The Challenge of Maximal Extractable Value in Decentralized Finance

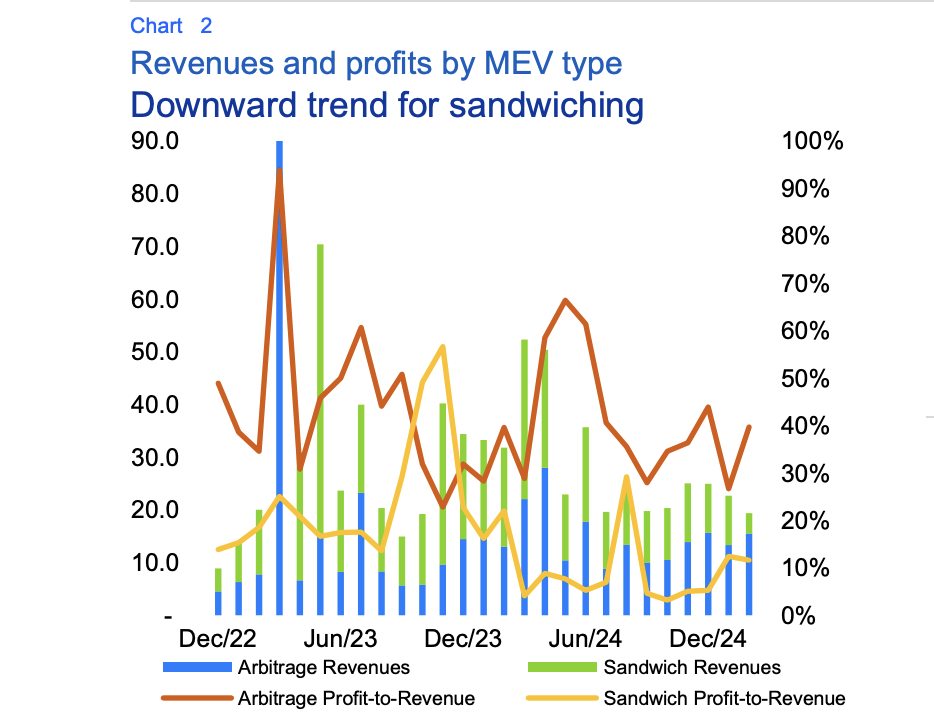

Maximal Extractable Value (MEV), a practice where miners or validators reorder transactions to maximize their profits, continues to pose significant barriers to the mainstream adoption of decentralized finance (DeFi). This phenomenon not only hinders institutional participation but also negatively impacts the user experience for retail investors, creating a substantial obstacle for DeFi's broader growth.

Industry experts highlight that all electronically traded markets face similar issues arising from information asymmetry, which enables exploitative tactics like front-running. A proposed solution involves processing transactions within trusted execution environments, a technology that keeps order flow data hidden until execution, thereby preventing market manipulation.

“What makes these solutions impactful is their ability to handle orders privately. Your trading intentions remain encrypted client-side and are only decrypted inside secure enclaves after being sequenced,” states Aditya Palepu, CEO of DEX Labs.

This approach to privacy preservation effectively eliminates front-running strategies, including sandwich attacks, which manipulate prices by strategically placing trades immediately before and after user transactions for profit. Consequently, markets become fairer and less susceptible to manipulative practices.

The ongoing debate within the crypto industry centers on the potential centralization risks, increased costs, and the broader implications of MEV on market stability and scalability. Industry stakeholders are actively exploring various solutions, such as batched threshold encryption, with the goal of making DeFi more equitable and secure for all participants.

Institutional Reluctance Hampers DeFi Growth and Retail Investor Access

A primary reason institutions remain hesitant to engage with DeFi is the inherent lack of transaction privacy. As Palepu points out, the transparency of blockchain transactions exposes institutions to front-running, market manipulation, and other significant risks, discouraging their active participation in the DeFi space.

“When institutions cannot participate effectively, it negatively impacts retail users and the broader market,” Palepu emphasizes. Institutional involvement is crucial for developing the robust trading infrastructure that is essential for healthy financial markets, which in turn underpin DeFi ecosystems.

The absence of institutional participation can lead to decreased liquidity, increased market volatility, and a higher potential for price manipulation, all of which create significant risks for retail investors. Furthermore, high transaction costs and a lack of market diversity can impede DeFi’s potential to evolve into a fully-fledged alternative to traditional finance.

Addressing MEV concerns and enhancing transaction privacy are widely considered foundational steps toward cultivating a fairer and more sustainable crypto ecosystem. These improvements are expected to foster greater institutional confidence and encourage broader retail engagement, ultimately leading to more resilient blockchain markets.