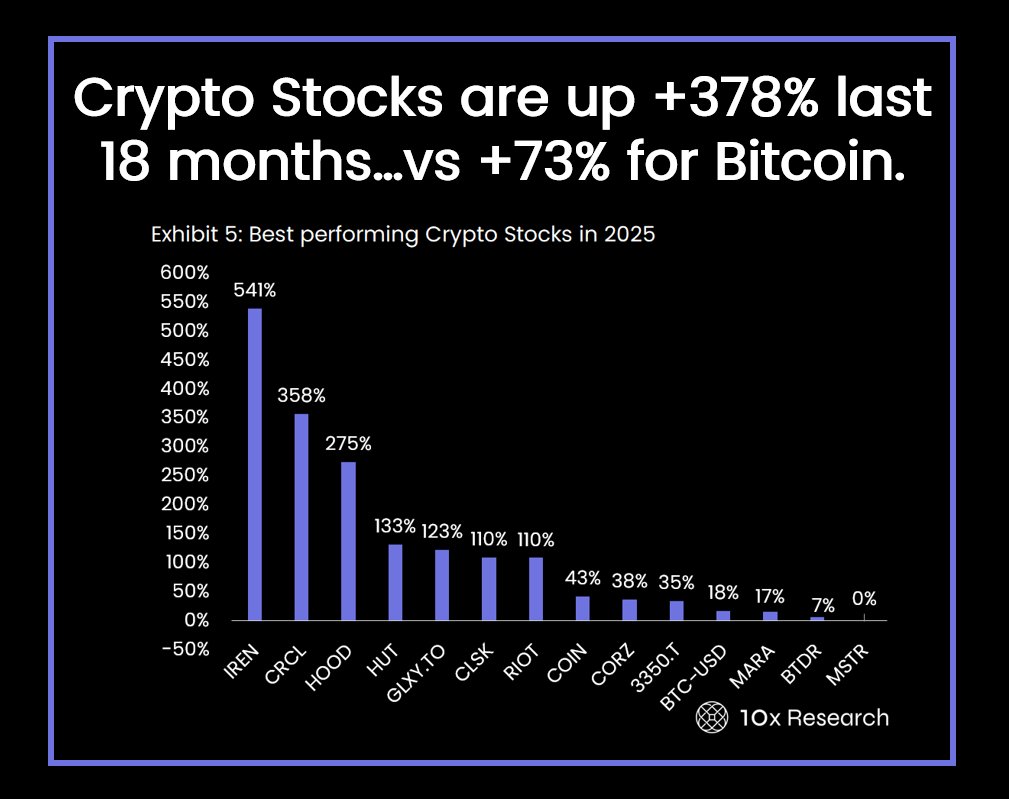

Bitcoin miners and crypto-linked equities are now vastly outperforming Bitcoin itself, according to a new report from 10x Research. The firm’s BTC Mining Index has gained an impressive +378% over the past 18 months, compared to Bitcoin’s +73% rise in the same period, marking one of the widest performance gaps in crypto’s modern market cycle.

Bitcoin Miners Lead the Charge

The report highlights that Bitcoin mining stocks have quietly evolved into some of the best-performing assets in the digital economy, fueled by diversification into AI computing and high-performance data infrastructure.

Leading the gains are:

- •Iris Energy (IREN) — up +541%

- •Circle (CRCL) — up +358%

- •Robinhood (HOOD) — up +275%

- •Hut 8 (HUT) — up +133%

- •Galaxy Digital (GLXY.TO) — up +123%

- •CleanSpark (CLSK) — up +110%

- •Riot Platforms (RIOT) — up +110%

By comparison, Bitcoin (BTC-USD) has only advanced +73%, while MicroStrategy (MSTR), long considered a high-beta proxy for Bitcoin, remains flat year-to-date, despite Bitcoin’s +19% climb since January.

MicroStrategy Valuation Compresses

10x Research’s regression model suggests MicroStrategy is now 29% undervalued relative to Bitcoin, with its net asset value (NAV) multiple shrinking to just 1.13x, the lowest in years. The firm attributes this compression to a “boom-to-bust” sentiment shift that began in early 2024, as investors rotated from long-term Bitcoin proxies to direct mining and infrastructure plays.

This rebalancing indicates a structural change in market psychology: capital is flowing toward productive crypto infrastructure, miners, exchanges, and hybrid firms integrating AI compute, rather than pure asset holders.

Exuberance Meets Caution

The report warns that while mining stocks have delivered outsized returns, the market is entering a phase of rising volatility and stabilizing ETF inflows, suggesting that investors should prepare for potential corrections.

“Volatility is creeping higher, ETF inflows are flattening, and resistance levels are being tested,” the 10x Research team wrote. “This mix of exuberance and caution is creating a new battleground for crypto equities.”

The New Narrative: AI, Mining, and Market Rotation

With companies like Iris Energy and CleanSpark expanding beyond Bitcoin mining into AI-driven compute services, investors are re-evaluating traditional valuation models. These hybrid strategies have positioned miners as not just Bitcoin plays, but as infrastructure providers for the digital economy.

10x Research concludes that this pivot marks a new era of crypto equity investing, where miners and hybrid firms may continue outperforming as long as AI demand, block rewards, and institutional ETF flows remain aligned.

In short, crypto equities, not Bitcoin, are currently driving the digital asset bull market.