Digital asset investment products recorded one of their worst weeks of 2025, with $2.03 billion in outflows, the largest since February. This marks a three-week slide reaching $3.2 billion, driven by a combination of macro uncertainty and significant selling pressure from large crypto holders.

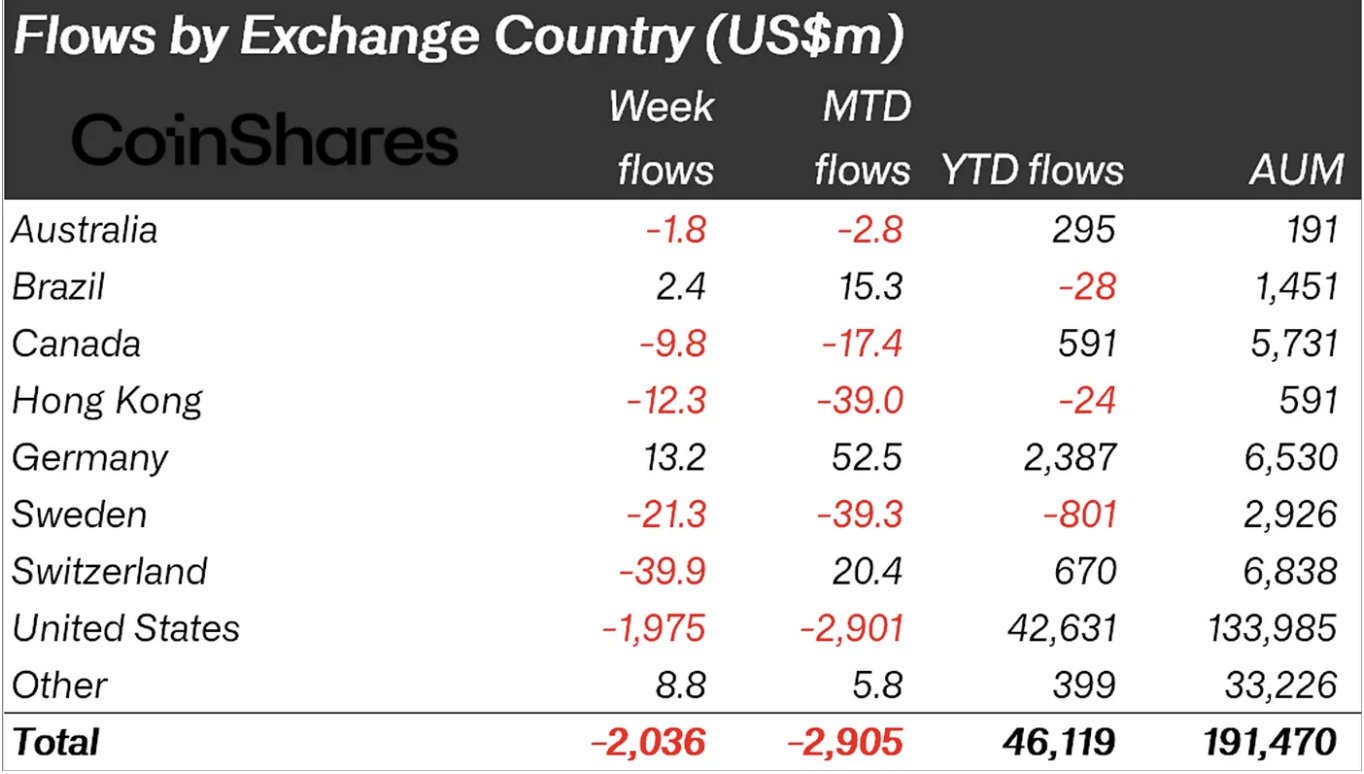

U.S. Dominates the Withdrawals

The United States was the primary driver of outflows, accounting for an overwhelming 97% of the total, with $1.97 billion withdrawn in a single week. Switzerland ($39.9 million) and Hong Kong ($12.3 million) also experienced notable redemptions. In contrast, Germany bucked the trend with $13.2 million in inflows, suggesting a degree of dip-buying sentiment among European investors.

AUM Falls Sharply From October Peak

CoinShares data indicates that total assets under management (AUM) in crypto exchange-traded products (ETPs) have declined significantly from their peak of $264 billion in early October to $191 billion currently, representing a 27% decrease. The weekly flows chart illustrates the severity of this reversal, showing one of the steepest outflow periods in nearly a year.

