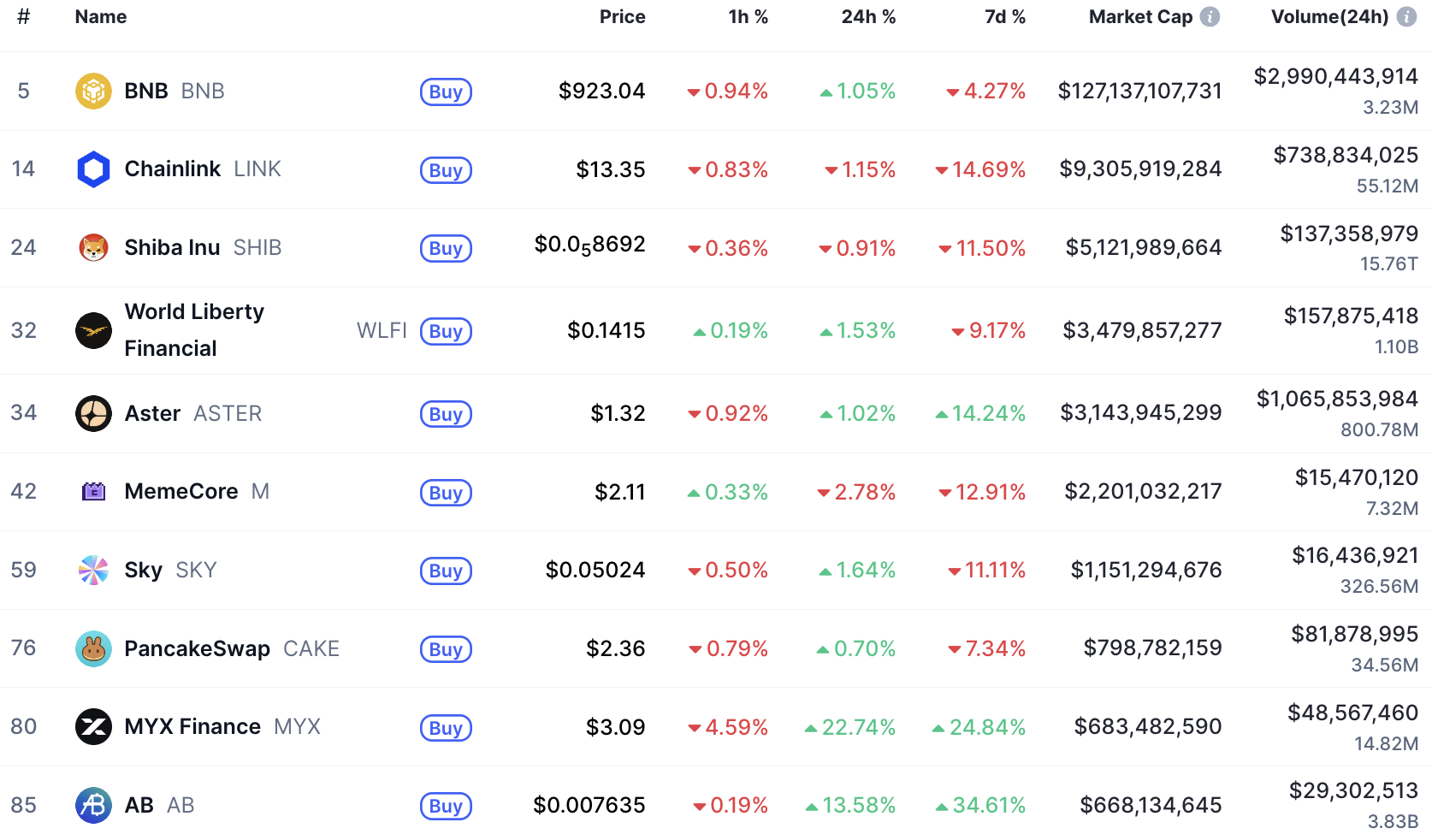

Amidst this sentiment, the cryptocurrency market is experiencing significant shifts. Bitcoin (BTC) is losing market share to altcoins as its dominance declines. Notably, the BNB Chain sector has demonstrated resilience and outperformed this week, despite the overall market downturn.

BNB Chain Market Performance

The BNB Chain sector experienced a further 5% decline this week, with its market capitalization dropping back to $221.3 billion, erasing approximately four months of growth. Despite this contraction, BNB Chain is showing stronger performance relative to most other altcoin sectors, even as altcoins collectively begin to outperform Bitcoin.

The majority of BEP-20 tokens are currently on a downtrend. This week, only three of the top 10 largest BNB Chain tokens managed to achieve positive gains.

BNB Chain's native perpetual decentralized exchanges (DEXs), Aster (ASTER) and MYX Finance (MYX), have shown notable strength this week. This performance is attributed to their low float token dynamics and consistent on-chain trading activity.

Within the $100 million market capitalization category, significant variations in performance were observed. The top performers this week saw gains exceeding 30% each:

- •Audiera (BEAT): +227.2% driven by stacked CEX and derivatives listings.

- •Wiki Cat (WKC): +48% with an unclear catalyst and low trading volume.

