Coinbase's Strategic Pivot to an "Everything Exchange"

Coinbase CEO Brian Armstrong has revealed significant plans for the platform's evolution, moving beyond its core cryptocurrency trading services to encompass stock trading and the ambitious goal of achieving tokenized equities within the next two years. This strategic expansion, detailed in a recent interview with Fortune, aims to position Coinbase as an "everything exchange" and could introduce transformative changes to the traditional financial markets.

The company's vision involves integrating blockchain technology into stock trading, with the ultimate aim of setting new industry standards and attracting a broader base of traditional investors. These initiatives are part of a larger effort to bridge the gap between decentralized finance and conventional financial systems.

Roadmap to Tokenized Equities by 2026

Brian Armstrong's objective is to transform Coinbase into a comprehensive exchange that offers a wide array of financial services, with a particular focus on stock trading and the development of tokenized equities. This ambitious target is set for completion within two years, signifying a major step towards integrating blockchain technology into the fabric of traditional finance.

Initial plans include the introduction of new stock trading functionalities, which will be rolled out to a limited group of users before a wider release. The development of tokenized equities is expected to enhance the management of company shares, potentially revolutionizing how businesses operate on a blockchain infrastructure. Early market responses indicate a strong interest in these developments, with Coinbase emphasizing its commitment to leading the transition to on-chain operations. Armstrong has expressed his belief that blockchain technology offers a superior method for managing shares, a perspective that has garnered considerable attention across various sectors of the finance industry.

The Growing Influence of Blockchain in Finance

The potential for tokenized equities to significantly reduce transaction times and associated costs in traditional stock trading is a key driver for this shift.

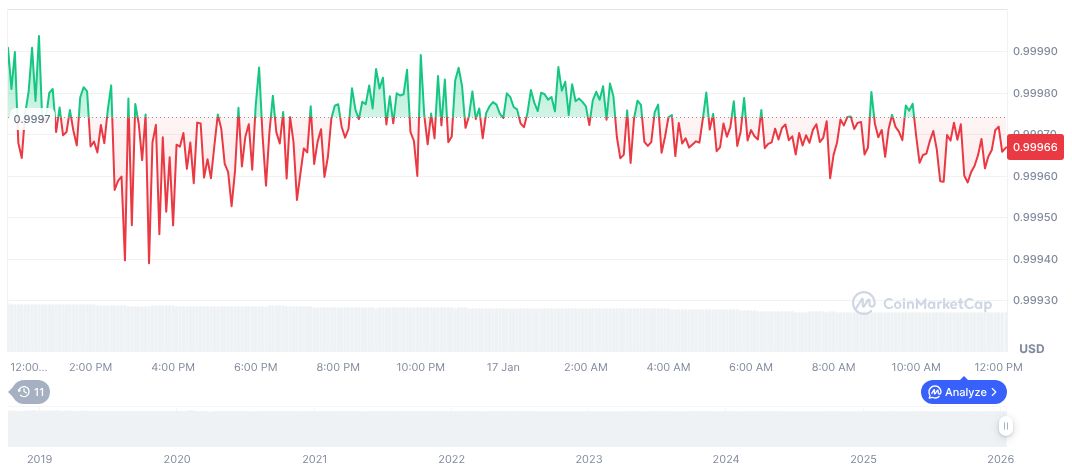

The stablecoin USDC maintains its peg at $1.00, with a substantial market capitalization of $76.02 billion and a 24-hour trading volume of $8.77 billion. While there has been a noted decrease of -24.87% in trading activity over the last 24 hours, the stablecoin has experienced a 1.63% increase in value during the same period, with minor fluctuations observed over longer durations.

Significant advancements in blockchain adoption, such as the diversification strategies announced by Coinbase, are poised to streamline the integration of this technology within the financial sector. These moves are expected to foster regulatory and technological progress, potentially catalyzing growth across the industry. By aligning traditional equity management with the benefits of blockchain, such as enhanced accessibility and efficiency, these developments promise to reshape financial markets.