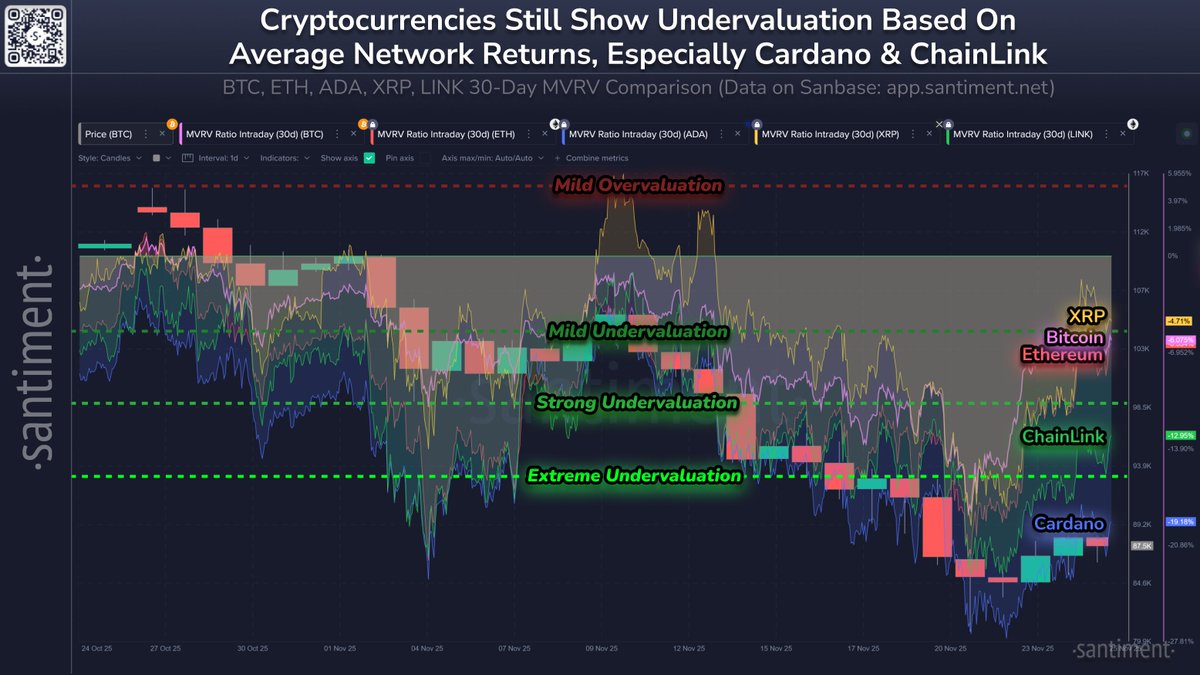

New data from Santiment indicates that despite a brief rebound at the start of the week, major cryptocurrencies are still experiencing significant short- and mid-term losses. Average wallets across several top networks are deeply in the red over the last 30 days. The firm’s latest MVRV-based readings highlight clear undervaluation zones across the market, with Cardano and Chainlink showing particularly sharp discounts.

Cardano, Chainlink Show the Sharpest Discounts

Santiment’s network return data reveals the following average 30-day returns:

- •Cardano (ADA): –19.2%, signaling extreme undervaluation

- •Chainlink (LINK): –13.0%, categorized as strong undervaluation

- •Ethereum (ETH): –6.3%, showing mild undervaluation

- •Bitcoin (BTC): –6.1%, also in mild undervaluation territory

- •XRP (XRP): –4.7%, seen as very slight undervaluation

These readings suggest that most assets, including Bitcoin and Ethereum, remain below their fair-value bands following November’s selloff.

What the Chart Shows

The MVRV chart visualizes each asset as it moves through Santiment’s undervaluation zones. Cardano is positioned the deepest, falling within the extreme undervaluation band and clearly separated from the rest of the group.

Chainlink follows in the strong undervaluation range, reflecting the sharp decline in its 30-day performance. Ethereum and Bitcoin are clustered around the mild undervaluation zone, indicating that their losses are meaningful but still far from extreme. XRP hovers closest to the neutral boundary, showing only a slight deviation from fair value.

The overall layout of the chart underscores how consistently these assets have traded within undervalued territory over the past month, with repeated dips signaling ongoing pressure across the broader market.

Overall Market Signal

Santiment’s MVRV analysis frequently highlights when assets become overheated or historically cheap. Currently, the data strongly leans towards the undervalued side, with ADA and LINK exhibiting the steepest discounts among major cryptocurrencies. Despite the early-week recovery, most wallets remain underwater, suggesting that investor confidence has not yet fully returned and that investors might be waiting for clearer stabilization before re-entering the market with conviction.