Key Developments in Pump.fun's Treasury Management

Pump.fun has transferred 480 million USDC to Kraken since November 15, 2025. Following these transfers, significant amounts of USDC have subsequently moved to Circle, prompting speculation regarding Pump.fun's treasury management strategies.

This pattern of transactions has intensified scrutiny over Pump.fun's financial activities, potentially impacting market perceptions and the valuation of related assets, particularly PUMP and USDC.

Pump.fun Addresses USDC Transfers Amidst Market Concerns

Pump.fun has moved 480 million USDC to Kraken, with the company stating these transfers are part of their standard business operations. The substantial volume of funds involved has attracted considerable attention within the cryptocurrency community. Leadership from Pump.fun has asserted that no funds have been cashed out by the team.

Market implications are being discussed, including potential concerns over USDC market liquidity. However, Pump.fun's leadership maintains that these actions represent prudent financial management. The subsequent transfer of 69.26 million USDC from Kraken to Circle suggests potential USDC redemption activities.

Complete misinformation from @lookonchain again. $0 have been cashed out — we’re not involved in the transactions between Kraken and Circle that you’re alleging us to be a part of. What’s happening is part of pump’s treasury management, where USDC from the $PUMP ICO has been...

Historical Context and Regulatory Oversight of Crypto Transfers

Unusually large cryptocurrency transfers to exchanges often trigger market skepticism. This situation draws parallels to past instances, such as Ripple's routine XRP sales, which historically stirred market uncertainty.

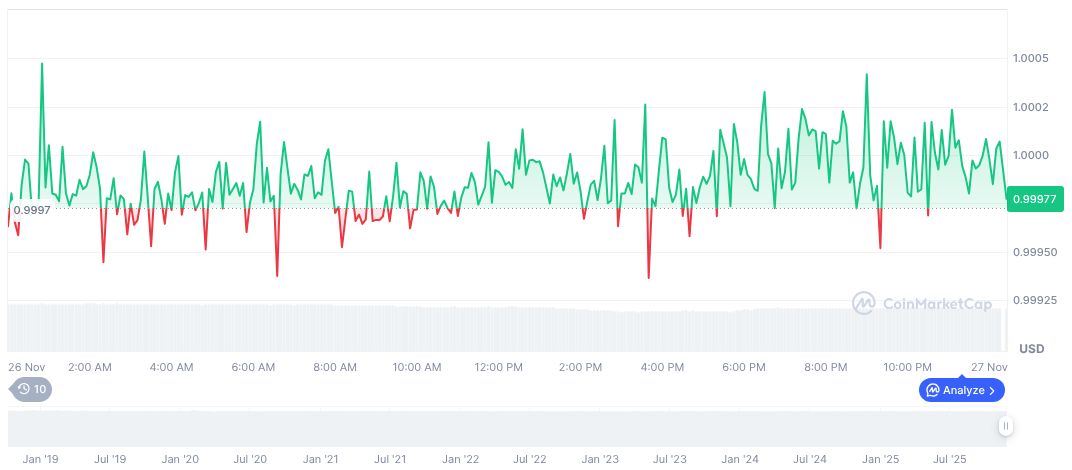

As of November 27, 2025, USDC's market capitalization stands at $75.76 billion, with a 24-hour trading volume of $13.18 billion, representing a 9.93% decrease. While price fluctuations have been minimal, USDC holds a market dominance of 2.45%, and its supply is unlimited.

Research indicates that consistent oversight of cryptocurrency treasury movements could lead to increased regulatory scrutiny. The scale and frequency of these treasury actions underscore the critical importance of transparency and regulatory alignment for all participants in the cryptocurrency sector.