Key Insights

- •The New York Stock Exchange (NYSE) has developed a platform designed for 24/7 trading and on-chain settlement of tokenized stocks, pending regulatory approval.

- •This new platform integrates the NYSE’s Pillar matching engine with blockchain-based post-trade systems that are capable of supporting multiple blockchain networks.

- •The development and announcement occurred amidst regulatory discussions surrounding the CLARITY Act, which saw a postponement of its markup after Coinbase withdrew its support due to concerns over stablecoin reward restrictions.

NYSE's Tokenized Securities Platform

The New York Stock Exchange (NYSE) has announced the development of a sophisticated platform intended for the trading and on-chain settlement of tokenized stocks. This development represents a significant step as traditional finance continues its integration with blockchain infrastructure.

Designed for enhanced efficiency, the NYSE’s digital platform is engineered to facilitate 24/7 trading operations, enable instant settlement, accommodate order sizes denominated in dollars, and utilize stablecoins for funding.

This innovative platform merges the exchange’s robust Pillar matching engine with advanced blockchain-based post-trade systems. These systems are built to support settlement and custody across a variety of blockchain networks.

Upon receiving the necessary regulatory approvals, this platform will serve as the foundation for a new NYSE venue. This venue will be dedicated to the trading of tokenized shares that are fungible with traditionally issued securities, as well as tokens that are natively issued as digital securities.

Shareholders holding tokenized assets will be entitled to participate in traditional shareholder dividends and governance rights, a feature that has garnered attention from traders in the crypto market.

The venue has been architected to adhere to established principles of market structure, ensuring distribution through non-discriminatory access for all qualified broker-dealers.

Broader On-Chain Market Structure Push

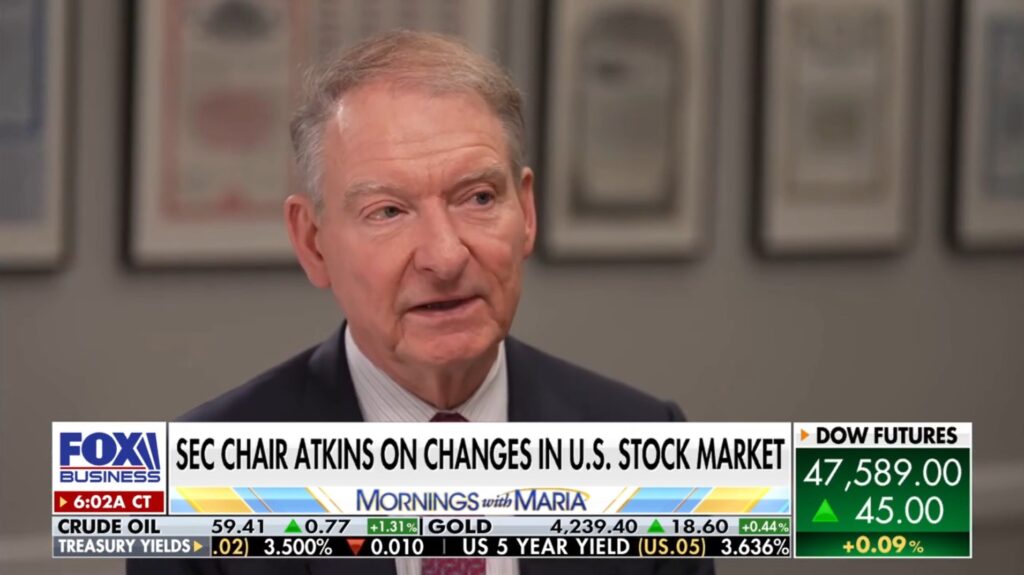

This development aligns with a broader trend toward on-chain market structures. SEC Chairman Paul Atkins had previously predicted in December 2025 that tokenization could become a fundamental component of the US economy within a few years. Atkins argued that on-chain settlement could significantly reduce risk by minimizing the time lag between trade execution and final settlement.

He conveyed his perspective to Fox Business, stating, "The next step is coming with digital assets and digitization, tokenization of the market. It’s the way the world will be… maybe not even in ten years, maybe even a lot less time, maybe a couple of years from now."

The NYSE's announcement fits into a pattern of recent, concrete moves towards reforming market structures.

