Key Takeaways from Web3 Discussions

- •ChainCatcher's Web3 events are instrumental in shaping discussions around asset movement and market liquidity.

- •Emerging trends in the Web3 landscape are being identified through these impactful discussions.

- •Significant on-chain data insights are revealing evolving patterns in liquidity.

ChainCatcher Facilitates Discussions on Market Dynamics

ChainCatcher recently organized several Web3 events, including roundtables featuring influential figures from the crypto industry, to deliberate on market trends and liquidity flows. These discussions took place amidst disruptions such as the suspension of the OKX DEX.

The events underscored notable shifts in liquidity and asset movements, emphasizing the continuous adaptation of decentralized systems in response to challenges faced by exchanges.

ChainCatcher Amplifies Liquidity Trends in Web3 Industry

ChainCatcher hosted a series of significant Web3 forums, bringing together leading experts and key opinion leaders from various sectors of the cryptocurrency industry. These events were structured to examine the relationship between decentralized exchanges and wallets, reinforcing ChainCatcher's position as a vital connector within the industry.

"In our discussion on DEX vs On-chain Wallets, we highlighted the shifting asset flows amid the OKX DEX suspension, which has redefined the landscape for liquidity movement," stated haze, Co-Founder, GMGN, during a ChainCatcher X Space Event.

The industry's response demonstrated active engagement, with prominent figures like Karry of Bitget stressing the importance of a strategic focus on adaptability and innovation. This approach is seen as crucial for enhancing wallet support and scalability in response to evolving market conditions.

Bitcoin's Value and Market Insights

As ChainCatcher explores shifts in decentralized exchanges, historical market events have frequently demonstrated sustained liquidity across critical decision points.

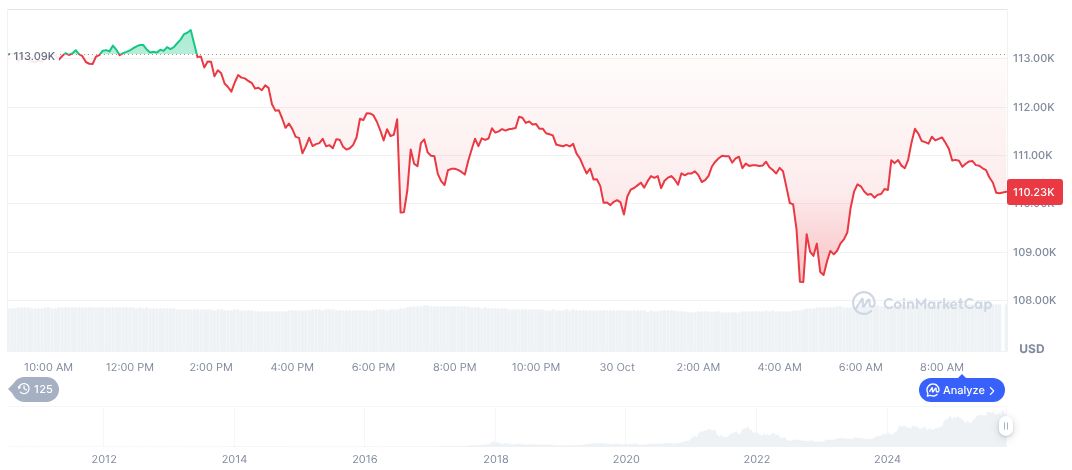

Bitcoin maintains its position as the leading cryptocurrency, with a price of $108,493.05 and an approximate market capitalization of $2.16 trillion as of October 2025. Its 24-hour trading volume reached $75.38 billion, despite a recent decrease of 4.46%.

Analysis suggests an increased emphasis on compliance within the cryptocurrency sector. Ongoing regulatory changes are anticipated to drive technological innovation. The ChainCatcher events underscored how market participants are adapting through strategic industry collaborations and the development of new protocol strategies.