Key Points

- •Initial valuation stemmed from mining costs.

- •Significant growth and market impact over 16 years.

- •Potential for increased regulatory scrutiny.

Coinbase CEO Brian Armstrong highlighted on X the historical purchasing power of Bitcoin, revealing that 16 years ago, 1,309 bitcoins could be obtained for merely $1, marking Bitcoin’s first USD valuation.

The revelation underscores Bitcoin's dramatic valuation rise, sparking reflection within the crypto community and drawing attention to the ongoing evolution of digital asset investments globally.

Bitcoin's Market Impact and Future Projections

Brian Armstrong's reflection provides a historical context to Bitcoin's growth, sparking wider community discussions.

This valuation highlights Bitcoin's sheer growth over time, sparking curiosity about its economic journey and impact on financial markets. Discussions emerged on social media platforms like Twitter, underscoring renewed interest in cryptocurrency's origins.

Market reactions included no immediate financial shifts, yet the reflection resonated within the crypto community, prompting a reflective sentiment about Bitcoin's impactful journey and fixed value limitations.

Market Data and Future Insights

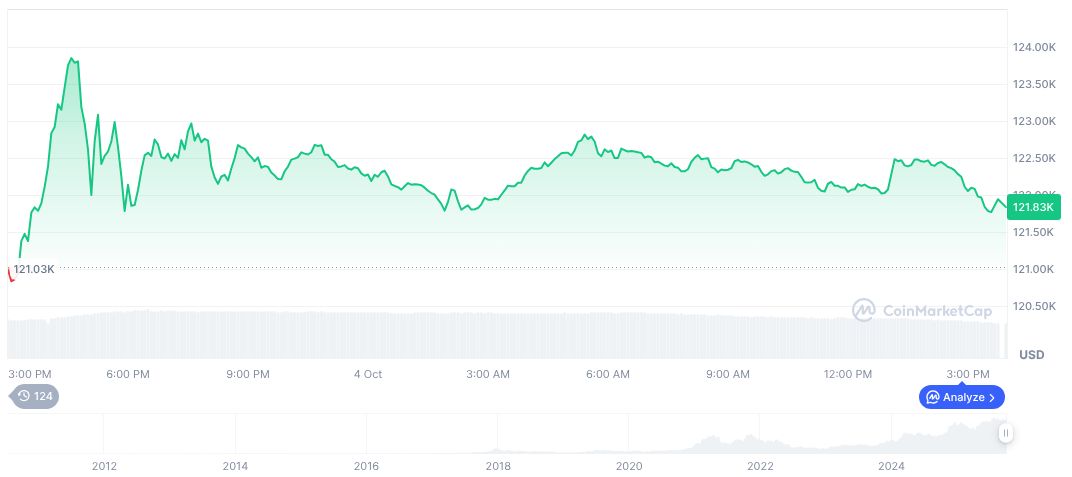

According to CoinMarketCap, Bitcoin (BTC) currently trades at $122,960.04, with a market capitalization of $2.45 trillion and a market dominance of 58.32%. The 24‑hour trading volume reached $69.02 billion, marking a 1.09% change, showcasing Bitcoin's dynamic market movements.

The Coincu research team notes the potential for increased regulatory scrutiny as Bitcoin's value continues influencing broader financial systems. Historical trends suggest Bitcoin's growing integration into mainstream economies, driven by factors like institutional uptake and digital asset frameworks.