SEC Commissioner Hester Peirce emphasized that tokenization does not alter the fundamental legal nature of an instrument. She specifically distinguished between issuer-tokenized shares and third-party custody models, which can introduce counterparty risk.

The Depository Trust & Clearing Corporation (DTCC) has already conducted tests on the recordkeeping layer through preliminary DTCC Tokenization Services. These tests have enabled tokenized security entitlements for eligible securities held through DTC and facilitated transfers between registered crypto wallets of DTC participants.

Nasdaq filed in September 2025 to enable the trading of securities in tokenized form. The filing defined tokenized securities as representations based on distributed ledger technology (DLT) or blockchain, while affirming that existing securities regulations would continue to apply.

Launch Timing Amid CLARITY Act Turbulence

The NYSE's platform development comes at a time of significant legislative activity and debate. The Senate Banking Committee postponed a planned markup of the CLARITY Act in mid-January 2026, following considerable industry feedback and opposition.

The bill encountered turbulence due to discussions regarding its potential to restrict or eliminate stablecoin rewards and broader uncertainties about its legislative viability.

The Senate Banking Committee delayed its vote after Coinbase CEO Brian Armstrong withdrew his support, stating, “we’d rather have no bill than a bad bill.” Armstrong attributed the decision to lobbying efforts by large banks against stablecoin yields and rewards.

A central point of contention revolved around whether the proposed market structure legislation would limit stablecoin yields and rewards. Crypto companies argued such limitations would be anticompetitive, while banks contended they were necessary to prevent deposit flight.

Brian Moynihan, CEO of Bank of America, had previously warned during the bank's investor presentation that approximately $6 trillion in deposits could potentially move into stablecoins if reward structures remained unchanged.

Coinbase received approximately $300 million in distribution payments from Circle during the first quarter of 2025, a revenue stream directly linked to these rewards. The removal of this reward pool could result in an annual revenue loss of around $1 billion for Coinbase.

The banking lobby specifically urged Congress to clarify that prohibitions within the GENIUS Act should extend to partners and affiliates. They raised concerns about deposit disintermediation and the implementation of yield-like incentives that bypass issuer bans.

NYSE's Move Amidst Legislative Uncertainty

The NYSE's initiative in developing a tokenized stock platform demonstrates that major established financial institutions are actively building out the infrastructure for tokenized markets, even in the face of legislative uncertainty.

However, this development does not necessarily signal a clear path for the CLARITY Act's passage. The NYSE's plan still requires approval from securities regulators and adherence to existing market structure regulations, which are independent of the CLARITY Act's final form.

The NYSE has the potential to proceed with tokenized stocks under the established framework that considers "tokenized securities as still securities," even as negotiations surrounding the crypto CLARITY Act continue.

The legislative path for the bill has become a complex negotiation involving critical issues such as stablecoin rewards, demands from the banking industry, and constraints imposed by the political calendar, rather than a straightforward legislative process.

This postponement effectively shifts the next significant legislative opportunity to late 2026 or 2027. Lawmakers are anticipated to be reluctant to address such a divisive issue during a campaign year.

ICE's Comprehensive Digital Strategy

The introduction of the NYSE's tokenized securities platform is an integral part of a broader digital strategy being pursued by Intercontinental Exchange (ICE), the parent company of the NYSE.

This strategy includes preparing ICE's clearing infrastructure to support continuous 24/7 trading operations and the potential integration of tokenized collateral.

ICE has collaborated with financial institutions, including BNY Mellon and Citi, to support tokenized deposits across ICE's clearinghouses. This initiative aims to facilitate the transfer and management of funds for clearing members outside of traditional banking hours.

Lynn Martin, President of NYSE Group, commented on the development: "For more than two centuries, the NYSE has transformed the way markets operate. We are leading the industry toward fully on-chain solutions, grounded in the unmatched protections and high regulatory standards that position us to marry trust with state-of-the-art technology."

Michael Blaugrund, Vice President of Strategic Initiatives at ICE, stated that the support for tokenized securities represents a crucial advancement in ICE's strategy to operate on-chain market infrastructure for trading, settlement, custody, and capital formation.

Despite the ongoing uncertainty surrounding the CLARITY Act markup, major players in traditional finance are increasingly engaging with the crypto industry, supported by a perceived shift towards a more favorable stance from the SEC.