A dormant Cardano whale has just executed one of the most disastrous on-chain trades of 2025, vaporizing $6.05 million in a single transaction due to low liquidity and poor execution strategy.

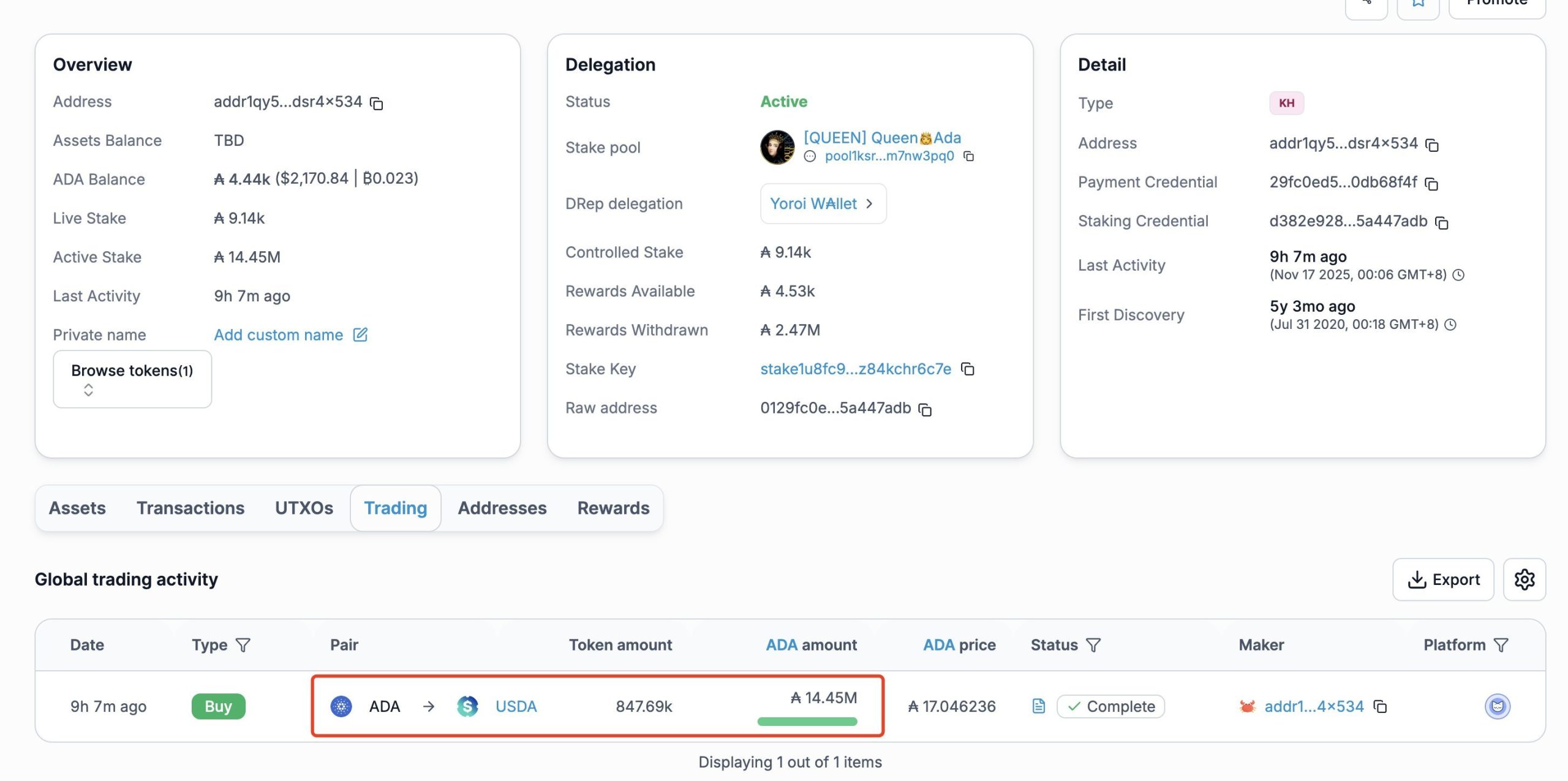

According to on-chain data reviewed by investigator ZachXBT, the wallet, active for the first time since September 2020, swapped 14.4 million ADA (worth $6.9 million) for just 847,696 USDA, a Cardano-native stablecoin pegged to the U.S. dollar. Instead of receiving close to the expected dollar value, the holder walked away with barely 10% of the tokens’ real market worth.

A Five-Year Dormancy Ends in Disaster

The wallet, beginning with addr1qy…d5r4x534, had shown no activity for roughly five years before suddenly executing the massive swap. Because the transaction was routed through an illiquid pool, the enormous order violently distorted the local price of USDA.

The result: The stablecoin spiked briefly to nearly $70, according to on-chain pricing, before sharply correcting back toward its intended $1 peg. The whale, meanwhile, received far below the correct conversion value.

How the Whale Lost Millions

The loss stemmed from two critical mistakes:

- Swapping in a severely illiquid pool

The pool lacked enough depth to support a $6.9M sell order, causing an instant price dislocation. - Choosing a lesser-known stablecoin pair (USDA)

With thin liquidity and limited trading volume, even moderate trades can trigger slippage, and this was anything but moderate.

By the time the swap was completed, the whale effectively accepted an exchange rate where ADA was valued at just a fraction of its true market price.

What the Data Shows

Blockchain dashboards confirm:

- •The ADA balance dropped from 14.4M to 0

- •The whale received 847,696 USDA

- •This represents a realized loss of ~$6.05 million

The USDA stablecoin’s rapid flash-spike toward $70 appears to have been caused, at least partially, by the whale’s own transaction.

A Cautionary Tale for Crypto Traders

This incident underscores why:

- •Large orders must be broken into smaller batches

- •Trades should only be executed in deep-liquidity pools

- •Flash-spikes in low-cap or low-liquidity pairs can destroy value instantly

More importantly, it highlights how even experienced holders, or wealthy ones, can suffer catastrophic losses from a single misstep in the decentralized ecosystem.

The wallet’s ADA had sat untouched for half a decade. Now, the owner must confront one of the largest self-inflicted losses in Cardano’s on-chain history.