Overview

| Cryptocurrency | Cronos |

| Token | CRO |

| Price | $0.1915 (+3.1%) |

| Market Capitalization | $9.04B |

| Trading Volume (24‑hour) | $126.66M |

| Circulating Supply | 33.61B CRO |

| All‑time High | $0.9698 Nov 24, 2021 |

| All‑time Low | $0.01149 Dec 17, 2018 |

| 24‑h High | $0.1922 |

| 24‑h Low | $0.187 |

Cronos Price Prediction: Technical Analysis

| Metric | Value |

| Price Volatility (30‑day variation) | 31.63% |

| 50‑Day SMA | $ 0.164653 |

| 14‑Day RSI | 61.82 |

| Sentiment | Neutral |

| Green Days | 15/30 (50%) |

| 200‑Day SMA | $ 0.108893 |

| Price Prediction | 15/30 (50%) |

Cronos price analysis: CRO resistance at $0.195, support at $0.1821

- •$0.1821 holds as a strong support zone, and buyers continue to defend this level, making it the foundation for CRO’s current rebound.

- •$0.195 caps upside momentum; sellers are actively rejecting moves above this barrier, keeping price growth limited for now.

- •The tight range signals a breakout ahead of the $0.190–$0.195 consolidation, suggesting that CRO is preparing for a decisive move soon.

On September 29, 2025, Cronos (CRO) trades at $0.1915, marking a 3.12% uptrend in the past 24 hours. The token is showing renewed strength as it continues to build momentum after periods of sideways consolidation. The day’s chart highlights clear support at $0.1821 and resistance at $0.195, forming a narrow trading range that traders are closely monitoring. The price movement reflects active participation and volatility within this zone, where short‑term sentiment plays a critical role in defining direction.

Cronos daily chart: CRO buyers hold ground above $0.190, resistance at $0.195

During the daily timeframe, CRO showed an encouraging rebound after testing the $0.1821 support level. The bounce triggered a wave of accumulation, creating higher lows and keeping the price above the mid‑range threshold of $0.190. Market structure indicates that buyers are holding firm, using dips as entry points, while the candlestick formations highlight persistent attempts to breach resistance.

Resistance remains firm at $0.195, which acts as the first barrier preventing further expansion. If CRO clears this ceiling, traders could expect follow‑through toward higher liquidity zones, solidifying a stronger uptrend. However, failure to sustain buying momentum may see the token retrace toward $0.186 and, in a deeper correction, back to the $0.1821 support, which is now a crucial line for bullish sentiment.

Cronos 4‑hour price chart: CRO consolidates between $0.190 and $0.195

On the 4‑hour chart, CRO continues to form higher lows, showing signs of steady accumulation and gradual momentum building. The structure reflects a consolidation phase between $0.190 and $0.195, where the price is oscillating without breaking either extreme. This pattern suggests that market participants are waiting for confirmation before committing to the next significant move.

Sellers remain active near $0.195, repeatedly rejecting upside moves, while buyers consistently defend the $0.190 zone. This tight range presents a breakout setup, with an eventual breach likely to dictate short‑term direction. A move above $0.195 would strengthen the bullish structure, while a breakdown below $0.190 could trigger a retest of $0.186 in the short term.

Cronos technical indicators: Levels and action

Daily simple moving average (SMA)

| Period | Value | Action |

| SMA 3 | $ 0.2922 | SELL |

| SMA 5 | $ 0.2880 | SELL |

| SMA 10 | $ 0.2585 | BUY |

| SMA 21 | $ 0.2036 | BUY |

| SMA 50 | $ 0.1646 | BUY |

| SMA 100 | $ 0.1285 | BUY |

| SMA 200 | $ 0.1088 | BUY |

Daily exponential moving average (EMA)

| Period | Value | Action |

| EMA 3 | $ 0.2823 | BUY |

| EMA 5 | $ 0.2771 | BUY |

| EMA 10 | $ 0.2507 | BUY |

| EMA 21 | $ 0.2128 | BUY |

| EMA 50 | $ 0.1705 | BUY |

| EMA 100 | $ 0.1421 | BUY |

| EMA 200 | $ 0.1245 | BUY |

What to expect from Cronos?

Cronos remains at a decisive point, trading tightly between $0.190 and $0.195. The market is preparing for a breakout move, with buyers defending lower levels and sellers maintaining pressure at resistance. A confirmed push above $0.195 would likely invite stronger bullish momentum, opening the way toward higher liquidity levels.

If buyers fail to clear resistance, CRO could slip back toward $0.186 and retest the $0.1821 support, which is a crucial line for maintaining its rebound structure. Traders will be closely monitoring this consolidation, as the next move is expected to set the short‑term trajectory for CRO.

Is Cronos a good investment?

Cronos has shown resilience by holding above the $0.1821 support and maintaining upward momentum despite repeated rejections at $0.195 resistance. Buyers’ ability to consistently defend key levels highlights ongoing demand, making CRO attractive for traders seeking short‑term opportunities in defined ranges.

