Key Insights

- •Bitmine Immersion has expanded its Ethereum treasury by acquiring an additional 96,798 ETH, valued at $273 million.

- •This strategic acquisition boosts the firm's total Ethereum holdings to 3,726,499 ETH.

- •BMNR stock experienced an 8% decline, closing at $30.44 on Monday.

- •Ethereum's price faces potential downward pressure, risking a fall to $2,500 if bullish momentum falters above $3,000.

Bitmine Immersion Adds $273 Million in Ethereum

Bitmine Immersion, recognized as the largest Ethereum treasury, has further augmented its holdings by acquiring an additional 96,798 ETH, a transaction valued at $273 million. This move underscores the company's ongoing strategy to increase its Ethereum reserves during market dips. The firm also maintains holdings of 192 BTC and $882 million in cash, alongside a $36 million stake in Eightco Holdings (ORBS), positioning it as the second-largest global crypto treasury after Michael Saylor's Strategy.

The company disclosed its comprehensive crypto and cash holdings, totaling $12.1 billion, in an official announcement on December 1. Between November 24 and November 30, Bitmine Immersion successfully purchased the aforementioned 96,798 ETH. This latest acquisition brings the firm's total Ethereum holdings to 3,726,499 ETH, representing $11.52 billion at an average acquisition price of $3,008 per ETH. At current market prices, this substantial holding is valued at nearly $10.43 billion.

Tom Lee, a proponent of the company, highlighted the upcoming Fusaka upgrade, also known as Fulu-Osaka, scheduled for activation on December 3rd. Lee noted that this upgrade is expected to introduce significant improvements in scalability, security, and overall usability for the Ethereum network. Previously, BitMine Immersion had demonstrated its commitment to acquiring Ethereum during price declines, with a recent purchase of 20,532 ETH valued at $63.32 million.

BMNR Stock Performance Amidst Market Fluctuations

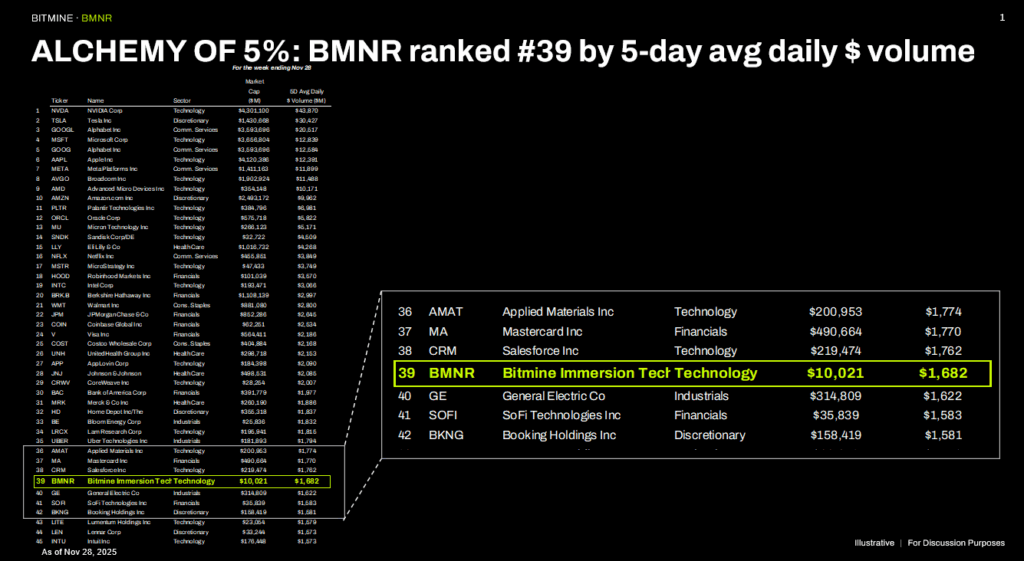

The recent dip in BMNR stock price, falling by more than 8% to $30.49 on Monday, coincided with a broader market downturn in Ethereum. On Friday, the stock had closed at $33.16, marking an 1.88% increase. The previous week saw a notable surge of 19% in BitMine stock, driven by a rebound in ETH prices. Year-to-date, the stock has demonstrated remarkable growth, rallying nearly 320%, according to Yahoo Finance data. Fundstrat recently reported that BMNR stock continues to be one of the most actively traded securities in the US, with an average daily trading volume of $1.7 billion recorded last week.

