A sharp round of forced selling struck the crypto market on Tuesday, clearing out more than $2 billion in leveraged positions within a single day. Bitcoin briefly slipped to just below $100,000 to $99,008 before recovering slightly to around $102K, reflecting the fast and unstable price swings that dominated trading conditions.

The sudden drop sparked panic among traders and marked one of the biggest single-day shakeouts. Renewed fears over macroeconomic tightening and investor risk aversion further intensified the sell-off across all major cryptocurrencies.

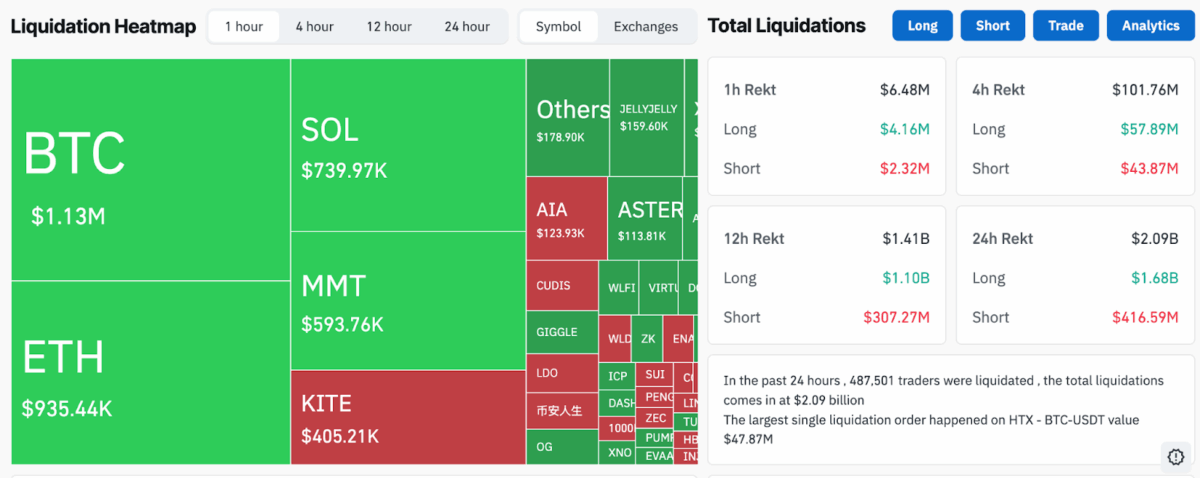

Data from CoinGlass shows that over $2.09 billion in crypto futures were wiped out in the past 24 hours. Most of the losses hit long traders, who lost $1.68 billion, while short positions lost $416.6 million. The biggest single loss happened on HTX, where a BTC-USDT trade worth $47.87 million was liquidated. In total, 487,501 traders saw their positions closed.

Bitcoin and Ethereum Lead Market Collapse

At the time of publishing, Bitcoin was holding around $101,922, 4.6% off its price of 24 hours ago. Ethereum fell even harder, sliding nearly 10% to $3,098. Other major coins like XRP, BNB, and Solana slid more than 5% in the same period. The total market capitalization of all cryptocurrencies fell to $3.39 trillion, slipping 4.5% within a day.

Meanwhile, trading volume increased 55% to $314.76 billion as traders scrambled to close positions amid market turbulence.

According to CoinGlass data, Bitcoin saw $581 million in 24 hours of liquidation, whereas Ethereum traders lost $587 million. MMT and Solana came next, at $107 million and $98 million, respectively. This was a result of traders who had borrowed funds selling off their coins, which caused them to be over-leveraged when the prices drastically moved against them.

The most liquidations, in the past 24 hours, among crypto exchanges were on Bybit, which saw $561 million of leveraged position wiped out, representing 34% of the total. Following Bybit, Hyperliquid also contributed a significant amount in liquidation, witnessing nearly $446 million of blow up. Binance, Gate, OKX, and HTX were following with a notable amount.

Macroeconomic Pressure Adds to the Chaos

Market analysts point to global risk sentiment as the main driver behind the recent decline. “We got the 25bp cut as expected, quantitative tightening officially wrapped up, and results from the Mag7 came in decently,” a leading market maker Wintermute noted in their recent X post. “However, markets still wobbled after Powell walked back the near-certainty of another cut in December. What was a 95% priced-in move going into the meeting has now slipped to roughly 68%, prompting a quick rotation risk-off as traders recalibrated.”

Tuesday’s correction also mirrored movements in traditional markets. The Nasdaq and S&P 500 both closed lower, with tech stocks hit hardest by renewed macroeconomic fears.

Noting the Monday sell-off, Wintermute added that the selloff was not largely panic-driven but it was more of a re-positioning. “Some investors got caught leaning too bullish into the event, a “classic travel and arrive” scenario where the 25bps was already completely priced in by the market. Equities stabilized quickly after, but crypto didn’t bounce the same way,” the market maker noted.

Market Outlook and Implications

In his latest article, Crypto exchange BitMEX’s Co-Founder Arthur Hayes, cautioned traders to brace for more turbulence. “Between now and when stealth QE begins, one has to husband capital,” he said. “Expect a choppy market especially until the US government shutdown ends.” Hayes added that this liquidity drain is one reason for the ongoing softness in crypto markets.

This recent drop echoes the October 10 crash when many long positions were closed at once. Although yesterday’s liquidations were far away from this, it raises concerns over short-term sustainability of the market.

The $2 billion wave of liquidations also highlights how risky leveraged crypto trading can be during uncertain market conditions. It also shows how closely crypto prices follow global financial trends. With the four-year mark since Bitcoin’s 2021 peak approaching, traders face a test of patience and careful decision-making as volatility continues.

Also Read: RLUSD Stablecoin Hits $1B Market Cap, Enters Global Top 10