Key Takeaways from the Consultations

China and the United States concluded economic and trade consultations in Kuala Lumpur, reaching a preliminary consensus on major trade issues on October 25-26, 2025. These agreements aim to stabilize global economic relations, potentially easing tariffs and enhancing trade flows, with indirect impacts on global markets, including cryptocurrency sentiment.

Details of the Trade Agreements

The economic and trade consultations between China and the U.S. concluded with a preliminary consensus on major trade issues. Delegations, led by Vice Premier He Lifeng of China and U.S. Secretary of the Treasury Scott Bessent, tackled critical topics including tariffs and rare earth exports. Trade representatives emphasized mutual respect and equality in the discussions.

Changes under consideration include the possibility of tariff truce extensions and adjustments to rare earth export controls. These steps could stabilize supply chains and positively influence global trade sentiments. Domestic approval procedures are the next step before finalizing a full agreement.

Statements from Trade Representatives

"We spent a lot of time last night. We spent a lot of time this morning. Talked about a framework. I think we're moving towards the final details of the type of agreement that the leaders can review and decide if they want to do it together."

U.S. Trade Representative Jamieson Greer made these remarks regarding the progress of the talks.

Li Chenggang, Vice Minister of Commerce of China, noted that recent economic disturbances were undesirable, reiterating efforts to nurture stable trade relations.

Impact on Cryptocurrency Market Trends

The trade negotiations suggest extended cooperation, echoing similar efforts in 2022 and 2023 that significantly impacted global markets. Historical precedents show such talks often stabilize global economic relations, providing reassurance during volatile periods.

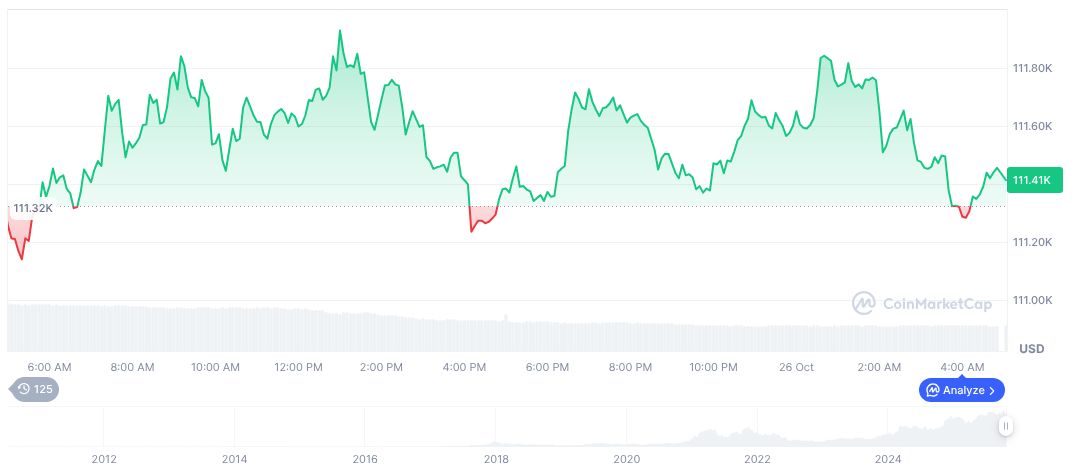

As of October 26, 2025, Bitcoin (BTC) trades at $113,572.20, with a market cap of $2.26 trillion. BTC's market dominance is 58.99% and experienced a 1.47% price increase over 24 hours. Fluctuations impact investor sentiment across global markets.

According to the Coincu research team, China-U.S. trade stability tends to bolster macroeconomic conditions, benefiting risk markets, including cryptocurrency. Trade agreements impact market perceptions, influencing digital assets indirectly by stabilizing geopolitical landscapes relevant to investor confidence.