Owning four to six Bitcoin or 111 to 166 Ether can be enough to purchase an average-priced house in the US or Australia. However, many Bitcoin holders are hesitant to cash out, with predictions from pundits like Samson Mow and Plan B suggesting future exponential growth. The concept of a Bitcoin-backed mortgage allows individuals to acquire a property today while retaining the potential to benefit from Bitcoin's future appreciation.

The ideal scenario for a Bitcoin-backed mortgage involves paying only the interest each year, with the hope of eventually paying off the principal with a smaller fraction of Bitcoin holdings in the future. These loans can be quicker and easier to obtain than traditional mortgages, requiring collateral worth approximately 50% more than the loan amount.

Despite the advantages, significant drawbacks exist, including interest rates that can be twice as high as those for ordinary mortgages. Holders also face the risk of margin calls if the price of Bitcoin plummets, causing their loan-to-value (LTV) ratio to drop below the required threshold. Depending on the specific product or protocol, Bitcoin collateral may be automatically liquidated, either in full or partially, to restore the LTV ratio. Some providers offer a grace period for users to supply additional collateral.

Cliff's Experience with Bitcoin Mortgages

Sixty-year-old Cliff, a construction supply company director, has successfully leveraged his Bitcoin holdings to acquire property. He invested 40%-50% of his wealth into Bitcoin over 18 months during the pandemic, influenced by "hard money" narratives. With Bitcoin's value increasing significantly since then, his portfolio is now substantial.

Cliff expressed a desire to retain his Bitcoin, believing it offers a superior rate of return compared to other investments. Simultaneously, he wanted to access liquidity from his holdings without selling them. Approximately a year ago, he secured loans from Australian crypto lender Block Earner against his Bitcoin portfolio to purchase two properties and fund a honeymoon.

Block Earner, having recently won a legal battle with the Australian Securities and Investments Commission (ASIC), is preparing to offer its four-year Bitcoin-backed mortgages this year, with a broader launch anticipated in early 2026. Cliff, however, was able to secure a 12-month loan under similar conditions to purchase property, with the option to pay it out or roll it over after paying the interest.

Cliff's objective was to acquire properties for personal enjoyment and to generate income through Airbnb rentals, thereby enhancing his quality of life. He remained unconcerned about Block Earner's potential collapse, unlike many crypto lenders that failed in 2022, such as Celsius Network, Voyager Digital, BlockFi, Genesis Global, and Vauld, partly because he was unaware of these incidents.

Block Earner requires 150% Bitcoin collateral. If Bitcoin's price drops significantly, users have 30 days to provide additional funds or Bitcoin. Otherwise, a portion of their collateral will be sold. Cliff mentioned that his LTV ratio fell below the required threshold on two occasions.

Bitcoin went over that but then came back down within the 30 days, I think a couple of times. And then I did sell a couple of Bitcoin at one point, sort of spur of the moment, I probably wish I didn’t… but that’s brought my loan to value ratio down to the point where I’m not even close any more.

Bitcoin Mortgages in the US, Australia, and DeFi

Even for those apprehensive about borrowing against Bitcoin to buy property, it can be a crucial option for crypto owners, as traditional banks often disregard crypto portfolios during mortgage assessments. Instead, they focus on savings, stocks, and other conventional assets.

James Coombs, chief commercial officer at Block Earner, explained that many customers and staff have encountered difficulties obtaining mortgages because their crypto assets are ignored or valued at zero in the assessment process.

Progress is being made in this area. In Australia, a major bank has partnered with Monochrome to accept shares of its Bitcoin ETF as collateral for high-value properties exceeding 5 million Australian dollars ($3.26 million). In the US, mortgage agencies Fannie Mae and Freddie Mac now consider Bitcoin as part of a borrower's reserves, which are funds available to cover mortgage payments if the borrower loses their job. However, Bitcoin is not treated as collateral for the loan itself.

Various centralized lenders, including SALT, LEDN, Figure, and Nexo, offer loans for purchasing houses against crypto collateral. These providers present diverse products, interest rates, and terms, necessitating careful comparison. While centralized lenders often provide user-friendly terms, they carry the inherent risk of insolvency.

Decentralized lenders such as Aave and Morpho operate under smart contracts, increasing the risk of automatic liquidation during market volatility, as seen during the flash crash on October 10. Mezo, a Bitcoin-only lender, provides funds in its native stablecoin MUSD, which has experienced fluctuations in value, dipping as low as 98.4 cents in the past month despite its Bitcoin backing.

Bitcoin Mortgages in the US and Australia

In the US, Milo has been offering Bitcoin-backed mortgages since 2022 and Ethereum-backed mortgages since 2023, facilitating over $80 million in property purchases to date. They provide up to 100% financing for loans up to $5 million with no down payment required. Across all their products, Milo has originated $250 million in mortgages.

In Australia, Block Earner launched its Bitcoin-backed mortgage product in June, covering loans up to $3.26 million. They anticipate homes being purchased through this product within the current calendar year. The company has a waiting list valued at approximately 500 million Australian dollars ($326 million) in property value, translating to around $65 million in loans, with an average mortgage size of $1.04 million. This demand exceeds their available funding, leading to the broader launch being postponed to early 2026.

