Key Takeaways

- •Li-Cheng Huang's address experienced five liquidations due to market downturns.

- •His current ETH long position is at risk of further losses.

- •The crypto community is closely observing the aftermath, with no public statements yet from Huang.

Significant Losses from Ethereum Liquidations

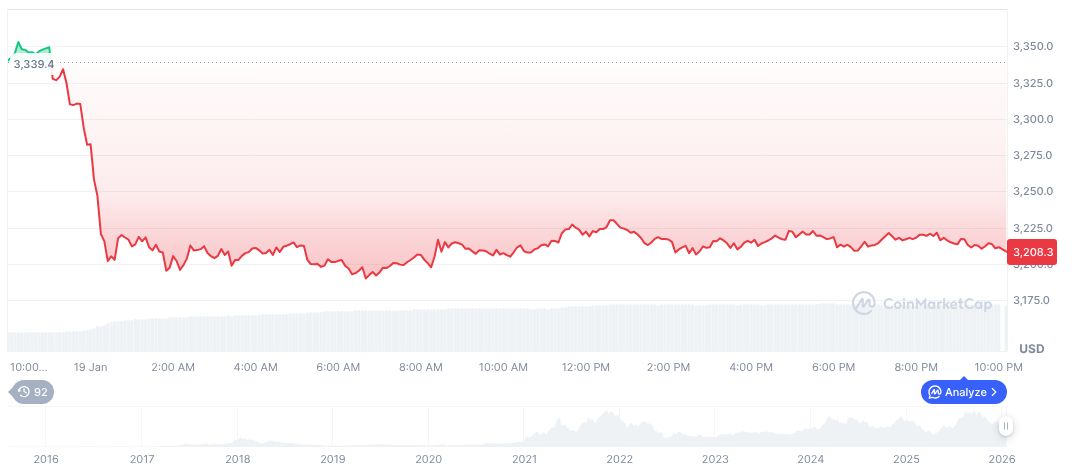

On January 20, prominent crypto trader Li-Cheng Huang, widely known as 'Machi Big Brother,' suffered five liquidations of his 25x long Ethereum position. This occurred amidst a market downturn and resulted in total losses amounting to $24.18 million.

This liquidation event serves as a stark reminder of the inherent risks associated with high-leverage trading. Rapid market fluctuations can quickly escalate losses, potentially influencing broader market sentiment and the trading strategies of individual participants.

Huang's Trading History and Risk Exposure

Huang, who is actively involved in high-leverage positions on platforms like Hyperliquid, has encountered repeated liquidations. This recent occurrence has significantly amplified his overall losses.

Prior to this market downturn, Huang's speculative trading strategies had occasionally resulted in substantial profits. However, these strategies also consistently exposed him to considerable risks.

Research suggests a growing necessity for more stringent regulations to effectively manage high-risk leverage trading. This has implications for various exchanges, including Hyperliquid. These events underscore the critical importance of informed risk assessment, a vital factor in the highly volatile cryptocurrency sector.

No direct statements were found in monitoring data related to this event.

Ethereum Volatility and Calls for Tighter Controls

The frequency of Huang's liquidations on Hyperliquid since 2025 has reportedly outpaced that of other well-known traders, such as James Wynn and Andrew Tate. This highlights the intense volatility associated with leveraged positions.

Ethereum's current performance is reflective of broader market conditions. Its price was approximately $2,985.03, marking a 7.24% drop over the preceding 24 hours. The market capitalization stood at $360.28 billion, indicating its absorption of fluctuations during this turbulent market phase.

Trading volume reached $30.47 billion, an 8.71% change in one day. These figures are according to CoinMarketCap data.

The Coincu research team has emphasized the potential need for more stringent regulations to manage high-risk leverage trading. This has direct implications for exchanges like Hyperliquid. These occurrences underline the essential need for informed risk assessment, a crucial element in navigating the highly volatile cryptocurrency sector.