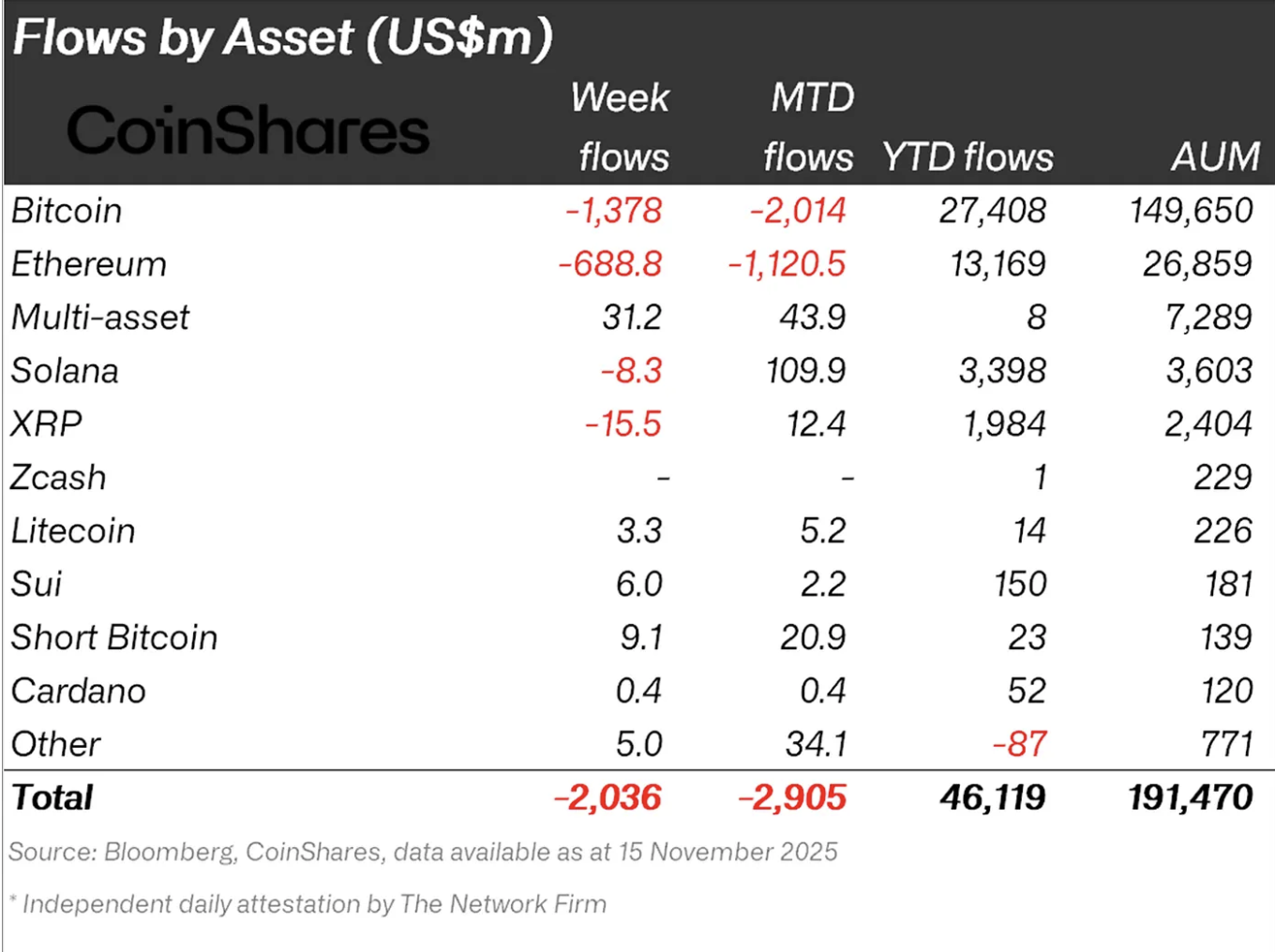

Bitcoin and Ethereum Take the Largest Hit

Bitcoin investment products experienced outflows totaling $1.378 billion last week, which amounts to 2% of its total AUM being withdrawn over the past three weeks. Ethereum saw an even sharper proportional decline, with $688.8 million in outflows, equating to approximately 4% of its AUM. Other assets saw smaller movements, including Solana (SOL) with -$8.3 million, XRP with -$15.5 million, Litecoin with +$3.3 million, and Sui with +$6 million. The flows-by-asset chart highlights Bitcoin and Ethereum as the primary contributors to the overall negative figures.

Multi-Asset and Short Bitcoin ETPs Gain Traction

Despite the widespread weakness, two categories of ETPs attracted significant inflows: Multi-asset ETPs saw inflows of +$69 million over the past three weeks, and Short Bitcoin ETPs received +$18.1 million. This positioning suggests that investors may be hedging against volatility or reallocating into diversified baskets rather than exiting the sector entirely.

Country Breakdown: U.S. Pressure vs. Global Nuance

Exchange-country data provides further insight into the outflows. The U.S. accounted for -$1.975 billion, representing the core driver of the drawdown. Switzerland saw -$39.9 million, Hong Kong -$12.3 million, and countries like Brazil, Canada, and Sweden experienced modest outflows. Germany, however, recorded inflows of +$13.2 million, offering a rare positive signal. The year-to-date (YTD) flows column indicates that despite the recent pullback, the U.S. still leads significantly in total inflows for 2025, suggesting that underlying structural interest in digital assets remains intact despite short-term market fears.

Macro Uncertainty Meets Whale Selling

CoinShares attributes the recent sharp downturn in digital asset investment products to two primary forces. The first is monetary policy uncertainty, as market participants anticipate shifts in interest rate timelines. The second is crypto-native "whale" selling, which exerts downward pressure on market prices and contributes to ETP outflows. The combination of these pressures has led to the steepest redemptions observed since early 2025.

Outlook

While the recent weekly flows present a bearish picture, the continued inflows into multi-asset products and Germany's contrarian buying indicate that sentiment is not uniformly negative. AUM levels remain considerably higher than early-cycle figures, and institutional positioning suggests a strategy of hedging rather than outright abandonment of the sector. The presence of inflows into multi-asset products, plus Germany’s contrarian buying, shows that sentiment isn’t uniformly negative. AUM remains far higher than early-cycle levels, and institutional positioning suggests hedging, not abandonment.