Bybit Halts New User Onboarding in Japan Amidst Emerging Regulations

Bybit, the world's second-largest crypto exchange by trading volume, has announced it will pause new user registrations in Japan starting October 31, as it adapts to new regulations from the country's Financial Services Agency. The company stated that this move is part of its proactive approach to align with Japan's emerging regulatory framework for digital assets. Bybit emphasized its commitment to operating responsibly and in compliance with local laws and regulatory expectations. Existing Japanese customers will not be affected, and all current services will remain operational. Bybit will provide further updates as discussions with regulators progress.

Nigerian Fintech Flutterwave to Launch African Stablecoin Payment System with Polygon

Flutterwave, Nigerias largest fintech company, is developing a cross-border payment platform powered by stablecoins, highlighting the growing role of blockchain technology in streamlining payments across Africa. The company is partnering with Polygon Labs to launch the service across its 34-country network. Polygon's blockchain infrastructure, designed for scalable, faster, and cheaper transactions on Ethereum, will be utilized to enhance settlement speed and efficiency. Flutterwave CEO Olugbenga Agboola believes this initiative could transform the flow of funds across the continent, enabling businesses and consumers to bypass the high costs and delays often associated with traditional payment systems. Agboola added that stablecoin adoption will drive more flows into Africa and has the potential to significantly increase current transaction volumes.

MEXC Apologizes to White Whale Trader Over $3 Million Freeze

Approximately three months after the pseudonymous crypto trader known as the White Whale reported that the MEXC exchange had frozen about $3 million worth of their holdings, a representative from MEXC has publicly apologized and released the funds. In an X post, MEXC Chief Strategy Officer Cecilia Hsueh admitted that the exchange "f***ed up" in handling the situation with the crypto user. In July, MEXC had frozen $3.1 million of the user's funds, citing the exchange's risk control rules. Hsueh stated that the funds have been released and the user can claim them at any time, also apologizing for an emotional and unprofessional communication with the trader.

Bitcoin's 4-Year Cycle Expected to See a 70% Drop in Next Downturn, According to VC

Vineet Budki, CEO of venture firm Sigma Capital, predicts that Bitcoin will continue to experience cyclical booms and busts, with a potential drawdown of up to 70% during the next market downturn. Budki explained that this significant retracement is likely because traders do not fully understand the asset they are holding. He stated that Bitcoin would not lose its utility if it dropped to $70,000, but the lack of understanding leads to selling pressure when prices decline.

Poor User Experience is Causing Stablecoin 'Ticker Fatigue,' According to ZachXBT

On-chain sleuth ZachXBT has highlighted that the proliferation of different stablecoin tickers and token standards is fragmenting liquidity across the crypto ecosystem. This fragmentation creates a poor user experience that is costly, technical, and time-consuming. ZachXBT pointed out obstacles such as cross-chain bridging restrictions, the need to pay gas and transaction fees in native blockchain tokens, and a lack of universal token support across exchanges. He provided an example where a user receives a stablecoin on one network but their wallet doesn't recognize it, requiring them to bridge another asset for gas fees and then navigate exchange limitations.

