Blockchain was invented to be open and transparent, with every transaction recorded on public ledgers, visible to anyone with an internet connection. This transparency helps trace the flow of money, but it also creates tough questions when governments start enforcing crypto sanctions.

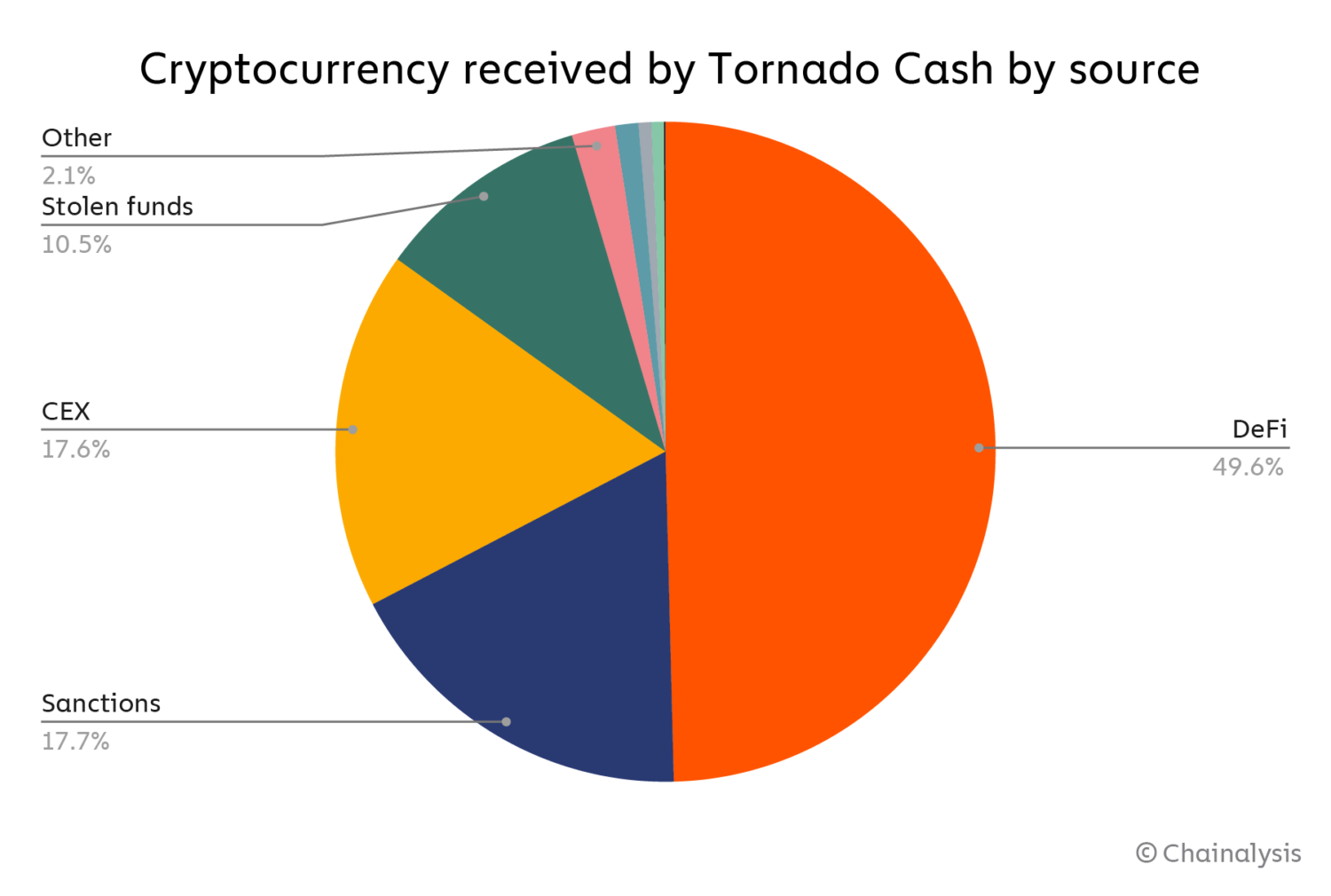

When the U.S. Treasury’s Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash, it made national headlines because Tornado Cash, as a tool, mixes funds to improve financial privacy. Still, regulators have said it also allows criminals to hide where the money came from. OFAC claimed the mixer had helped launder more than $7 billion and blocked its addresses under Executive Order 13694. This sparked a major debate, with some lawmakers seeing it as a victory in the fight against crime and many in the blockchain community fearing it as a step toward blockchain censorship, in which public transaction records are restricted, and regulators effectively ban entire services.

😔💔 I’m Roman Storm. I poured my soul into Tornado Cash—software that’s non-custodial, trustless, permissionless, immutable, unstoppable. In 31 days, I face trial. The DOJ wants to bury DeFi, saying I should’ve controlled it, added KYC, never built it. SDNY is trying to crush…

— Roman Storm 🇺🇸 🌪 (@rstormsf) June 13, 2025

The Tornado Cash saga didn’t end there, and its creators are now on trial with Roman Storm, one of the founders, facing charges including compliance violations, money laundering conspiracy, and running an unlicensed money-transmitting business. His defence argues he simply wrote open-source code and had no control over how people used it, a bit like a programmer who created a car but doesn’t drive it.

