Key Developments in Cryptocurrency Legislation

Coinbase CEO Brian Armstrong has denied reports suggesting that the Trump administration might withdraw its support for a cryptocurrency market structure bill. Armstrong affirmed that the White House remains actively involved in discussions regarding the bill, emphasizing ongoing engagement with community banks.

The ongoing debate surrounding the bill highlights the inherent tensions between regulatory objectives and the interests of the cryptocurrency industry. The potential implications for community banks and the possibility of restrictions on stablecoins are key factors shaping future market dynamics.

White House Reaffirms Commitment to Crypto Bill

Brian Armstrong clarified that the administration has been advocating for increased collaboration with banks. Efforts are currently underway to develop mutually beneficial solutions that prioritize community banks in the upcoming legislative proposals. These initiatives aim to ensure that community banks are central to the development of new cryptocurrency regulations.

Previous rumors indicated a potential withdrawal of White House support for the bill unless Coinbase could secure a favorable agreement with banks. Any significant changes to the bill could substantially alter the regulatory landscape for both stablecoins and community banks, impacting their operations and market presence.

Community reactions to these developments have been varied. Some observers believe that Armstrong is strategically working to protect the crypto industry from premature and potentially restrictive regulations. Meanwhile, voices within Congress have pointed to the continued bipartisan efforts focused on advancing the bill through legislative channels.

Stablecoin Market Anticipates Regulatory Shifts

The Genius Act, a prior legislative effort aimed at regulating stablecoins, similarly ignited extensive discussions last year. This reflects the persistent tension observed between traditional banking institutions and cryptocurrency firms in the evolving financial ecosystem.

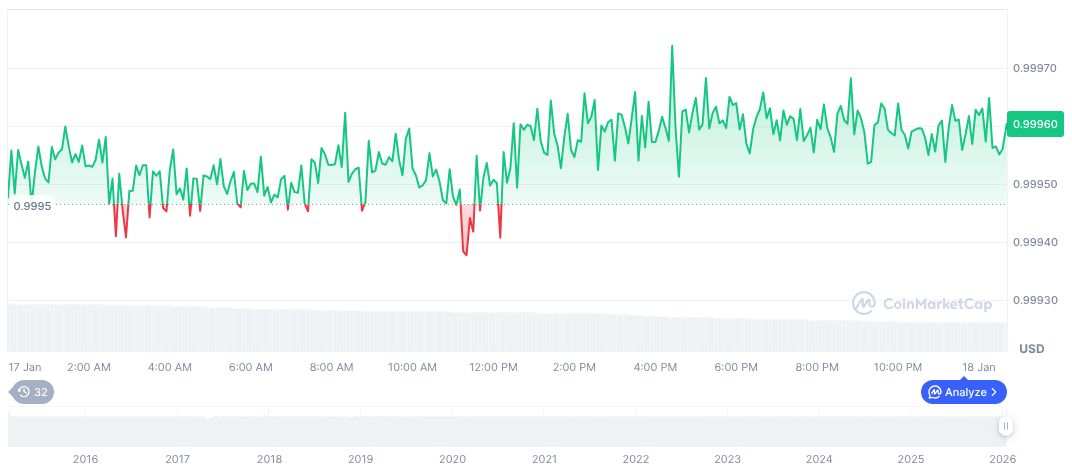

According to data from CoinMarketCap, Tether USDt (USDT) currently holds a market capitalization of $186.78 billion, consistently maintaining a value of $1.00. As stablecoin costs experience adjustments, USDT continues to be a significant player, accounting for 5.79% of the market dominance. Trading volume has seen a notable decrease of 37.24% over recent months, accompanied by minor price fluctuations.

The research team at Coincu has identified that long-term prospects for stablecoin regulations could have a significant impact on Decentralized Finance (DeFi) and token markets. Regulatory clarity is a highly sought-after outcome, as various crypto entities are preparing for potential changes in compliance requirements and operational frameworks.