Chainlink whale wallets, specifically those holding between 100,000 and 1,000,000 LINK, have decreased their holdings by a significant 31.05 million tokens over the past three weeks. On October 30, these addresses collectively held approximately 191.5 million LINK, a figure that had fallen to around 158.5 million by November 24. While this reduction began gradually, it accelerated notably between November 12 and November 21. The behavior observed in these large wallets often reflects broader market trends, suggesting that major players have been reducing their exposure, potentially by moving tokens to exchanges or other wallets.

Chainlink whales have been dumping $LINK tokens over the past 3 weeks.

— Ali (@ali_charts) November 18, 2025

Addresses holding 100K-1M $LINK have offloaded 31.05M tokens, reducing their total holdings from 191.5M to 158.5M.

This significant sell-off occurred as the price of $LINK faced downward pressure. pic.twitter.com/f0e0h2z1bH

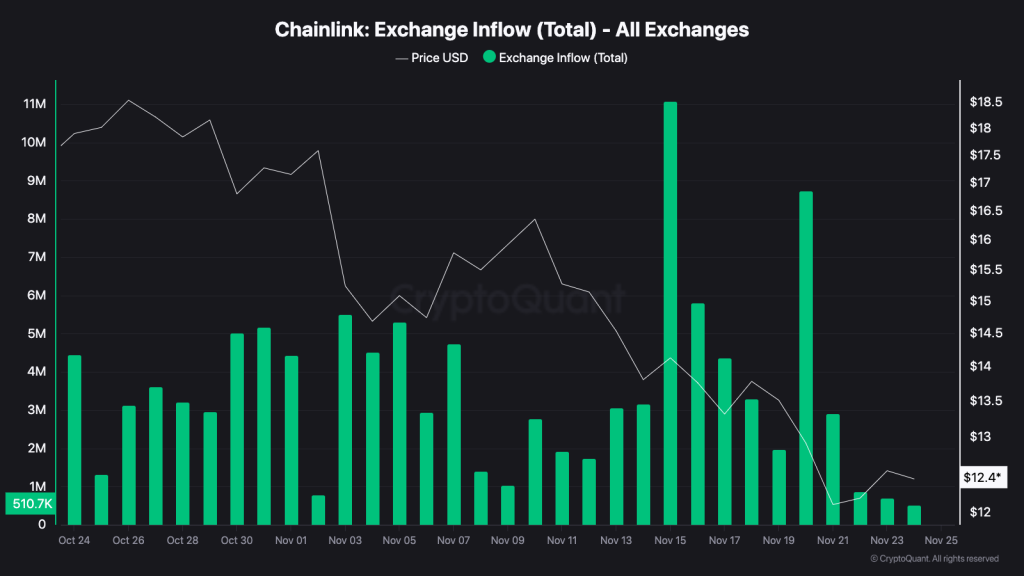

Exchange Inflows Increase as Price Falls

Data from CryptoQuant indicates a rise in the number of LINK tokens being sent to centralized exchanges. Two substantial inflow events were recorded: one on November 15, with over 11 million LINK transferred, and another on November 20, involving approximately 8 million LINK. Such movements often precede periods of increased selling activity. Between October 24 and November 24, Chainlink's price experienced a decline from over $18.50 to roughly $12.40. The most significant spikes in exchange inflows coincided with some of the steepest price drops during this period.

According to analyst Ali Martinez, "The chart shows a clear decline in Chainlink holdings among whale wallets… This drop in whale supply appears to be gradual at first, followed by sharper outflows."

Price Action Shows Breakdown

Chainlink's price recently breached a support level situated around $12.50 and is currently trading near $12.41, having lost over 11% in the past seven days. The token's current trajectory follows a pattern of lower highs established since early November. A descending trendline continues to exert downward pressure on the price action. Analysts observing this pattern identify resistance in the range of $15 to $16. While the price may attempt to retrace towards this level, it could face rejection unless there is a significant increase in volume and demand. A further decline towards the $11.50 mark is now a key level being closely monitored.

Kamran Asghar observed, "$LINK is actively breaking down from its consolidation pattern. The $12.50 floor has cracked." His analysis suggests that the price may retest the trendline before continuing its downward movement.

Focus Shifts to $11.50 Level

Despite a minor bounce in LINK's price and holdings observed around November 23, the broader trend indicates continued caution among large-scale holders. The consistent outflows over recent weeks, coupled with ongoing exchange inflows, are shaping the near-term market sentiment. As of November 24, LINK is trading at $12.41, with a 24-hour trading volume exceeding $584 million. The $11.50 support zone is now a critical point of attention as market participants evaluate whether selling pressure will continue or stabilize in the upcoming trading sessions.