Chainlink price has stabilized around the $14 support level as the cryptocurrency market rally begins to fade. The token has formed a highly bullish chart pattern, coinciding with soaring LINK ETF inflows and a notable drop in the supply held on exchanges.

Key Observations

- •Chainlink price has formed a bullish falling wedge pattern on its daily chart.

- •The Grayscale LINK ETF has accumulated over $48 million in assets.

- •Strategic LINK Reserves have surpassed the 1 million token mark.

Chainlink Price Chart Indicates a Potential Rebound

The daily timeframe chart for Chainlink (LINK) reveals several highly bullish technical patterns. The price has formed a double-bottom pattern at $11.56, with a neckline resistance at $13.50. The double-bottom formation is recognized as a significant bullish reversal signal in technical analysis.

Furthermore, Chainlink has established a large falling wedge pattern, characterized by two converging descending trendlines. The price has already broken above the upper boundary of this wedge.

The token is also nearing a breakout above the Supertrend indicator, which typically signals an impending bullish trend continuation. Additionally, it is poised to move above the 50-day moving average.

Based on these indicators, the Chainlink price is expected to continue its upward trajectory, with bulls targeting the next significant resistance level at $20. This represents a potential increase of 45% from its current trading level. A decisive drop below the critical support at $11.56 would invalidate this bullish outlook.

LINK ETFs Approach $50 Million Milestone

A primary driver for the Chainlink price action appears to be the positive reception of the top LINK ETF by market participants. Data from SoSoValue indicates that the spot LINK ETF has experienced inflows every day since its launch.

The fund now holds over $48 million in assets, bringing its total assets to more than $70.6 million, which accounts for 0.75% of Chainlink's market capitalization. This suggests considerable room for growth in the coming months, as the fund aims to reach the 5% value seen in Bitcoin and Ethereum ETFs.

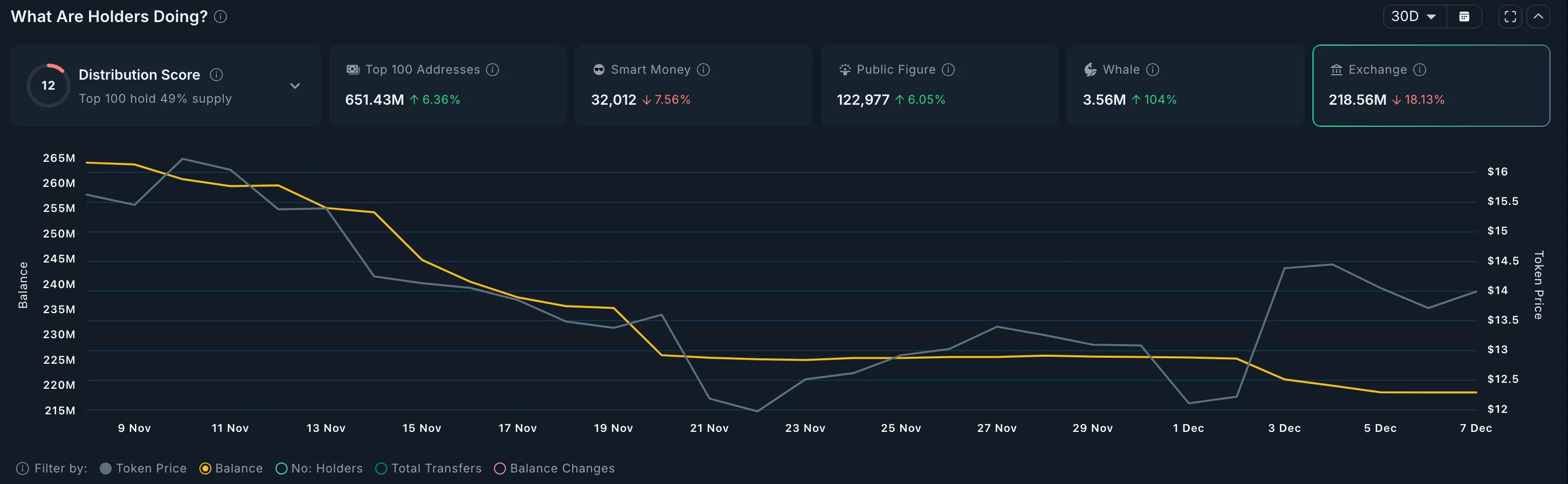

Concurrently, there are clear indications that the supply of LINK tokens held on exchanges has been declining over the past few months. Data reveals that the exchange supply currently stands at 218 million tokens, a decrease from the high of 264 million recorded in November.

In parallel, large holders, often referred to as whales, have been actively accumulating LINK tokens. Data shows that these whales now possess 3.56 million tokens, a significant increase from the 1.73 million tokens held in November, signaling a surge in demand.

According to Mode data, the Chainlink team is continuing its token accumulation strategy through the Strategic LINK Reserves. The number of tokens held in these reserves has risen to 1 million, valued at approximately $14.7 million, just a few months after the initiative's commencement.

Chainlink began accumulating these tokens in August, directing the fees generated from its network towards these strategic purchases.