Key Points

- •The People's Bank of China held a high-level meeting to reinforce earlier crypto restrictions, specifically targeting stablecoins.

- •Stablecoins are identified as instruments facilitating illegal currency exchange.

- •Hong Kong continues to maintain an open cryptocurrency policy.

On November 28, 2025, the People's Bank of China convened a meeting in Beijing with representatives from over ten departments to escalate its campaign against virtual currency trading, with a particular emphasis on stablecoin regulations.

This meeting highlights China's ongoing commitment to stringent measures against virtual currencies and stablecoins, which could significantly influence trading practices and regulatory frameworks within the region.

China Strengthens Control on Stablecoins Amidst Latest Cryptocurrency Ban

The People's Bank of China (PBOC) is reaffirming its stance against virtual currencies, aiming for comprehensive enforcement against crypto-related financial transgressions. This significant initiative involved collaboration with the Ministry of Public Security, the Central Cyberspace Affairs Commission, and other key departments. The primary objective is to eradicate activities involving stablecoins, which officials have identified as conduits for illegal foreign exchange and money laundering operations.

Financial activities involving virtual currencies are now to be classified as illegal operations within mainland China. Stablecoins, including prominent ones like USDT and USDC, have been specifically noted for their role in circumventing stringent capital outflow regulations.

"Virtual currencies have no legal status as fiat currency, and business activities related to virtual currencies constitute illegal financial activities." — People's Bank of China Official

Regulatory Tightening Spurs Cross-Border Crypto Shift

China has historically implemented strict regulations on virtual currencies, profoundly impacting market dynamics and trading activities within its borders.

The recent PBOC meeting reinforces policy actions first enacted in 2021, which mandated the cessation of all virtual currency trading. Such persistent prohibitive measures have historically led to suppressed market activity and reduced liquidity within China's jurisdiction.

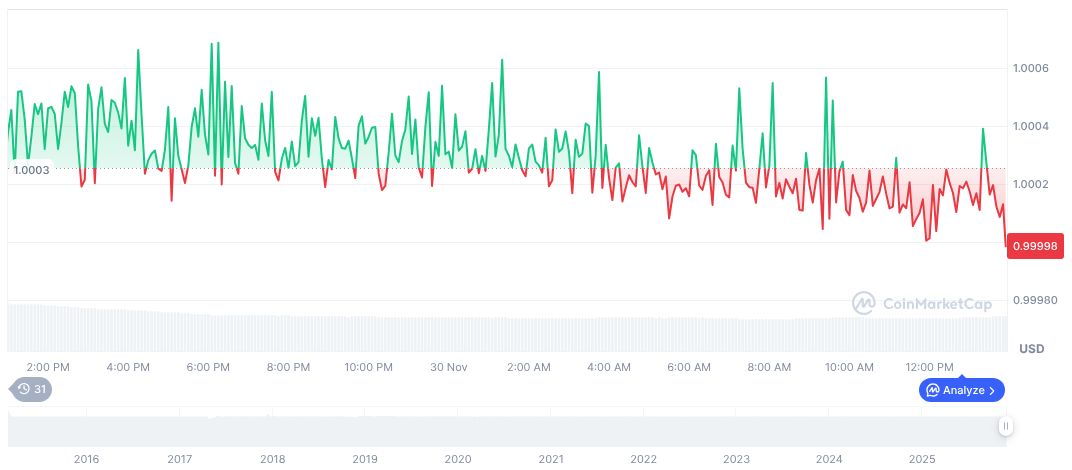

Tether USDt (USDT) is currently priced at $1.00. With a market capitalization of $184.63 billion and a market dominance of 6.30%, this stablecoin has seen a substantial 64.35% increase in its 24-hour trading volume, reaching $91.26 billion. Over the past 30 days, the price has experienced a marginal increase of 0.06%.

The Coincu research team anticipates that these stringent regulations may encourage a further migration of cryptocurrency activities toward Hong Kong. Such regulatory shifts are likely to foster a more robust parallel market, despite official restrictions, propelled by ongoing technological advancements in the cryptocurrency space.