China-US Economic Relations Discussed in Kuala Lumpur

China's Vice Premier He Lifeng concluded trade discussions on October 26 in Kuala Lumpur with U.S. officials, emphasizing the mutual benefits of China-U.S. economic collaborations. These talks are aimed at stabilizing China-U.S. trade relations, which are critical for global markets. While no immediate cryptocurrency impacts were observed, the dialogue is seen as a positive step towards managing economic interdependence.

Focus on Stable Trade Relations and Cooperation

Vice Premier He Lifeng of China met with U.S. officials in Kuala Lumpur to advance China-US economic and trade relations. They concluded discussions on October 26, emphasizing the importance of mutual benefit and win-win cooperation. Vice Premier He highlighted that cooperation benefits both nations, while confrontation is detrimental. The talks covered key issues such as tariff extensions, export controls, and agricultural trade. Both parties expressed commitment to addressing each other's concerns through dialogue. Their joint efforts aim to safeguard stable trade relations, aligning with international community expectations.

Key market players welcomed the dialogue for its potential to ease tensions and foster global economic stability. Although no direct impact on cryptocurrency was noted, analysts suggest traders monitor long-term shifts in global risk sentiment. Reactions emphasize the necessity of ongoing high-level communication.

Historical Trade Talks and Their Influence on Global Markets

The 2018-2019 U.S.–China trade talks caused fluctuations in global markets, including equities and digital assets like BTC and ETH, demonstrating how geopolitical events influence crypto dynamics.

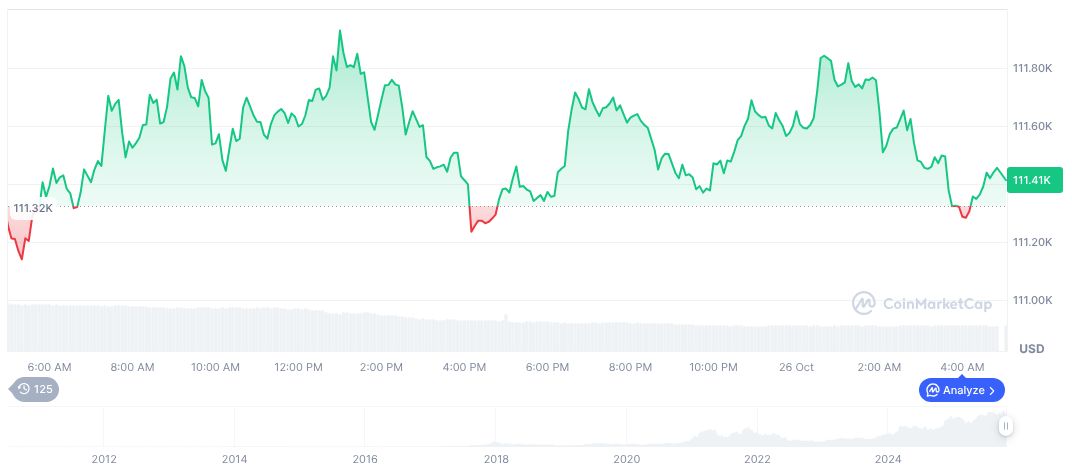

Bitcoin's current price is $113,667.61, with a market cap of $2.27 trillion and dominance at 59.06%, according to CoinMarketCap. Over the past 90 days, BTC experienced a price change of -3.64%, with a 24-hour trading volume of $34.56 billion, representing a 26.08% change.

Researchers suggest that the ongoing trade dialogue may generate financial and regulatory pathways influencing digital markets. Historical data indicates a connection between global economic policies and digital asset trends, with potential long-term effects on regulatory landscapes enhancing mutual economic benefits in digital sectors.