However, the token remains locked in consolidation, and the outcome of the $0.190–$0.195 zone will be critical in shaping near‑term direction. Investors should weigh the potential for a breakout‑driven rally against the risk of a pullback toward lower supports. CRO’s appeal will largely depend on whether it can establish sustained strength above $0.195, confirming a bullish extension.

Why Is Cronos (CRO) up Today?

Cronos (CRO) is trading higher today, up 3.12% at $0.1915, as buyers stepped in strongly after the recent test of the $0.1821 support level. This rebound has been supported by steady accumulation, with traders using dips as entry points to maintain upward momentum.

The recovery has also been fueled by active participation in the $0.190–$0.195 range, where buyers continue to defend lower levels. The consistent defense of support, combined with repeated attempts to challenge resistance, has provided the short‑term lift seen in CRO’s price action.

Recent news

As reported by Cryptopolitan, Cronos has released its 2025–2026 roadmap, detailing plans to position itself as a key infrastructure provider for tokenized assets and AI‑powered finance. Over the next 12 to 18 months, it will launch a comprehensive tokenization platform covering asset classes such as equities, real estate, commodities, funds, insurance, and forex, with features like instant settlement, yield generation, lending, and DeFi integration.

To make its ecosystem AI‑native, Cronos will introduce an AI Agent SDK and a Proof of Identity standard, enabling direct interaction between AI agents and on‑chain finance. Adoption will be driven by integration with Crypto.com’s 150 million users and 10 million merchants. At the same time, institutional demand will be supported through CRO ETFs in the U.S. and Europe, backed by partners like 21Shares, Canary Capital, and Trump Media Technology Group. The roadmap also highlights support for CRO‑based digital asset treasuries, bolstered by the recent $6.4 billion Trump Media–Crypto.com SPAC merger aimed at establishing a dedicated CRO treasury and validator.

Will Cronos reach $0.5?

Based on long‑term forecasts, Cronos (CRO) is projected to reach $0.5 by 2026 as its ecosystem and user adoption continue to grow.

Will Cronos reach $1?

Projections for Cronos estimate it could reach $1 by 2028, driven by its expansion in DeFi, NFT integrations, and partnerships.

Will Cronos reach $100?

It is unlikely that Cronos’s price will reach $100, as this would require an extremely high market capitalization beyond the current CRO coin price prediction for the crypto sector.

Does Cronos have an excellent long‑term future?

Cronos CRO holds promising long‑term potential due to Crypto.com’s ongoing innovations, such as DEX expansions, NFT integration, and metaverse applications, collectively enhancing CRO’s appeal and utility. These strategic initiatives, along with CRO’s liquidity and staking rewards, position it as a solid investment for those with a long‑term perspective.

Cronos price prediction September 2025

For September, Cronos (CRO) is primed for promising growth with significant price movements. The minimum projected trading price is $0.2520, with an average of around $0.2785. CRO is expected to attain a peak price of $0.2785.

| Month | Potential Low | Potential Average | Potential High |

| September | $0.2520 | $0.2785 | $0.2864 |

Cronos price prediction 2025

Experts suggest that in 2025, Cronos will trade at a minimum price of $0.2970 and a maximum price of $0.3238. The average trading price is expected to be around $0.3103.

| Cronos Price Prediction | Potential Low | Potential Average | Potential High |

| Cronos Price Prediction 2025 | $0.2970 | $0.3103 | $0.3238 |

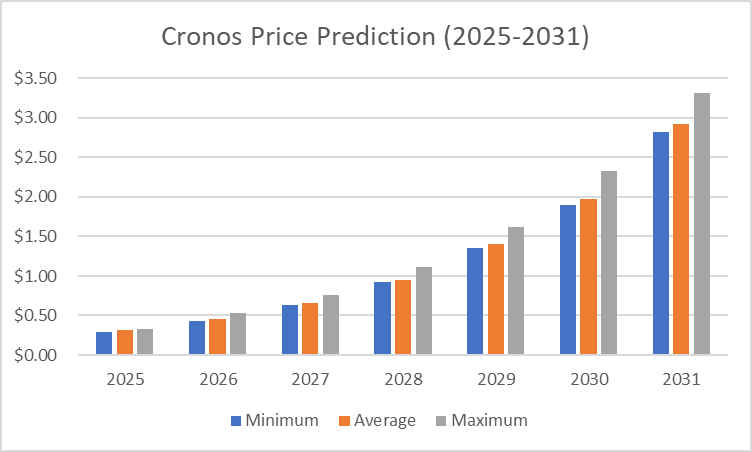

Cronos price prediction 2026‑2031

| Year | Minimum Price | Average Price | Maximum Price |

| 2026 | $0.4352 | $0.4508 | $0.5275 |

| 2027 | $0.6369 | $0.6550 | $0.7640 |

| 2028 | $0.9255 | $0.9517 | $1.11 |

| 2029 | $1.35 | $1.40 | $1.62 |

| 2030 | $1.90 | $1.97 | $2.33 |

| 2031 | $2.82 | $2.92 | $3.31 |

Cronos price prediction 2026

The Cronos price prediction for 2026 suggests a minimum predicted price of $0.4352, a maximum level of $0.5275, and an average price of $0.4508.

