Key Insights

- •Crypto news indicates a decline in market liquidity as new capital inflows slow, despite overall asset growth.

- •Bitcoin has dropped below $100,000, and Ethereum has lost 5%, reflecting weak market sentiment.

- •Altcoins remain under pressure, with the Fear and Greed Index indicating high caution.

Market Liquidity Weakens Across the Crypto Space

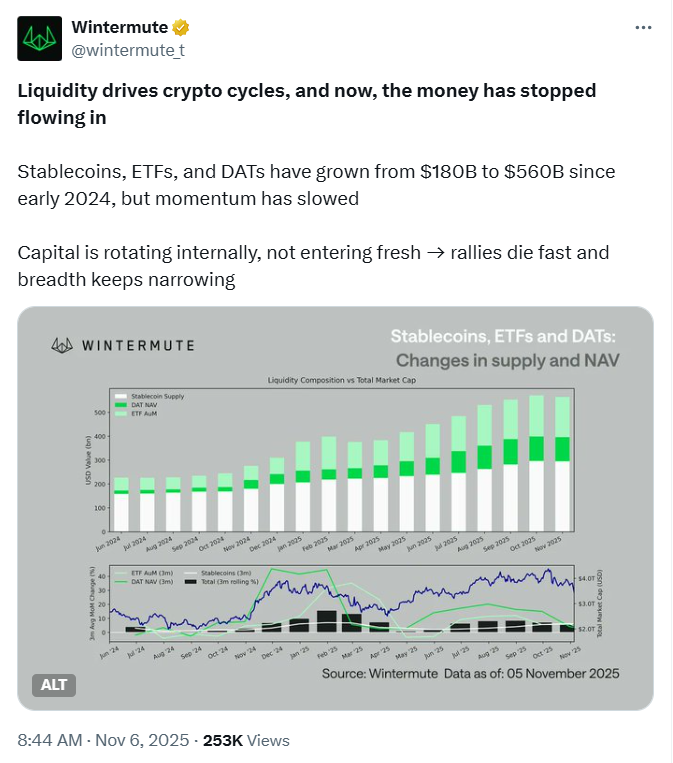

According to recent crypto news, liquidity in the market has decreased. Wintermute, a prominent trading firm in the cryptocurrency sector, has observed a slowdown in new capital inflows. This observation comes despite a significant increase in the total value of stablecoins, exchange-traded funds (ETFs), and Digital Asset Treasuries (DATs), which have grown from $180 billion to $560 billion since the beginning of 2024.

The firm noted that there are minimal signs of new capital entering the market. Instead, funds are primarily circulating among existing assets rather than originating from external investors. This dynamic leads to shorter-lived rallies and limits the upward momentum of crypto prices.

Consequently, crypto prices are experiencing limited gains, and rallies are constrained in their extent. Bitcoin has fallen below $100,000, marking a 3% decrease in the past 24 hours after a more significant 9% drop over the preceding week. Ethereum has also seen a downward trend, losing 5% and trading at $3,200, despite increased activity on its network. Traders are exercising caution, even as the spot Bitcoin ETF recorded a slight rebound after experiencing substantial outflows in recent days.

Analysts Warn of Limited Triggers for Crypto Price Increases

Analysts suggest that without the injection of new liquidity, cryptocurrency prices may continue to face downward pressure. Market observer Ted Pillows has drawn parallels between the current market conditions and 2019, a period when the U.S. Federal Reserve paused its quantitative tightening policy. During that time, altcoins experienced a decline of approximately 40% and did not recover until the Fed resumed adding liquidity to the system.

Pillows believes a similar trend could unfold if fresh funds do not re-enter the market soon. He anticipates that most altcoins could continue to decline, with only a select few potentially seeing gains. The market's performance, he added, is now contingent on the return of new capital into the financial system.

Wintermute's report further indicated that the recent uptick in trading activity is largely driven by internal capital rotation. This means that investors are reallocating funds between different cryptocurrencies rather than introducing new investments into the market. This phenomenon has led to rallies fading quickly and has narrowed the range of tokens attracting significant investor interest.

While some market participants view this situation as a temporary phase, others believe that the crypto markets may remain in a state of stagnation for an extended period unless macroeconomic conditions improve.

Altcoins Face Weakness Amidst Low Fear Index

In other crypto news, altcoins exhibited mixed performance on November 6. At its peak, the Solana price traded at $160.75, showing a 1.54% increase in the past day, though it remains down 14% for the week. BNB experienced a slight decline, slipping 0.61% to $947.34, while Cardano traded at $0.5361, down nearly 13% over the past seven days. Dogecoin was priced at $0.1630, reflecting a 0.78% drop in 24 hours.

Litecoin and Monero were among the few cryptocurrencies that saw gains, rising 1.47% and 3.14% respectively, to trade at $87.98 and $353.22. Despite these isolated increases, most major tokens have depreciated in value over the last week. The Altcoin Index registered at 23 out of 100, indicating weak sentiment among traders.

The global crypto market capitalization stands at $3.43 trillion, a 0.92% increase. The CMC20 Index rose by 0.62% to $216.6, while the Fear and Greed Index remained low at 24, signaling high caution among investors. Market observers interpret the current outlook as a clear demonstration of the crypto market's dependence on steady liquidity.

Without a consistent flow of new funds, even fundamentally strong projects may struggle to sustain their gains. Currently, the market's momentum is primarily driven by internal trading rather than new investment. Wintermute's warning underscores a critical point: until stronger inflows resume, the crypto market could experience prolonged stagnation. Traders are closely monitoring for the return of new capital, which could potentially ignite the next significant market movement.