On-chain data is transforming into both invisible infrastructure and portable, user-owned identity and reputation, fundamentally redefining how trust is built in the Web3 landscape. As assets and identities increasingly move on-chain, product design is shifting from platform-controlled ecosystems to user-centric, composable applications that integrate around the individual. The next significant breakthrough is anticipated in converting raw blockchain activity into interpretable signals through behavioral scoring, AI-driven analytics, and standardized identity frameworks.

The Narrative of On-Chain Data: Infrastructure or User-Owned Asset?

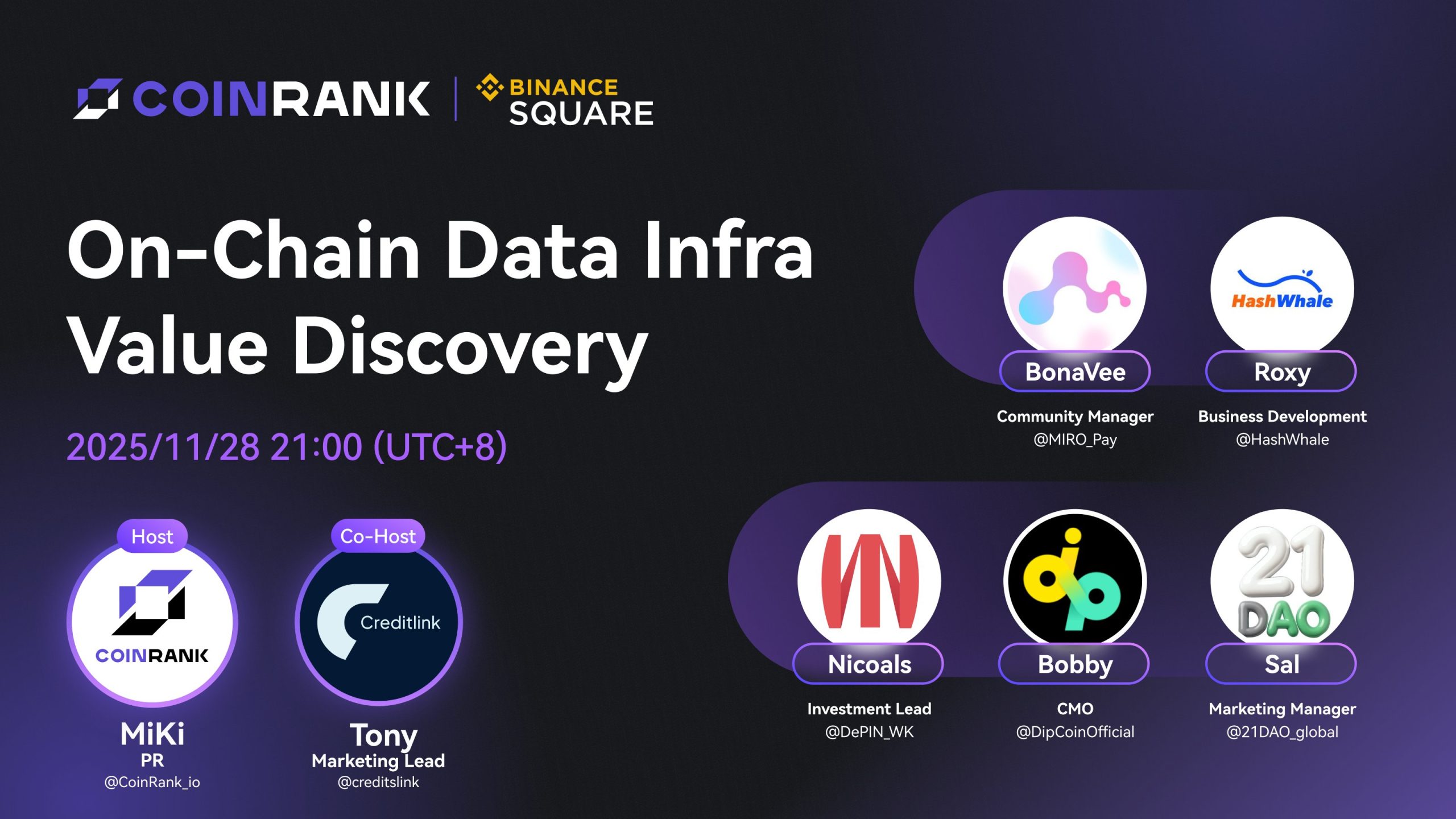

During a recent AMA hosted by CoinRank, a foundational question was posed that set the tone for the discussion: in the future internet, will on-chain data function more like invisible infrastructure, or will it evolve into a user-owned digital asset that individuals can hold, utilize, and carry across various applications? This framing resonated deeply, as it captured the dual nature of on-chain data in the present.