Ethereum Price Faces Resistance Above $3,000

The decline in BitMine stock occurred as Ethereum bulls struggled to maintain the price above the critical $3,000 level, leading to an 8% drop over the preceding 24 hours. At the time of reporting, ETH was trading at $2,811, with a 24-hour low of $2,798 and a high of $3,049. Trading volume experienced a substantial increase of 118% in the last 24 hours, suggesting that investors are actively considering buying opportunities at current price levels.

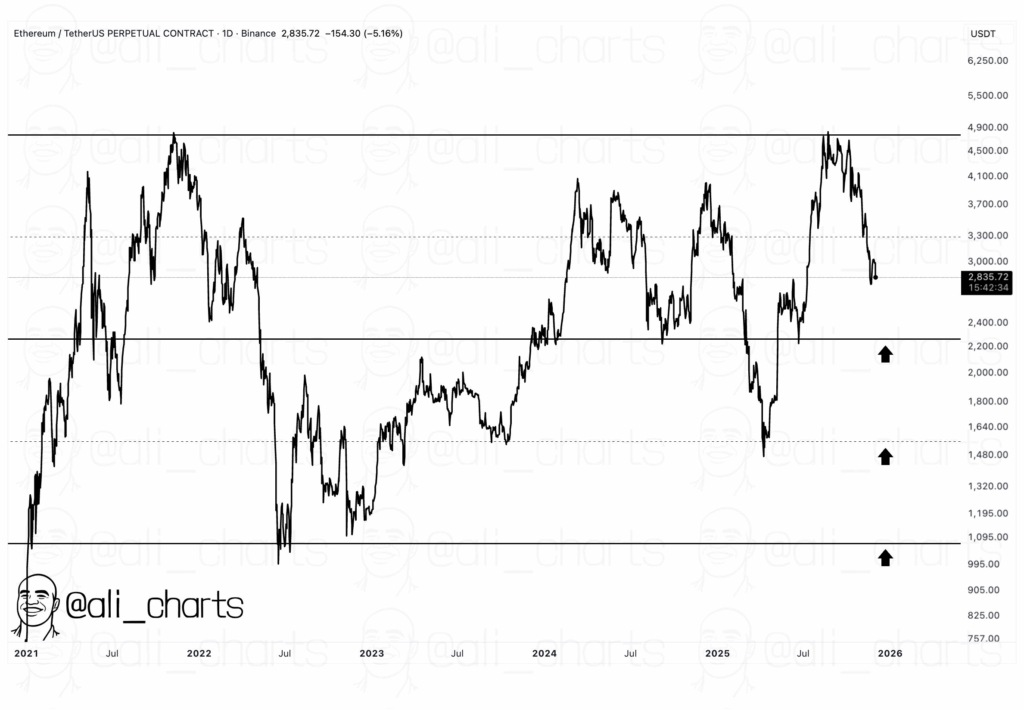

Crypto analyst Ali Martinez has expressed a bearish outlook on Ethereum, recommending a dollar-cost-averaging strategy with accumulation targets set at $2,200, $1,500, and $1,100. The $3,000-$3,100 range remains a significant resistance zone that needs to be breached for upward momentum to continue. Failure to hold the current support levels could lead to a price drop towards the $2,500-$2,600 range.

Data from CoinGlass indicates mixed sentiment within the derivatives market. The total ETH futures open interest saw a modest increase of 0.54% in the past hour. However, the 24-hour futures volume decreased by over 4% to $35.28 billion. Furthermore, the 4-hour ETH futures open interest on CME and Binance experienced declines of more than 1% and 3.50%, respectively, suggesting a cautious approach from traders in these platforms.