Coinbase's Strategic Move to Acquire BVNK

Coinbase Global Inc. is currently in late-stage discussions to acquire BVNK for approximately $2 billion. This potential acquisition is subject to pending due diligence and is expected to be finalized by late 2025 or early 2026. Coinbase Ventures has previously invested in BVNK, indicating a strategic alignment and a history of partnership between the two entities.

The acquisition is poised to significantly enhance Coinbase's capabilities within the stablecoin infrastructure sector. This move could offer substantial benefits for major stablecoins such as USDC and ETH, reflecting a growing interest from institutional players in this segment of the cryptocurrency market. Such an integration is anticipated to strengthen Coinbase's competitive position and potentially influence broader crypto market dynamics.

Industry reactions to the potential deal have been notably subdued, with no official statements released by key figures or regulatory bodies at this time. While community discussions remain limited, the ongoing acquisition talks underscore the increasing institutional focus and investment in stablecoin technology and infrastructure.

A notable parallel exists in the broader fintech landscape: in 2025, Stripe acquired stablecoin startup Bridge for $1.1 billion. This move by Stripe highlights a discernible trend among major fintech companies to invest in and integrate stablecoin infrastructure, a strategy now echoed by Coinbase's current pursuit of BVNK.

Chris Harmse, Co-founder of BVNK, has stated that "BVNK is the global leader in stablecoin infrastructure, highlighting its broad banking partnerships and licensing."

Focus on Stablecoins: Market Dynamics and Regulatory Outlook

The stablecoin sector is experiencing a surge in institutional interest, with companies like Coinbase making significant strategic investments. This trend suggests a maturing market that is attracting larger players and potentially leading to the development of more robust and regulated frameworks.

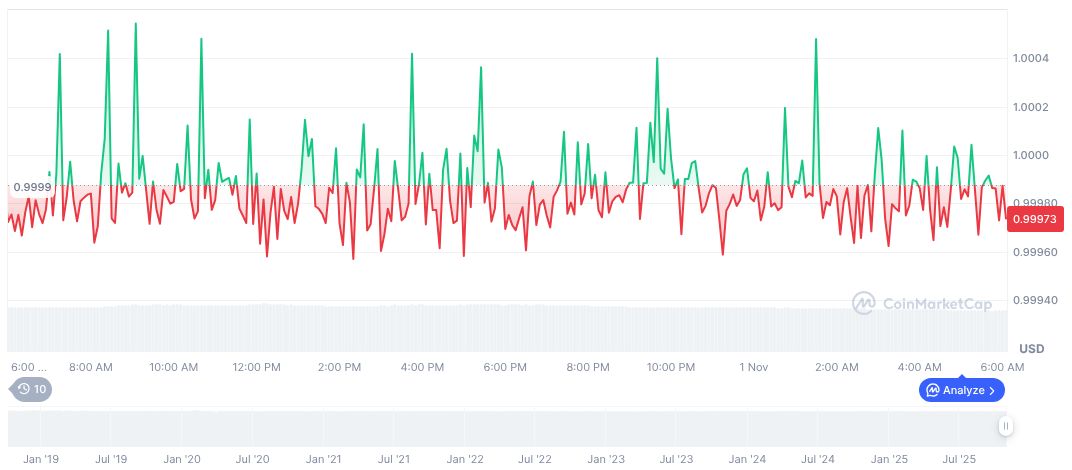

USDC, a prominent stablecoin, is currently maintaining its peg at $1.00, with a market capitalization of $75.92 billion and a 2.05% market dominance. Recent trading data indicates a slight decrease in its 24-hour trading volume, which stands at $17.03 billion, a drop of 7.28%. Despite this, USDC has seen a 2.51% increase in value over the past 24 hours, although its performance over the past week has been negative, suggesting a period of minor volatility.

Coincu research suggests that Coinbase's potential acquisition of BVNK could further invigorate the stablecoin market. This increased activity may attract more significant regulatory scrutiny, potentially leading to the establishment of more comprehensive and secure stablecoin frameworks. The historical context of ongoing integration between traditional fintech and stablecoin technology supports this outlook.