The global crypto market cap has slid to $2.97 trillion, extending a multi-week decline that now mirrors the cautious mood across equities and bonds. Fresh labor data from the United States has shaken investors’ expectations ahead of the Federal Reserve’s December policy meeting, creating a wave of uncertainty that is weighing heavily on digital assets.

The volatility began after the delayed September jobs report finally arrived, revealing 119,000 new jobs, more than double market forecasts. While that number normally would signal economic resilience, the underlying details were far less reassuring.

The month’s unemployment rate hit 4.44% unrounded, drifting dangerously close to the 4.5% threshold that several Fed officials consider a warning level. Without an October jobs report and with November data scheduled to arrive after the next FOMC meeting, policymakers now face an unusually murky data landscape.

Market Reaction and Indicators

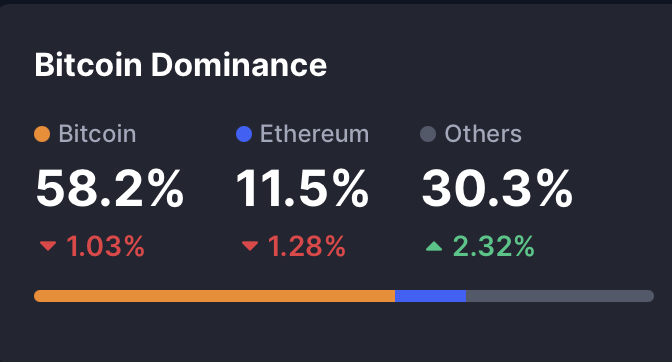

That lack of visibility is unnerving markets. With the Fed potentially forced to maintain higher rates for longer, risk assets have been quick to react. Bitcoin dominance dropped to 58.2%, while Ethereum fell to 11.5%, showing that outflows are not isolated to a single sector. The Altcoin Index slid to 24/100, signaling weakening relative performance across mid-cap tokens. Meanwhile, the Crypto Fear & Greed Index plunged to 15, reflecting deepening fear among retail investors.

Market structure confirms the stress: total crypto market cap has erased nearly $400 billion over the past month, with momentum accelerating in recent days. Volume remains elevated at $202 billion, suggesting that traders are actively repositioning rather than waiting on the sidelines.

Outlook

With unemployment creeping toward levels the Fed considers risky, and with incoming data limited, the current environment leaves investors bracing for more volatility. Until clarity returns to U.S. monetary policy, the crypto market may remain under pressure.