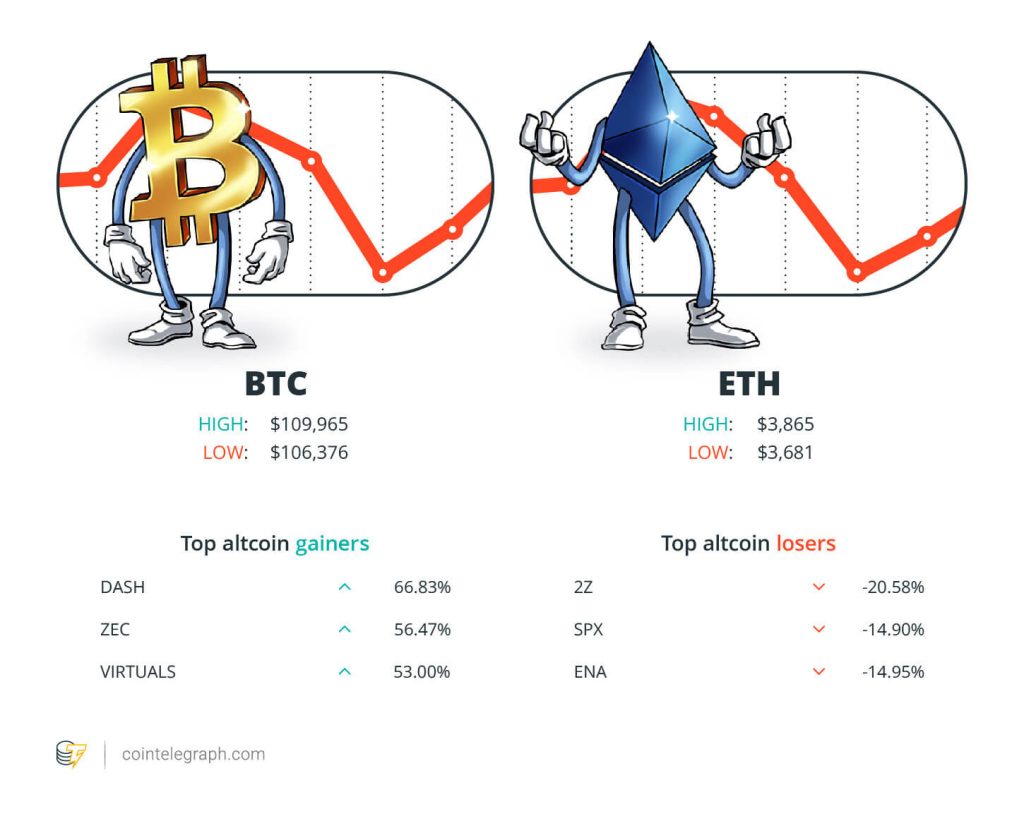

Market Performance: Winners and Losers

At the end of the week, Bitcoin (BTC) is trading at $109,965, Ether (ETH) is at $3,865, and XRP is at $2.50. The total market capitalization stands at $3.71 trillion. Among the top 100 cryptocurrencies, the largest gainers this week include Dash (DASH) at 66.83%, Zcash (ZEC) at 56.47%, and Virtuals Protocol (VIRTUALS) at 53.00%. The top three altcoin losers are DoubleZero (2Z) at 20.58%, SPX6900 (SPX) at 14.90%, and Ethena (ENA) at 14.95%.

Most Memorable Quotations

"For the last 20 years. We’ve been gradually losing our digital freedoms."

"Generally, we dont have any plans to pursue M&A [merger and acquisition] activity, even if it would look to be potentially accretive."

"I was a little distracted because I was tracking the predictions market about what Coinbase will say in their next earnings call, and I just want to add here, the words Bitcoin, Ethereum, blockchain, staking, and Web3, make sure we get those in before the end of the call."

"Overall, we remain moderately risk-on and see a credible path for Bitcoin to break its all-time high before year-end."

"Most stablecoin demand comes from outside the US, expanding dollar dominance globally, not competing with your local bank."

"Altcoin ETF inflows are the inevitable next step after Bitcoin and Ethereum ETFs proved institutional demand."

Top Prediction of The Week: Quantum Threat to Bitcoin Still Years Away

Amit Mehra, a partner at venture capital firm Borderless Capital, believes that while quantum computing is still in its infancy, it could pose a threat to Bitcoin and other proof-of-work algorithms in the future. Speaking at the 15th Global Blockchain Congress in Dubai, Mehra indicated that his firm is closely monitoring quantum compute and the development of quantum resistance technology. He anticipates that quantum computing will take until the end of the decade to mature significantly but cautioned against underestimating the rapid evolution of technology, suggesting it is a problem that could arise in the very near future, if not immediately.

Top FUD of The Week: New Hampshire Senate Stalls Crypto Mining Deregulation Bill

A bill aimed at deregulating crypto mining in New Hampshire was stalled after the state Senate Commerce Committee experienced a split vote. Senators reported a surge in public feedback on the bill since its last debate. After being deadlocked on both advancing and rejecting the measure, the committee ultimately voted to send the bill for further review in interim study. House Bill 639 proposed to prevent municipalities from imposing restrictions on crypto mining, such as those related to electricity use or noise, and to prohibit state and local authorities from levying unique taxes on digital assets.

In other news, Australian police successfully cracked a coded cryptocurrency wallet backup containing 9 million Australian dollars ($5.9 million). Australian Federal Police (AFP) Commissioner Krissy Barrett described the effort as "miraculous work," crediting a data scientist within the agency for deciphering the wallet. During an investigation into an alleged criminal who stockpiled cryptocurrency, the AFP discovered password-protected notes and an image containing random numbers and words on the suspect's phone. The digital forensics team determined this could be related to a crypto wallet. The suspect allegedly refused to hand over the wallet keys, an offense that carries a 10-year penalty in Australia.

Coinbase researchers have stated that concerns from banks about stablecoins harming US banks by cannibalizing deposits are misplaced and do not reflect the real-world uses of these tokens. Coinbase policy chief Faryar Shirzad argued that the narrative of stablecoins destroying bank lending ignores reality, as most stablecoin demand originates outside the US, thereby expanding dollar dominance globally rather than competing with local banks. Shirzad shared a market note suggesting that these arguments echo past worries about innovations like money market funds and fail to account for how stablecoins are actually utilized.

Top Magazine Stories of The Week

Grokipedia: Far Right Talking Points or Much-Needed Antidote to Wikipedia?

Elon Musk's Grokipedia is being examined to determine if it serves as a more neutral and comprehensive rival to Wikipedia or if it primarily disseminates far-right talking points.

China Officially Hates Stablecoins, DBS Trades Bitcoin Options: Asia Express

DBS has announced the trade of Bitcoin and Ethereum options with Goldman Sachs, while China's central bank chief has expressed disapproval of stablecoins.

Solana vs Ethereum ETFs, Facebook's Influence on Bitwise: Hunter Horsley

Hunter Horsley discusses the differences between Solana and Ethereum ETFs and reflects on how his experience as a product manager at Facebook influenced his approach at Bitwise.