- •AB (AB): +34.6% following a partnership with World Liberty Financial.

- •Yooldo (ESPORTS): +30.2% after a listing on Biconomy.

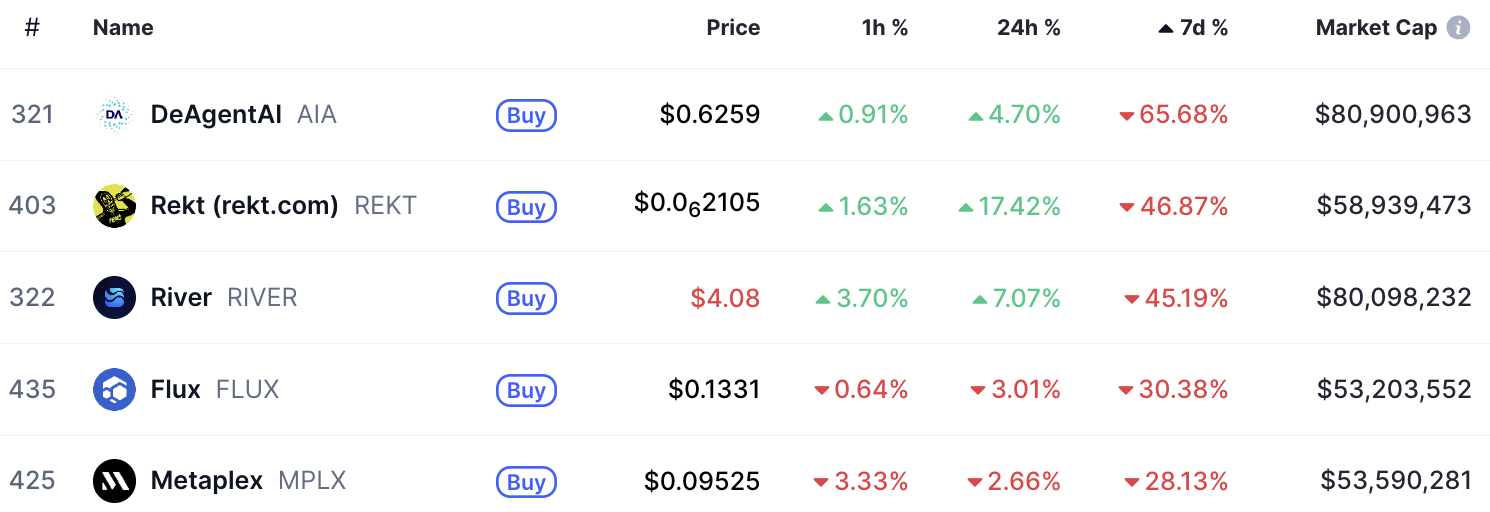

Conversely, tokens with market capitalizations below $100 million exhibited particularly weak performance, accounting for all of the week's largest losers. The inherent volatility of small-cap tokens typically extends to both upward and downward movements, as is currently evident.

Strategies for Navigating Volatile Markets

Given the current market volatility, it is advisable to pause, re-evaluate your portfolio, and reinforce your understanding of fundamental principles.

- •Develop a Clear Thesis: It is easy to be swayed by market noise. Adhere to your established strategy, but remain adaptable to new information that may alter the broader market outlook.

- •Identify Shorting Opportunities: Shorting can present a valuable opportunity, whether for hedging your portfolio or trading both sides of the market. This is particularly relevant for assets exhibiting fundamental weaknesses or poor market fit, though careful attention to funding fees is essential.

- •Exercise Caution with Leverage: The market can experience significant volatility around critical pivot points. Regardless of whether you are holding long or short positions, avoid adopting an all-or-nothing trading mentality.

The coming weeks will be pivotal in determining whether the current market correction is a temporary setback within a larger bull run or the beginning of a more sustained downturn.

BNB Chain Development Roundup

Despite the prevailing bearish sentiment, the BNB Chain ecosystem witnessed several notable developments this past week:

TermMax Alpha Launches on BNB Chain: TermMax has released its Alpha version on BNB Chain, introducing zero-liquidation leveraged trading for Binance Alpha tokens. This platform features fixed-cost leverage, on-chain order books, and structured vault strategies designed for advanced decentralized finance traders.

Renaiss Protocol Advances TCG RWAs on BNB: Renaiss Protocol has commenced alpha testing as BNB Chain's inaugural platform for Tokenized Collectible Real-World Assets (RWAs). The protocol is tokenizing PSA-graded physical trading cards into on-chain NFTs and developing liquidity infrastructure for collectible-backed assets on BNB Chain.

BNB Chain Hosts Local Hack: Abu Dhabi: In collaboration with YZi Labs, BNB Chain is organizing a Local Hack event in Abu Dhabi. This initiative includes online pre-hack sessions and an on-site hackathon, offering $160,000 in prizes and direct access to the $1 billion Builder Fund.

Aster to Introduce ‘Machi Mode’: Aster is set to launch “Machi Mode” next week. This feature will reward traders with liquidation points when their positions are significantly impacted, serving as a thematic nod to the well-known BNB Chain whale, “machibigbrother.”