Cronos price prediction 2027

In 2027, Cronos’s price is predicted to reach a minimum of $0.6369. CRO can reach a maximum level of $0.7640, with an average trading price of $0.6550.

Cronos price prediction 2028

The Cronos price prediction for 2028 suggests a minimum value of $0.9255, a maximum value of $1.11, and an average trading price of $0.9517.

Cronos price prediction 2029

According to the findings, the CRO price could reach a minimum of $1.35 and a maximum of $1.62, with an average forecast price of $1.40.

Cronos price prediction 2030

In 2030, Cronos’s price is predicted to reach a minimum of $1.90. CRO can reach a maximum price of $2.33, with an average trading price of $1.97.

Cronos CRO price prediction 2031

The price of CRO is predicted to reach a minimum of $2.82 in 2031. It can further get a maximum cost of $3.31 with an average price of $2.92.

Cryptopolitan’s Cronos CRO price prediction

According to our Cronos price forecast, the coin’s market position is bullish, and its price might reach a maximum value of $0.3238 by the end of 2025. By 2026, investors can anticipate an average price of $0.4508 and a maximum price of $0.5275, provided the market is bullish. It is advised to conduct investment advice and determine the future price targets of Cronos for a profitable return. To trade Cronos, one should go for leading CEXs.

Cronos market price prediction: Analysts’ CRO price forecast

| Firm | 2025 | 2026 |

| DigitalCoinPrice | $0.59 | $0.69 |

| Coincodex | $0.567 | $0.683 |

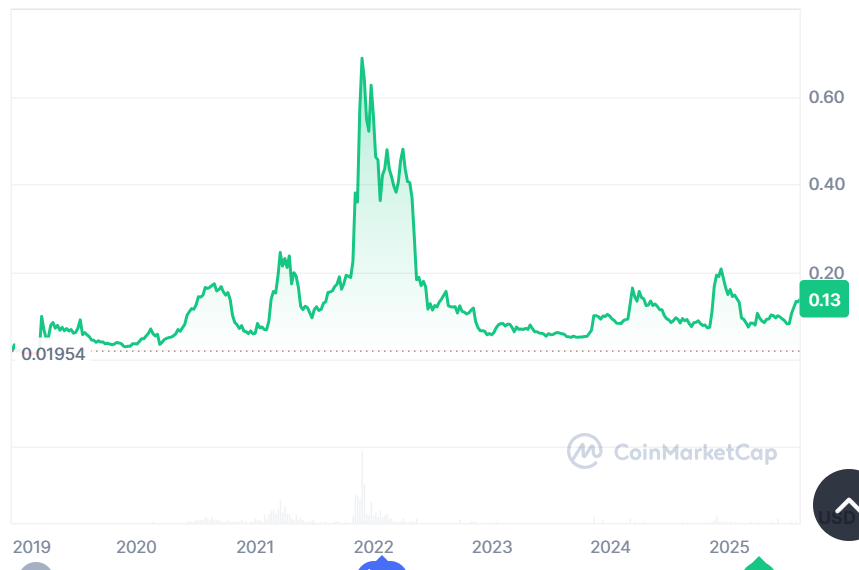

Cronos historic price sentiment

- •CRO launched at $0.01977 in December 2018 and saw early fluctuations, hitting $0.07344 by March 2019, but ended 2019 at $0.03358. In 2020, CRO rose steadily, reaching above $0.20 by August before dropping to $0.06 by year‑end.

- •In 2021, CRO followed the crypto bull run, surpassing previous highs and achieving an all‑time high of $0.9698 on November 24, boosted by listings on Coinbase Pro and Bitrue.

- •CRO opened 2022 at $0.5575 but fell to $0.4409, partially due to concerns over a potential security breach on the Crypto.com platform, which temporarily suspended withdrawals in January.

- •In 2023, Cronos experienced a peak in mid‑March near $0.80, followed by a steep decline and stabilization around $0.20 by mid‑year. It maintained a slight oscillation around this range in the following months.

- •CRO started 2024 at $0.10, rallied to a yearly high of $0.18 in March, and declined to $0.12 by June. It stabilized between $0.08 and $0.10 from July to October, traded at $0.07193 and $0.09521 in November, and ended the year in a range of $0.138 and $0.234 in December.

- •In January 2025, Cronos traded within the range of $0.158 to $0.163 but lost momentum towards the end of the month, leading to a trading range of $0.1005 – $0.160 in February.

- •Later in March, Cronos traded within the range of $0.08076 and $0.0950. However, after touching the $0.1 mark by the end of March, the Cronos price triggered a bearish rally.

- •In April, the CRO price declined heavily due to the rising trade war between the US and China. The Cronos price dropped to a low of $0.08. However, it has been surging toward $0.09 in recent weeks of May.

- •As of June, Cronos (CRO) declined from approximately $0.098 to $0.081, experiencing a steady downtrend with brief attempts at recovery near $0.085 in July.

- •By the end of August, the price of Cronos skyrocketed toward $0.38 but it later declined below $0.25 in early September.