The cryptocurrency market is currently experiencing significant apprehension. The Fear and Greed Index has fallen to 21, having previously dipped as low as 10. Concurrently, there has been a noticeable decrease in Google searches for Bitcoin, and many investors have adopted a cautious stance following a substantial market crash on October 10.

With declining interest and reversed ETF flows, a key question arises: Is this downturn merely a correction, or does it signal the onset of a genuine bear market?

Crypto Market Index Hits Extreme Fear

Recent market data indicates that the crash on October 10 was the primary catalyst for sentiment reaching a record low of 10. This decline was exacerbated by unexpected news regarding a U.S.–China tariff war.

Following the announcement, the price of Bitcoin experienced a significant drop from $126,000 to $98,000, resulting in the liquidation of over $19 billion in leveraged trades. In parallel, major altcoins such as SOL and XRP saw declines exceeding 40% within a matter of hours.

This sharp downturn led to a considerable thinning of crypto order books. Market makers withdrew liquidity to mitigate further losses, Bitcoin ETF inflows transformed into outflows, and the global demand for digital assets weakened.

With the majority of investors remaining hesitant, fear has permeated the market for several consecutive weeks.

Investors Show Declining Interest as Google Searches Drop

Although the markets have shown some stabilization, with the crypto greed & fear index climbing slightly to 21, the market remains firmly within the fear zone.

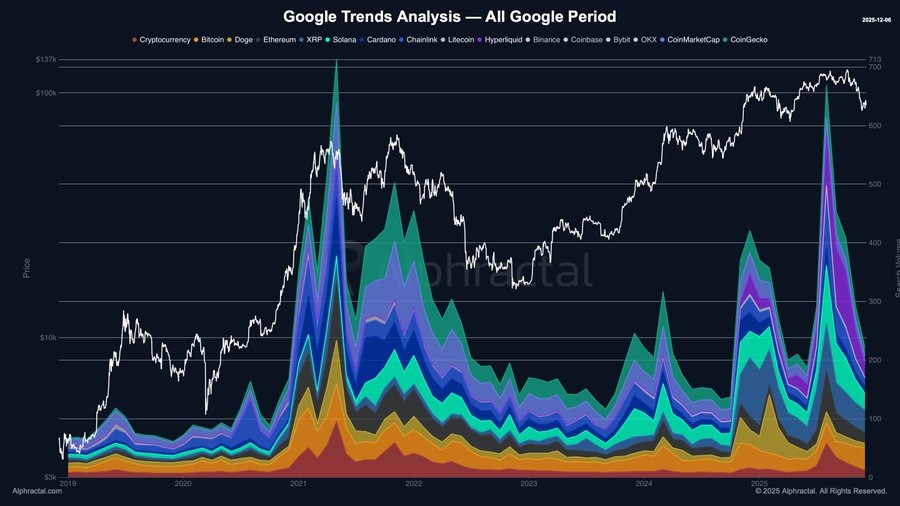

Meanwhile, retail interest in cryptocurrency, as tracked by global Google Trends for terms like "crypto," "Bitcoin," and related searches, has receded to levels observed during previous mid-cycle corrections.

Market observers suggest that periods of low interest coupled with high fear often represent accumulation zones. These are opportune times for astute investors to quietly build positions while the broader market remains pessimistic.

Is This a Bear Market or Mid-Cycle Reset?

Despite the widespread panic, analysts hold differing views on the market's trajectory. Crypto trader KillaXBT notes that Bitcoin appears to be repeating a pattern observed after previous FOMC weeks. In this instance, Bitcoin briefly surpassed $95,000 before experiencing a roughly 5% decline and is currently trading near $90,000.

KillaXBT anticipates that the next significant market movement is likely to occur around December 10–11, based on the latest FOMC data.

In a notable divergence, while the Nasdaq, silver, and S&P 500 have all trended upwards, Bitcoin has moved in the opposite direction, recording a 3% decrease today. This marks the first time since 2014 that the cryptocurrency market has declined while traditional assets have seen gains.