Key Developments in Crypto Regulation

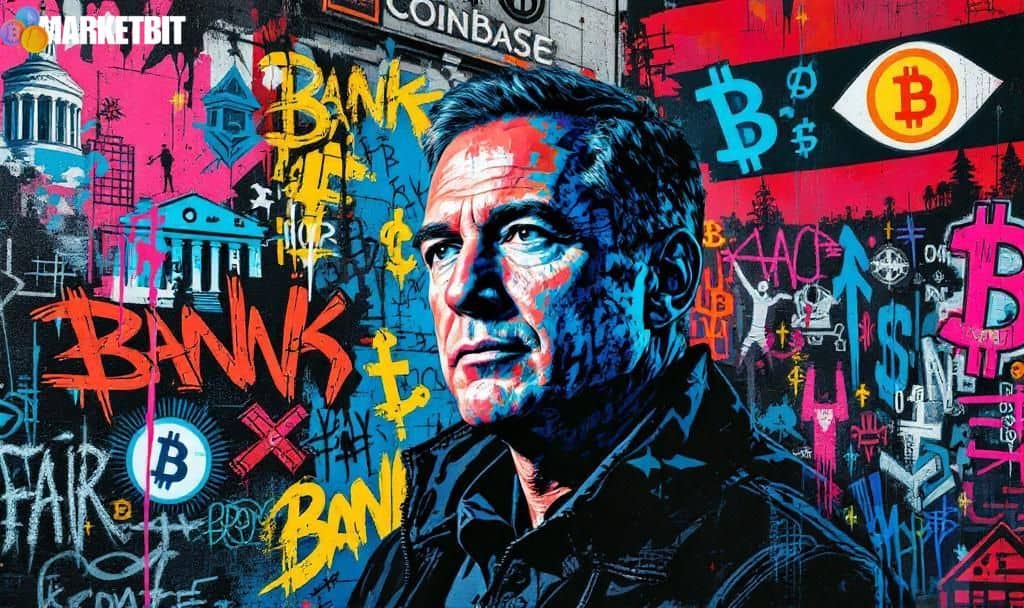

Coinbase CEO Brian Armstrong has denied ongoing reports suggesting a potential bank deal aimed at advancing Bitcoin and crypto market structure legislation. While Armstrong has previously alluded to possible banking collaborations to shape the future of digital assets, he has clarified that no official deal is currently being negotiated.

Armstrong's statements underscore persistent tensions regarding the influence of traditional banks on cryptocurrency regulation. These dynamics, while affecting markets for Bitcoin and stablecoins, have not yet materialized into concrete institutional support or direct confirmation of any specific agreements.

Recent claims, indicating that Brian Armstrong was "currently working on" a deal with banks to bolster crypto legislation, have been officially refuted. Instead, Armstrong used an interview to voice his concerns about the lobbying efforts of financial institutions. Coinbase has not issued a formal statement on this matter.

Impact on Crypto Markets

Brian Armstrong has consistently voiced his opposition to the significant influence of banks in shaping cryptocurrency regulations. In a Fox Business interview, he expressed his dissatisfaction, stating, "It just felt deeply unfair to me that one industry [banks] would come in and get to do regulatory capture to ban their competition."

The implications of these statements and subsequent denials resonate throughout the crypto markets, particularly impacting the performance and outlook for Bitcoin and stablecoins. Investors are maintaining a cautious stance due to the prevailing regulatory uncertainty, a sentiment amplified by Armstrong’s observations on how banks influence governmental decisions.

The financial consequences of this situation could include delays in legislative progress due to industry pushback against provisions favoring commercial banks. On a social level, there is an increasing public discourse concerning fair regulatory practices for cryptocurrencies, reflecting the anxieties and priorities of the broader crypto community.

Legislative Dynamics and Future Outlook

A degree of caution persists in the market, as no tangible actions have been taken by banks or in the form of new legislative proposals. Analysts are closely observing Brian Armstrong’s public statements for any further insights or developments in this evolving landscape.

Maintaining clarity and precision in communication remains paramount for preserving investor confidence. The trajectory of future engagement in regulatory discussions may be influenced by historical precedents, where commercial banks have previously participated in collaborative crypto initiatives. Greater clarity on policy matters and the outcomes of legislation related to the crypto market structure could pave the way for more inclusive frameworks.