Crypto markets opened 2026 with over $2.3 trillion in total capitalization, while daily volumes still average above $90 billion worldwide. Blue chips like BNB coin price holding near historic highs and Ethereum price stabilizing after years of growth show strength, but also maturity. With returns compressing and upside harder to find, can these giants still deliver life-changing profits for new capital?

That question has analysts turning toward Zero Knowledge Proof, a privacy-focused AI and data network in its presale auction stage that researchers describe as structurally different. Built on advanced cryptography and decentralized incentives, the project aims to reward users, not platforms, while securing data without exposure.

Experts say Phase 2 burns every unused coin, driving scarcity framing ZKP as the next big crypto.

Zero Knowledge Proof and the Scarcity Engine

Zero Knowledge Proof is designed as a privacy focused AI and data network where users, rather than platforms, retain control over value creation and usage. Analysts studying its architecture highlight the Substrate framework, zero knowledge cryptography, and hybrid consensus as reasons research groups frame it as long term digital infrastructure with global relevance and even the potential for a blistering 7000x gains.

Experts also point to a capped supply near 257 billion coins, daily auction based distribution, and proof systems consuming about ten watts per device. With prices already rising roughly three hundred percent from early levels, several analysts have begun calling Zero Knowledge Proof the next big crypto before tightening supply fully asserts pressure.

This scarcity is intentional. Phase Two activates a rule that eliminates all unallocated coins from each daily pool, shrinking available supply permanently. Analysts describe this design as cumulative pressure, where every cycle removes future selling capacity and steadily elevates the underlying value base.

Researchers monitoring chain flows note that destruction exceeds distribution as demand builds. This dynamic reverses supply math, leaving fewer units accessible. Models based on this structure project extreme scarcity patterns in early public market phases.

As analysts outline scenarios involving four digit multiples, timing becomes the deciding factor. Each burn raises entry thresholds. For early participants, Zero Knowledge Proof combines enforced scarcity, growing demand, and asymmetric upside potential into a investment narrative.

BNB Coin Price and Market Position

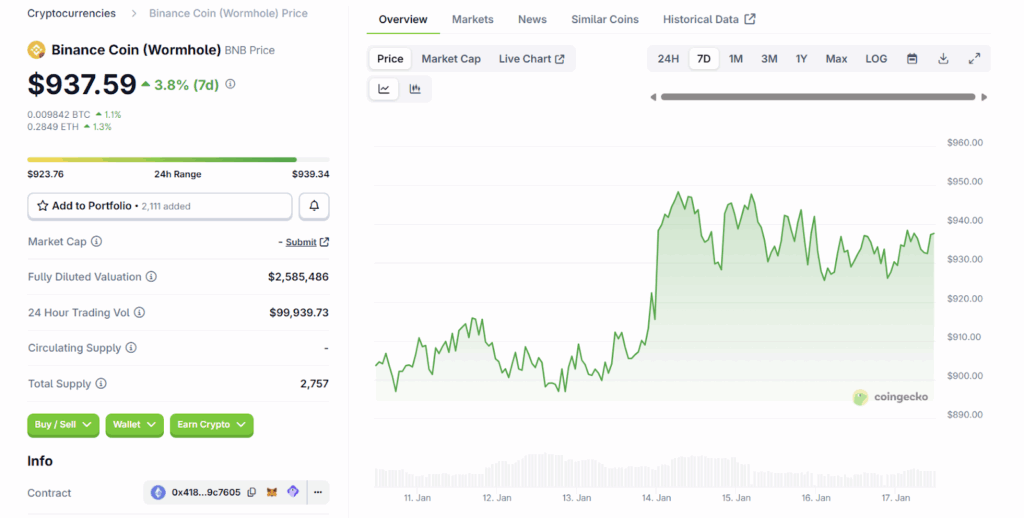

BNB remains one of the largest cryptocurrencies by market value, trading in the $930 to $940 range in mid January 2026. The BNB coin price has stayed above the $900 support level after weeks of consolidation, showing steady demand despite wider market pauses. Its market capitalization sits near $126 to $128 billion, supported by daily trading volume around $1.8 to $2 billion. This level of activity places BNB among the most liquid digital assets, with price movement closely tied to overall market direction rather than sudden spikes.

Another factor is supply reduction. In early 2026, BNB completed its 34th quarterly burn, removing about 1.37 million coins from circulation. This ongoing process limits long term supply growth. While gains may be slower, the BNB coin price reflects stability, scale, and a mature role within the crypto market. It remains watched by institutions and long term holders.

Ethereum Price USD and Market Stability

Ethereum continues to hold a central role in the crypto market, with the Ethereum price USD trading between $3,288 and $3,350 in mid January 2026. The network carries a market capitalization near $396 to $397 billion and posts daily trading volume around $20 to $22 billion. Price action since January 14 shows consolidation after recent gains, with ETH holding above key support levels.

Analysts note resistance near the $3,300 to $3,350 zone, which has slowed short term momentum. Even so, the Ethereum price USD reflects strong network use, steady wallet growth, and continued demand from developers. Ethereum remains a benchmark asset rather than a high risk play. Its size and liquidity offer reliability, but upside potential is more measured compared to newer projects. This stability makes it important for market structure, even as traders look elsewhere for faster growth opportunities over longer time frames globally.

The Next Big Crypto as Scarcity Takes Center Stage

BNB and Ethereum continue to anchor the crypto market through size and liquidity. The BNB coin price reflects scale, steady volume, and controlled supply through regular burns rather than rapid upside. Likewise, the Ethereum price USD shows consolidation near long-held ranges, backed by strong network use and deep capital support across exchanges.

These assets remain important benchmarks, yet their maturity limits extreme return potential. Analysts often note that growth slows as capitalization expands, pushing investors to examine newer models where supply mechanics and early-stage demand can still shift outcomes meaningfully.

Experts point to Zero Knowledge Proof, where analysts cite aggressive coin destruction and rising scarcity, calling it the next big crypto as shrinking supply steadily reshapes long-term value dynamics ahead.