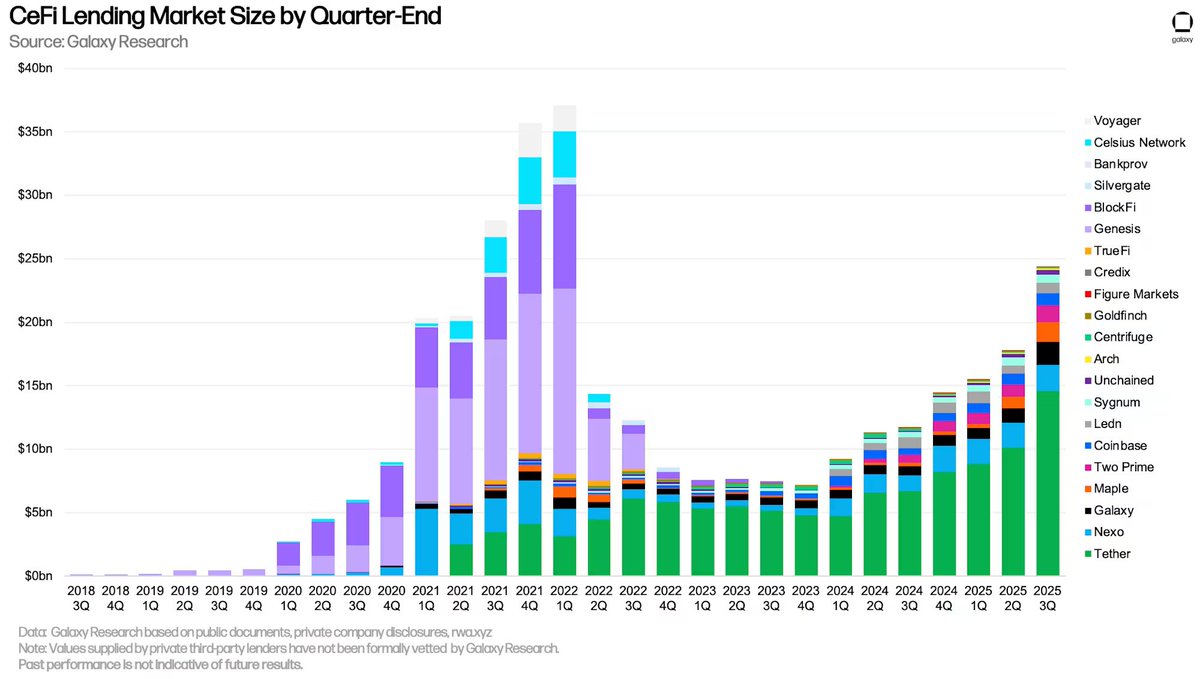

The centralized crypto-lending sector has experienced an unexpected resurgence, with recent data indicating that the market has reached its strongest position since the final stages of the previous bull cycle.

According to an analysis by Galaxy Research, aggregate outstanding loans across major centralized finance (CeFi) lenders climbed to nearly $25 billion by the end of Q3 2025. This marks the highest reading observed since Q1 2022.

This rebound signifies a substantial shift away from the market unwinding that followed the failures of prominent firms such as Celsius, Voyager, BlockFi, and Genesis.

Historical data clearly illustrates that lending volumes surged past $35 billion in early 2021 before experiencing a significant collapse throughout 2022. Since that period, the industry has transitioned into a new phase characterized by controlled expansion, enhanced transparency, and increased participation from regulated institutions.

Top Lenders Emerge in the 2025 Market

In addition to the overall market data, a "league table" of CeFi lenders reveals the platforms that are currently dominating the revived lending market:

- •Tether has secured the top position, leading the market.

- •Nexo follows closely, ranking second.

- •Galaxy holds the third position.

- •Other active lenders in the market include Maple, Two Prime, Coinbase, Ledn, Sygnum, Unchained, Arch, and several other entities.

This current ranking reflects a significant evolution within the industry. The market is now led by firms that possess deeper liquidity reserves, implement more conservative risk management frameworks, and operate with greater transparency when compared to the rapid, loosely regulated lending boom experienced between 2020 and 2021.

Market Structure Demonstrates Increased Strength

The commentary accompanying the data highlights a strong emphasis on the transparency and accuracy of the data inputs. This focus represents a major departure from prior market cycles, during which loan books were often opaque, excessively leveraged, or not disclosed at all.

In the current environment of 2025, lenders appear to be prioritizing clearer reporting practices and verifiable exposure breakdowns, moving away from a reliance on speculation.

The provided chart also indicates the following trends:

- •A prolonged recovery period throughout 2023 and 2024, characterized by modest loan book sizes.

- •A powerful upward trend began in early 2025.

- •A steep increase in lending volumes leading into Q3 2025, primarily driven by highly trusted lenders such as Tether and Nexo.

It is notable that the major legacy players from the previous bull run, including Celsius, BlockFi, and Voyager, are no longer significant contributors to the market. This observation underscores the substantial structural turnover that has occurred within the CeFi sector.

A New Chapter for Centralized Lending?

With lending volumes experiencing consistent growth for five consecutive quarters and approaching pre-crisis levels, the CeFi sector appears to have entered a new phase. This phase is built on principles of stability rather than aggressive promises of high yields.

If this positive trajectory persists into Q4, the sector could potentially surpass its early-2022 levels. This would firmly signal the return of institutional lending demand to the cryptocurrency market for the first time in nearly three years.