Crypto markets have entered one of their most pessimistic phases in years, with sentiment collapsing to levels last seen during the 2022 Luna crash. According to trader Michaël van de Poppe, both market behavior and the Fear & Greed Index are now reflecting a deep pocket of fear that rarely appears, and historically precedes strong reversals.

Sentiment Has Fallen Off a Cliff

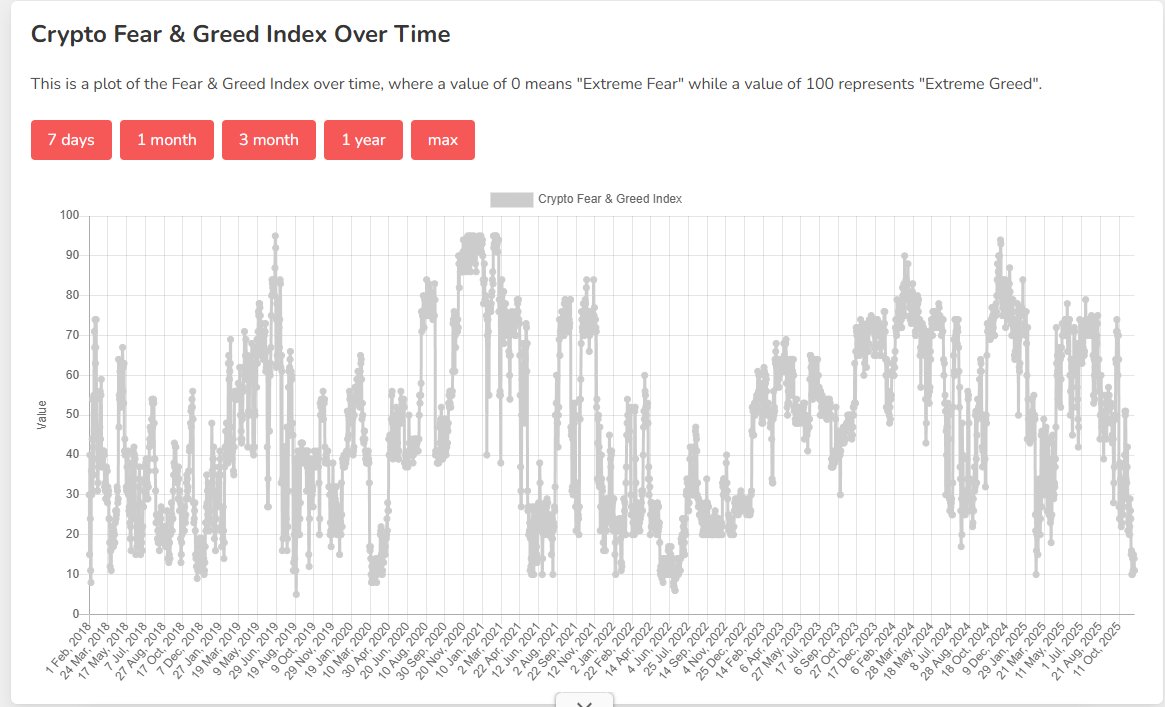

The Fear & Greed Index, which tracks market emotion on a scale from 0 (extreme fear) to 100 (extreme greed), has plunged toward the bottom of its multi-year range. The accompanying chart shows a dramatic contraction in sentiment, with readings matching the lows recorded during the Luna collapse, one of the most severe capitulation events of the last cycle.

Van de Poppe highlighted that interest in crypto on social media is also near zero, a sign that retail participation has faded almost entirely. While this may seem negative, he notes that similar conditions have historically marked market bottoms rather than tops.

This Environment Has Preceded Major Cycle Rallies

When the crypto Fear & Greed Index reaches extreme fear:

- •Bitcoin typically finds medium-term support

- •Capital begins repositioning quietly rather than aggressively

- •Volatility compresses before expansion

- •Market narratives shift from panic to accumulation

The chart shows repeated cycles of sentiment crashing to the low range followed by strong upside moves. Van de Poppe suggests that the current setup closely mirrors those earlier accumulation phases.

Why Some Traders View This as a Rare Opportunity

While fear dominates headlines, the market backdrop includes several constructive elements:

- •Long-term holders remain confident, showing no major distribution

- •On-chain activity suggests quieter accumulation rather than exit flows

- •Major assets like Bitcoin and Ethereum remain well above their historical trend levels despite the pullback

Van de Poppe argues that hindsight will likely reveal this period as a high-value accumulation zone, not a moment of genuine structural danger.

The last time the index was this low was the Luna crash. In hindsight, this will be a great opportunity.

A Market Defined by Fear But Not Fundamentals

Despite the emotional pressure traders are feeling, no clear structural breakdown has occurred across major crypto assets. Instead, the mood reflects exhaustion, frustration, and the absence of retail engagement.

For patient investors, conditions like these often present asymmetric opportunities, the periods where fear is loud, prices are discounted, and long-term cycle trends quietly stay intact.