This case raises big questions: if someone can get in legal trouble just for writing code, could other blockchain developers be next? And if OFAC can ban a decentralized tool by name, is blockchain still truly open?

Why Crypto Sanctions Raise Hard Questions

Blockchains are meant to be neutral as they don’t care who is sending or receiving money, but when governments impose crypto sanctions, they force platforms and users to censor transactions with specific addresses or services.

With Tornado Cash, OFAC demanded that U.S. companies block any interaction with its smart contracts with validators, nodes, and wallets having to reject those transactions or risk punishment, an apparent affront to cryptoprivacy. This means network operators must choose between following blockchain’s open rules or obeying government orders, creating a conflict for developers and users. Do you build for total openness, or follow the law? As privacy advocates put it, financial privacy is a right, yet governments say it helps criminals. This is why Tornado Cash’s court battle has become a serious talking point in conversations around blockchain ethics and censorship.

Tornado Cash: Privacy Tool or Illicit Mixer?

Tornado Cash launched in 2019 as a way to restore transaction privacy on Ethereum, where it randomizes public ledger entries so that coins can’t be traced back to their owners. But as governments investigated, they argued that it had “acted as a giant washing machine” for illegally obtained crypto, including funds from the North Korean Lazarus Group and various scams.

This was then followed by the legal hammer, where Tornado Cash was sanctioned in August 2022, meaning Americans were barred from using or supporting it and in March 2025, a court ruled that OFAC overstepped its authority by sanctioning pure code, that is, the smart contracts themselves. The sanctions were lifted, but the fight was far from over. Now, a criminal trial is exploring whether a developer can be held legally responsible for how someone else used their code.

Censorship Creep in a Permissionless World

One of blockchain’s biggest strengths is its censorship resistance, allowing anyone to build or use decentralized systems freely. But forcing tools like Tornado Cash offline challenges the very core of this idea.

The New York Fed found that after Tornado Cash was sanctioned, many Ethereum validators became hesitant to include its transactions, even though the network itself operates openly. A study published by staff at the Federal Reserve Bank of New York documented in detail a growing unwillingness by participants in Ethereum’s settlement chain to process transactions made through the Tornado Cash privacy application. This demonstrates how crypto sanctions can influence decentralized networks from the inside, even without direct legal control.

If participants start censoring transactions to avoid regulatory risk, the blockchain stops feeling truly open, and that is a slippery slope for anyone who values blockchain’s core qualities.

Balancing Privacy and Compliance

Privacy is important, and just like a locked bank account protects your financial information, privacy on blockchains can help protect users, especially in oppressive places or for whistleblowers. Still, the apparent downside is that privacy can also shield criminals.

Experts are looking into cryptography solutions like zero-knowledge proofs, as some of these tools aim to keep transaction details private while still allowing authorities to check who’s sending or receiving large amounts, balancing financial privacy with compliance needs. Such technologies could let regulators verify suspicious behaviour without undermining privacy in general, a typical middle ground that might be crucial for blockchain’s future privacy.

Where Regulation Might Be Headed

Crypto sanctions are expanding, and regulators are vigorously trying to find out how to apply rules designed for banks and money services to decentralized systems, but this raises tough questions like:

- •Can governments legally ban or censor open-source code?

- •Who gets held responsible: the creator, platform, or user?

- •How much compliance should crypto companies build into their systems?

- •Can blockchain still be fully open with these rules?

Some believe we’ll see more rules, especially around public ledgers and blockchain analytics. Others hope for innovative legal frameworks that respect both decentralization and public safety.

Why This Matters to You

You might think this debate doesn’t affect you. Still, it probably does, and if you care about using crypto freely, whether for investing, supporting open-source projects, or protecting your privacy, you might be affected by rules that limit what you can build or access.

If smart contracts start getting censored, or if certain crypto tools become illegal, the open nature of Web3 could shrink, and that could change everything from how DAOs operate to how regular people interact with money systems. Imagine not being able to use a DeFi lending platform just because it wasn’t approved in your country, or getting blocked from a crypto wallet because it was linked to a tool like Tornado Cash.

Even developers could find themselves in trouble for writing code that’s seen as too private or too free because the line between innovation and regulation is getting thinner. That means the future of financial privacy might not be up to tech alone; it will also depend on legal systems, politics, and the crypto community’s response.

On the flip side, stronger privacy protections could open new doors to freedom and use cases. Still, they also risk misuse by criminals hiding behind them, thereby making governments more eager to clamp down. It is quite a hard balance: build tools that protect good people without accidentally helping bad actors, and that is why conversations around compliance and regulation are so complex.

The future of public ledgers, financial privacy, and blockchain censorship will most likely be shaped by everyday users as much as by lawmakers, and it is a path we must all walk together. And so the more we understand what’s at stake, the better chance we have of shaping a fair, open, and secure Web3 future.

In Conclusion,

The Tornado Cash situation shows that while public ledgers create transparency by giving every transaction visibility, they don’t resolve the deeper tension between financial privacy and regulation. Crypto sanctions might protect security, but they can also cause blockchain censorship and threaten decentralized ideals.

The future may lie in clever technology, better laws, and smart design, but it’s also a reminder that regulation doesn’t always stop at the code; it often reaches behind it, connecting digital freedoms to real-world control.