BonaVee from MIRO Pay described this duality as a spectrum. On one end, on-chain data is becoming the silent backbone of the internet, akin to servers and network protocols operating beneath the surface. Applications will seamlessly integrate verifiable information, much like they currently call APIs, with most users remaining unaware of the underlying changes. On the other end, data begins to resemble personal property. Identity, reputation, transaction history, and credentials are no longer confined within specific platforms but exist on-chain in portable formats that users can take with them anywhere.

Nicholas from WebKey echoed this sentiment, emphasizing that on-chain data is more than just analytics; it forms the bedrock of identity, ownership, and trust in Web3. Wallet behavior, device activity, and DePIN usage collectively create a user footprint that is genuinely under individual control. This shift is subtle yet significant: data transitions from being something platforms extract to something users actively leverage. Collectively, these initial viewpoints highlighted the tension shaping the internet's future—data as infrastructure versus data as an asset—and how Web3 is concurrently advancing both.

When Assets and Identity Move On-Chain: A New Product Paradigm Emerges

As the panel progressed to the second topic, the conversation focused on the implications of on-chain assets and identities for product design. Roxy from HashWhale underscored composability as the first major transformation. With identity, credit, and payments already residing on-chain, developers are freed from rebuilding these core components from scratch. They can now integrate existing modules directly, enabling enterprise-grade use cases and significantly simplifying product architecture.

This evolution is particularly impactful for institutions. On-chain identity can reduce Know Your Customer (KYC) onboarding costs, enhance fraud detection capabilities, and support automated credit assessment and compliance processes. A verifiable and auditable identity layer becomes the essential foundation for serious institutional adoption.

Tony from Credit Link argued that the Web3 product stack is pivoting from a platform-controlled model to a user-controlled one. Users directly own their data and assets, while applications are designed to revolve around them. Identities and portfolios can move seamlessly between services, leading to smoother and more personalized user experiences.

Sai from 21DAO contributed a user experience perspective, suggesting that as Web3 becomes increasingly driven by decentralized applications (dApps), competition will center on the user interface rather than the underlying mechanics. For 21DAO, this translates to building a task-and-reward experience that feels intuitive and enjoyable. He noted that future products must prioritize user-centric design and simplicity over purely technical sophistication. These insights collectively highlighted a broader trend: once assets and identities are established on-chain, product design will move away from creating closed ecosystems towards building interoperable experiences centered on the user.

Turning Raw Behavior into Credit: How Credit Link Builds Trust

The AMA then delved into a more detailed segment focused on Credit Link. Tony explained that the team defines high-value data not by its sheer volume, but by its clarity and reliability. Instead of collecting every conceivable data point, their focus is on information directly linked to economic behavior, including transaction history, liquidity management, collateral efficiency, and long-term participation patterns. Essentially, high-value data is any information that contributes to a more accurate assessment of trust and risk.

Credit Link processes this data through a behavioral credit model that continuously analyzes real-time on-chain performance. Rather than relying on static snapshots, the platform generates dynamic credit scores that can be applied across lending, trading, staking, and other financial scenarios. This empowers protocols with enhanced decision-making tools and allows users to access opportunities based on demonstrated character rather than mere speculation.

Tony also highlighted the accessibility of features on the Credit Link website. Users can input a token contract or wallet address to review safety profiles or credit scores without needing to connect a wallet, and this service is provided free of charge. Projects and institutions can utilize batch analytics to filter airdrops, identify and remove sybil wallets, assess ecosystem risks, or analyze macro behavior patterns. The core message was clear: usable credit begins with interpretable on-chain behavior.

