Chainlink’s evolution from a simple decentralized oracle network into a full-scale infrastructure layer for onchain finance is accelerating fast, fueled by record real-world asset (RWA) tokenization and rising institutional adoption.

Messari’s latest analysis highlights how the project has quietly transformed into the connective tissue powering data, interoperability, privacy, compliance, and end-to-end financial orchestration across both DeFi and TradFi. With more than $322 billion in tokenized RWAs now referencing or settling through Chainlink-enabled rails, and global players like J.P. Morgan, Fidelity, UBS, and Swift building directly on its stack, the network is redefining what “middleware” means in the blockchain ecosystem.

From Oracles to Full-Stack Onchain Infrastructure

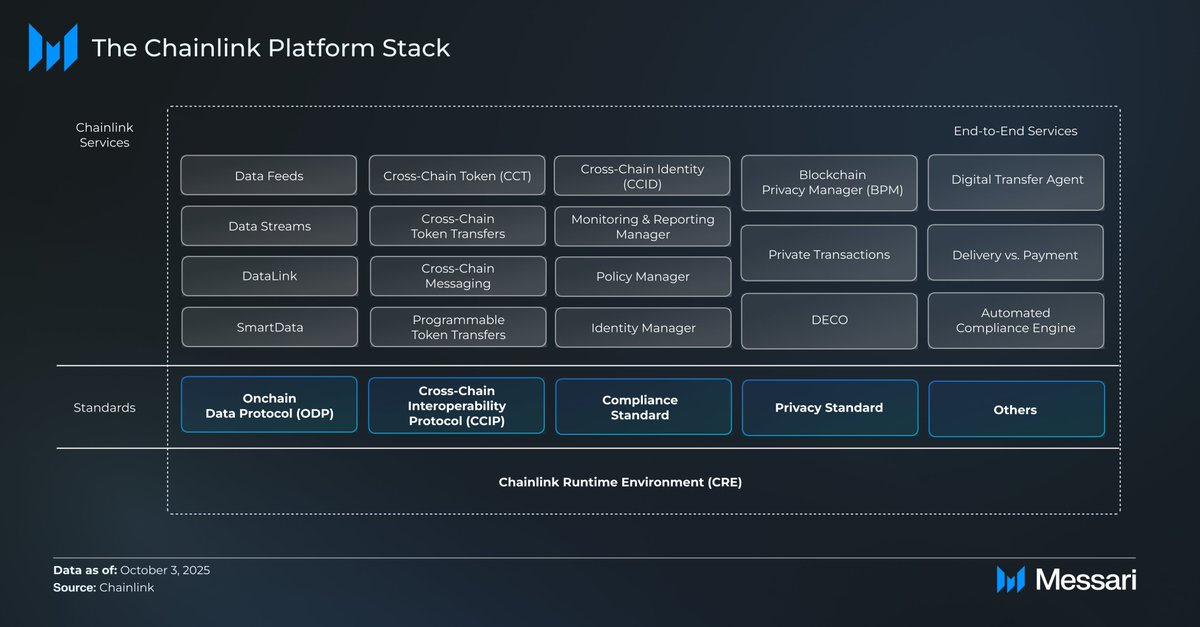

What began as a solution for delivering external price data to smart contracts has matured into a multilayer platform. Chainlink’s architecture now includes data feeds, data streams, identity tools, cross-chain token transfers, privacy-preserving computation, automated compliance engines, monitoring systems, and policy management services.

At the foundation are emerging standards, CCIP (Cross-Chain Interoperability Protocol), the Onchain Data Protocol (ODP), and Chainlink’s compliance and privacy frameworks, all running on the Chainlink Runtime Environment (CRE). These standards are increasingly becoming the backbone for banks, asset managers, and exchanges seeking consistent, secure interoperability across chains.

Enterprise Adoption Accelerates Across TradFi

In the last 48 hours, new institutional pilots have reinforced this shift. Several European asset managers began testing CRE-compatible infrastructure for cross-chain fund settlement, while Asia-based banks expanded ongoing CCIP experiments tied to tokenized collateral management. This comes as tokenized treasury markets hit record weekly volumes, with a growing share routed through Chainlink-enabled data and interoperability layers.

Projects like Swift’s interbank tokenization experiments, J.P. Morgan’s cross-chain settlement prototypes, and UBS’s structured product tokenization pilots all rely on Chainlink’s unified standards. What’s emerging is a de facto interoperability layer for financial institutions that require settlement-grade security rather than speculative DeFi speed.

DeFi Adoption Remains Core

While institutions expand their use cases, Chainlink remains deeply embedded in DeFi’s critical infrastructure. Lending markets, derivatives protocols, DEXs, stablecoin issuers, and RWA platforms depend on Chainlink not only for price data but also for:

- •Cross-chain messaging

- •Tokenized asset transfers

- •Private transactions

- •Compliance automation

- •Smart-data computation

The shift toward modular rollups and app-specific chains has amplified demand for CCIP as the connective standard between ecosystems.

The Backbone of Onchain Finance

Messari’s report concludes that Chainlink is no longer “just the oracle provider”; it is becoming the operating system for onchain finance, offering everything a modern financial network requires: data provisioning, cross-chain settlement, privacy controls, and institutional-grade compliance.

With RWA tokenization accelerating, ETFs expanding across blockchains, and banks moving from pilots to production environments, Chainlink’s full-stack approach places it at the center of the next phase of global finance.