Practically, Block Earner's Bitcoin-backed mortgage functions as a Bitcoin-backed deposit combined with a standard mortgage for the remaining loan amount through a partner lender. The comparison interest rate for the Bitcoin-backed deposit portion is 11.9%, while the remainder is at a typical variable rate.

Borrowers can secure loans up to 60% of the home's value. Coombs notes that the most common scenario among those on the waitlist involves using Bitcoin for approximately 22% of the deposit, assisting individuals who wish to meet the 20% deposit requirement without having readily available cash.

In both the US and Australia, borrowers with less than a 20% deposit are typically required to obtain costly additional insurance, known as private mortgage insurance in the US and lender’s mortgage insurance in Australia. This insurance protects the lender in case of borrower default.

A potential concern for prospective clients is ASIC's appeal to the High Court seeking to overturn Block Earner's Federal Court victory, which had exempted them from requiring an Australian Financial Services License for their Earner product. Block Earner asserts that this legal case pertains to a discontinued product and poses no risk to current mortgage holders, emphasizing that they operate as an authorized representative of Mortgage Direct, which holds an Australian Credit License.

Dr. Aaron Lane, a senior law lecturer at RMIT University, believes the outcome of the ASIC case is unlikely to affect mortgage holders. He explains that the crypto Earner product offered yield, whereas the Bitcoin in the current scenario serves as collateral for a loan, which falls under the purview of the credit license. He added that due to the distinct nature of the products, the High Court's decision is unlikely to have any bearing on this particular mortgage product.

Alternatives to Bitcoin Mortgages for Crypto Holders

Mortgage broker Chris Dodson, director of Mortgages Plus, welcomes financial innovation but points out that Block Earner's interest rates and fees are significantly higher than standard offerings. He describes these rates as "aggressive," noting they can be double those of mainstream banks or even second and third-tier lenders. Dodson also highlights that alternative products exist for borrowers looking to secure a deposit without risking their Bitcoin.

OwnHome's Deposit Boost Loan assists with the 20% deposit requirement, partnering with a standard mortgage provider for the remainder of the loan. This product allows borrowers to contribute as little as 2% of the deposit, with OwnHome covering the remaining 18% at an interest rate of approximately 12% to 13%, which Dodson notes is similar to Block Earner's rates.

Your Bitcoin at Risk, Not Your Property

Coombs emphasizes that borrowing for a deposit using Bitcoin collateral does not place the borrower's property title at risk. He explains that there is no contagion risk to the property. With Block Earner, only the deposit component of the loan is secured by Bitcoin. Therefore, the primary risk is the potential loss of the Bitcoin collateral, not the property itself.

For Cliff, this is a calculated risk he is willing to undertake. He stated that the amount borrowed exceeds his initial Bitcoin investment, meaning he would not be worse off than when he started if circumstances were to deteriorate.

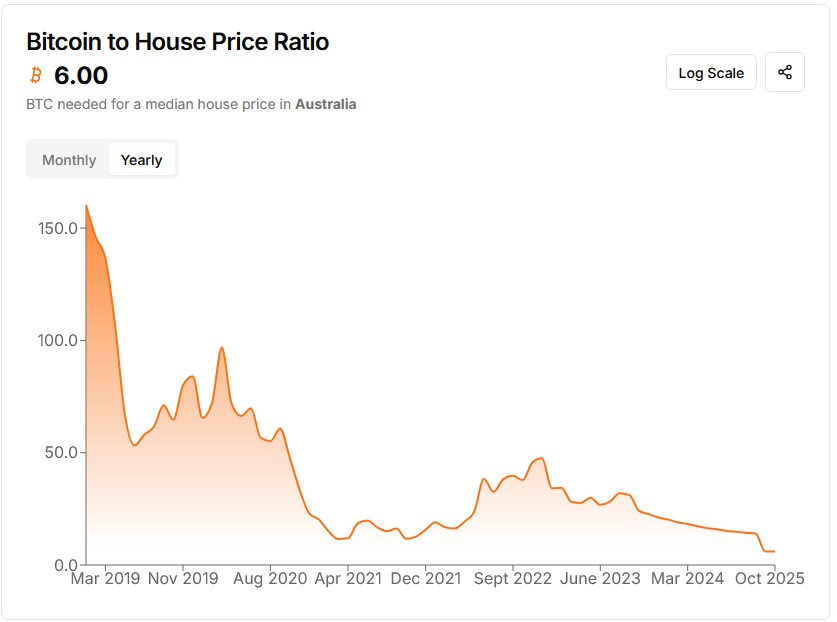

In an optimistic scenario, Cliff hopes to pay off his properties as the value of his Bitcoin increases. In December 2019, the average home in Australia cost 84 Bitcoin. Today, it costs approximately 6 Bitcoin.

Cliff mentioned that if the LTV ratio improves significantly, he might consider selling a portion of his Bitcoin to clear the loan. He added that while this is not the current situation, it could be a possibility in future market cycles.