Key Developments in Digital Asset ETPs

CoinShares' latest report indicates a significant event in the digital asset market, with record outflows totaling $2 billion from digital asset Exchange Traded Products (ETPs) last week. The United States accounted for the vast majority of these outflows, representing 97% of the total. This substantial withdrawal highlights a shift in investor sentiment, with Bitcoin and Ethereum leading the declines. However, amidst this widespread sell-off, certain altcoins such as Solana and XRP experienced contrary inflows, suggesting a more nuanced market dynamic.

U.S. Policy Uncertainty Triggers Record Outflow

CoinShares reports a record-setting pullback in digital asset ETPs, largely influenced by United States monetary policy concerns and a liquidity cascade prompted by significant holders. Germany, conversely, witnessed a $13.2 million inflow, highlighting its divergent approach amidst global caution. Digital assets like Solana, XRP, and others attracted investments even during widespread market hesitance.

Bitcoin and Ethereum experienced notable outflows, with $1.38 billion and $689 million respectively, while multi-asset ETPs gained traction among investors moving funds. Short positions on Bitcoin increased, suggesting diminished confidence in a price revival.

"This week’s accelerating outflows are being driven by the aftermath of the October 10 liquidity cascade and a sharp rise in macroeconomic concerns—especially about the U.S. rate policy," noted James Butterfill, Head of Research at CoinShares.

Market Data and Insights

Did you know? Recent historical trends show potential for sharp rebounds in the crypto market, suggesting investors remain attentive to macroeconomic cues.

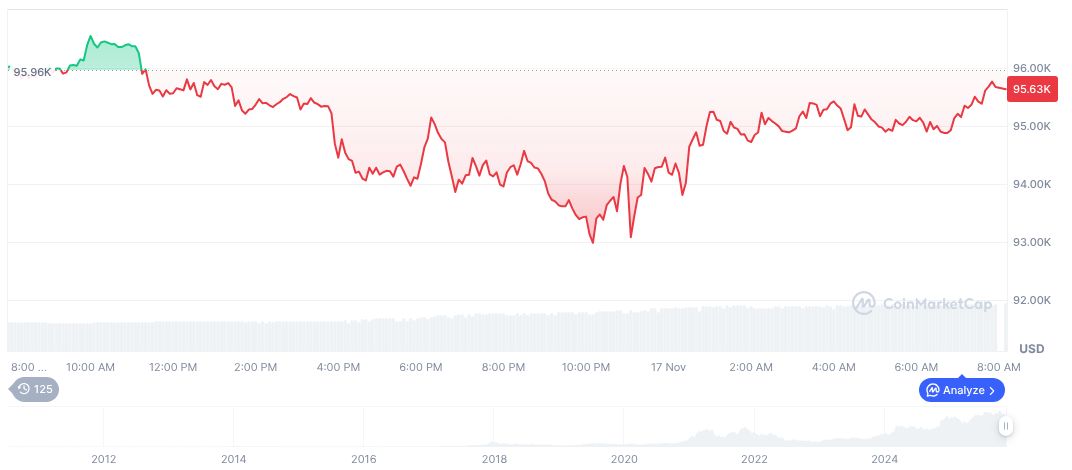

According to CoinMarketCap, as of November 17, 2025, Bitcoin is priced at $95,566.89, reflecting a 0.82% decrease over 24 hours and a 10.12% drop in the past week. Its market cap stands at $1,906 billion, accounting for 58.73% market dominance.

Coincu's research team suggests that ongoing U.S. monetary policy uncertainties could intensify risk-off sentiment, affecting regulatory perspectives and technological advancements.