The Next Breakthrough: From Raw Logs to Interpretable Signals

When discussing the next major advancement for on-chain data, the panelists unanimously agreed on a central theme: interpretation. Bobby from Dipcoin drew a parallel between the current state of on-chain data and the internet before the advent of search engines. The data exists, but it has not yet been organized into meaningful signals. Once identity, reputation, predictive analytics, and behavioral insights mature, entirely new applications will become feasible.

Dipcoin's strategy involves surfacing trader insights directly within the trading interface, supported by confidence metrics and real-time risk flags derived from on-chain data. When complex patterns are translated into readable guidance, the utility of on-chain data increases exponentially.

Roxy from HashWhale identified AI and on-chain credit as the next significant growth areas. AI systems trained on verifiable data can detect fraud, identify anomalous activity, and generate risk scores that surpass human capabilities. Combined with transparent on-chain credit systems, this paves the way for innovative products in borrowing, insurance, and premium access services.

Nicholas from WebKey emphasized the importance of usability in real-world applications. The forthcoming breakthrough will not solely be about generating more data, but about achieving better integration. Once on-chain information can reliably power DeFi credit, reputation systems, and even traditional financial products, adoption rates are expected to accelerate significantly. His team is actively developing secure hardware and Decentralized Identifier (DID) binding to anchor on-chain identity to real individuals rather than anonymous wallets.

Tony added that the establishment of standardized frameworks will be crucial. Fragmented data must be mapped into credit models that are recognized and accepted across different protocols. When identity and reputation become measurable metrics, the market can transition from cycles driven by speculation to growth fueled by utility.

Building the Ecosystem: Credit Link’s Expanding Integrations

Tony also provided updates on Credit Link's ecosystem expansion. The team has integrated with AAI to offer token risk analytics directly within a DEX trading environment. They are also collaborating with Astar and ListDao to enhance DeFi risk management and provide robust data support for their ecosystem partners.

A notable example is the CDL vault on ListDao, where users can deposit assets such as Bitcoin, USDT, and Astar to earn yield and unlock various utilities. These utilities include borrowing CDL or participating in incentive campaigns, thereby creating genuine demand and circulating use cases within a mature DeFi ecosystem.

Beyond these specific collaborations, Credit Link is actively pursuing integrations across a wide range of DeFi protocols, Decentralized Exchanges (DEXs), social platforms, and analytics infrastructure. Their overarching objective is straightforward: on-chain credit should be universally usable, not restricted to a single application.

Challenges Ahead: Data Quality, Privacy, and Interoperability

To conclude the panel, the speakers outlined the obstacles that lie between the current state of on-chain data and its full realization. The prevalence of noise and low-quality data remains a significant challenge, with bots, airdrop farmers, and non-organic behavior distorting the true picture. Verification and sybil resistance are equally pressing concerns. Sai from 21DAO highlighted how reward platforms face difficulties when a single user controls numerous wallets, prompting them to adopt proof-of-action systems instead of relying solely on raw activity counts.

The delicate balance between privacy and transparency continues to be a critical issue. Users desire control over their data, not exposure, making privacy-preserving computation essential for widespread adoption. Standardization and interoperability present further complexities, as each blockchain and application stores data in incompatible formats. User experience may emerge as the most substantial barrier of all; for the average user, interfaces resembling spreadsheets offer little clarity. Dashboards must evolve to provide actionable guidance, not just raw information.

Despite these challenges, the conversation conveyed a strong sense of forward momentum. Hardware-level Decentralized Identifiers (DIDs) from WebKey, behavioral scoring from Credit Link, proof-of-action verification from 21DAO, and real-time insights from Dipcoin are all contributing to the same objective: transforming messy on-chain logs into a reliable foundation that real users and real products can trust.

Closing Thoughts: The Foundation of a New Data Economy

The AMA concluded without a single, definitive answer, but such a resolution was not necessary. The discussion itself made one aspect abundantly clear: on-chain data infrastructure is no longer a niche technical subject. It is rapidly becoming a central layer of Web3, fundamentally reshaping how trust, identity, and financial opportunities are created and exchanged online.

Participants were encouraged to follow CoinRank, Credit Link, and all guest projects on X for further updates. Projects interested in participating in future AMAs were invited to reach out and share their perspectives. Whether adoption proves to be a gradual process or a rapid surge, on-chain data is emerging as one of the defining architectures of the digital economy, connecting users, applications, and ecosystems through a foundation of verifiable, portable, and user-owned information.