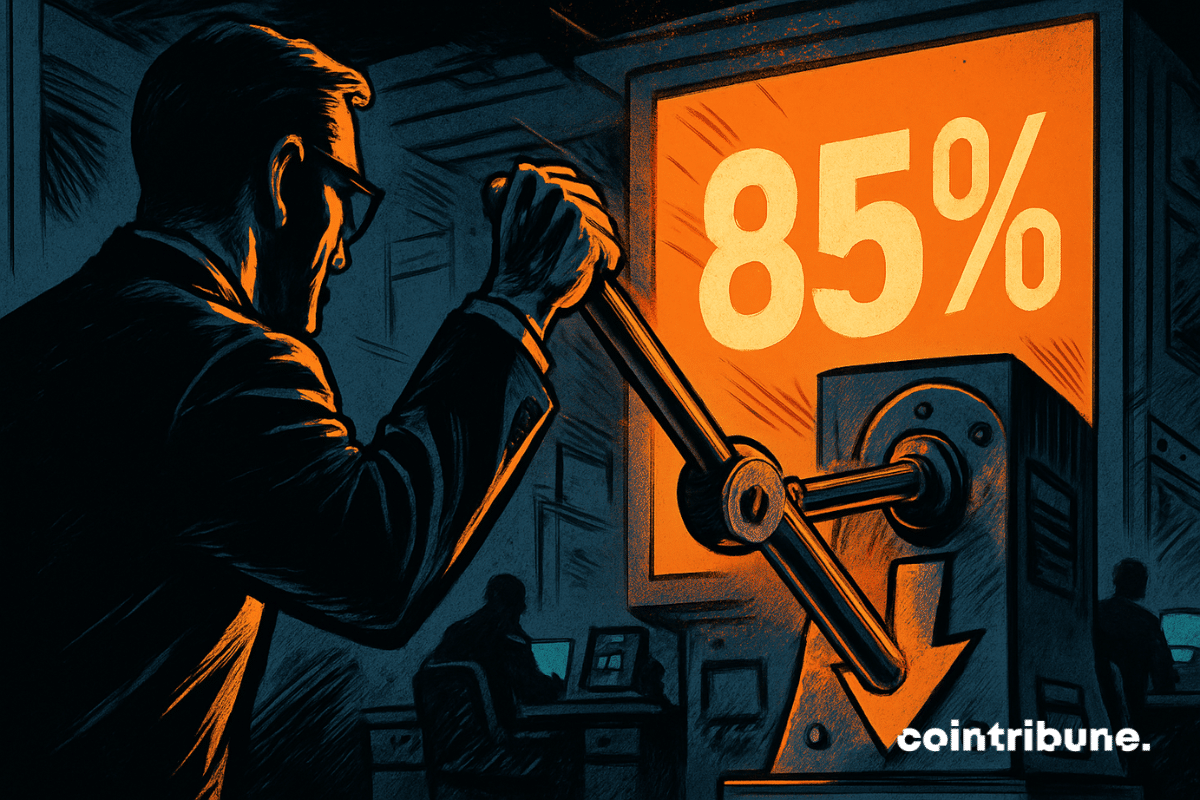

The US Federal Reserve may be on the cusp of a significant turning point. According to the latest data from the CME FedWatch Tool, markets now estimate an 85% probability of a rate cut as early as December. This represents a rapid development, contrasting sharply with the firm stance displayed in recent months. If this scenario materializes, it would signify the end of an unprecedented monetary tightening cycle and could potentially reshape the landscape of financial markets.

The Fed Moves Towards Monetary Easing

The market appears to be anticipating a substantial shift in monetary policy. Data from the CME FedWatch Tool indicates that the probabilities of a rate cut at the FOMC meeting on December 9 and 10 have surged to 85%, a significant increase from the previous week when these probabilities were largely in the minority.

This swift change is being driven by a series of public statements from Federal Reserve officials:

- •Fed Governor Christopher Waller stated, "if inflation continues to decline over the coming months, it is quite possible the Fed will start cutting rates in a few months."

- •Mary Daly, President of the San Francisco Fed, highlighted that "moderation in employment could justify a monetary policy easing."

- •Recent labor market indicators have revealed a slowdown in job creation and a stabilization of wage growth.

- •This development, coupled with controlled inflation, has strengthened market conviction in the prospect of imminent monetary easing.

This shift in tone is particularly noteworthy, as it starkly contrasts with the caution exhibited by the Fed in recent months, during which its primary focus remained on achieving price stability. The current signals suggest a pivot in monetary policy, aimed at averting an excessively pronounced economic weakening.

Cryptocurrencies React Positively to Anticipated Easing

While discussions continue within the Federal Reserve, the cryptocurrency market appears to have already reacted. Bitcoin, the largest cryptocurrency by market capitalization, experienced an intraday peak at $88,162 and is now approaching the significant $90,000 mark.

Ethereum has seen an increase of over 1% in the last 24 hours, with the clear objective of reclaiming the $3,000 level. This upward momentum is not confined to these two leading assets; other major cryptocurrencies such as XRP, ADA, SOL, and BNB are also exhibiting positive trends.

The entire market is benefiting from this wave of optimism, leading to a total market capitalization exceeding $3 trillion.

Investors seem to be incorporating the possibility of a return to more favorable liquidity conditions into their strategies. This trend is further amplified by other macroeconomic factors, including the recent news that Ukraine has accepted the terms of a peace plan proposed by Donald Trump to end the conflict with Russia. This development bolsters the sentiment of geopolitical stabilization, thereby increasing risk appetite in the markets.

The Federal Reserve now faces a critical decision for December. Amidst signs of economic slowdown and contained inflation, the option of monetary easing is gaining traction. Markets, with cryptocurrencies at the forefront, are closely monitoring every statement. Any misstep could disrupt the current momentum. A rate cut would undoubtedly redraw the existing market balance, but the ultimate decision rests with the upcoming FOMC meeting.