Today marks a significant day in the crypto markets with numerous impactful announcements. Leading the headlines is BitMine’s official declaration, simultaneously coupled with BlackRock’s major initiative concerning Ether. The market charts effectively mirror the excitement stemming from these developments.

BitMine’s Ethereum Reserve Strategy

Despite a setback to MNAV and BMNR shares hitting new lows, BitMine Immersion has unveiled a new acquisition of Ether. The company’s combined crypto and cash reserves have now surged to a remarkable $13.2 billion. Since June, BitMine has steadily been accumulating Ether, setting a target to incorporate 5% of the total Ether supply into its reserves—a journey it has accomplished halfway thus far.

Previously, BitMine disclosed holding 3% of the total Ether supply, which has now increased to 3.2%. Chairman Lee foresees a more rapid evolution as Wall Street’s interest in tokenization intensifies. The company’s annual shareholders meeting is scheduled for January 15, where significant announcements are anticipated.

Ranked 37th among the most followed stocks in the United States, BMNR attracts an average daily volume of $1.8 billion.

Just last week, the company declared another acquisition of 138,452 ETH at an average price of $3,139 per unit. This brought its total reserves to 3,864,951 ETH, marking a 156% increase in new acquisitions since the week of November 17. The announcement also touched upon several crucial elements regarding Ethereum and the broader market landscape.

“Activated on December 3, the Fusaka upgrade, also known as Fulu-Osaka, introduces a range of improvements in scalability, enhanced security, and usability. The Federal Reserve is set to conclude QT (quantitative tightening) in December, and a rate cut is anticipated on December 10.”

Chairman Lee noted that it has been eight weeks since the massive liquidation on October 10, and key metrics in the crypto sector are starting to show signs of recovery. Following the global cryptocurrency treasury leader MSTR, BitMine emerges as the second-largest corporate crypto whale.

BlackRock’s Move in Ethereum (ETH)

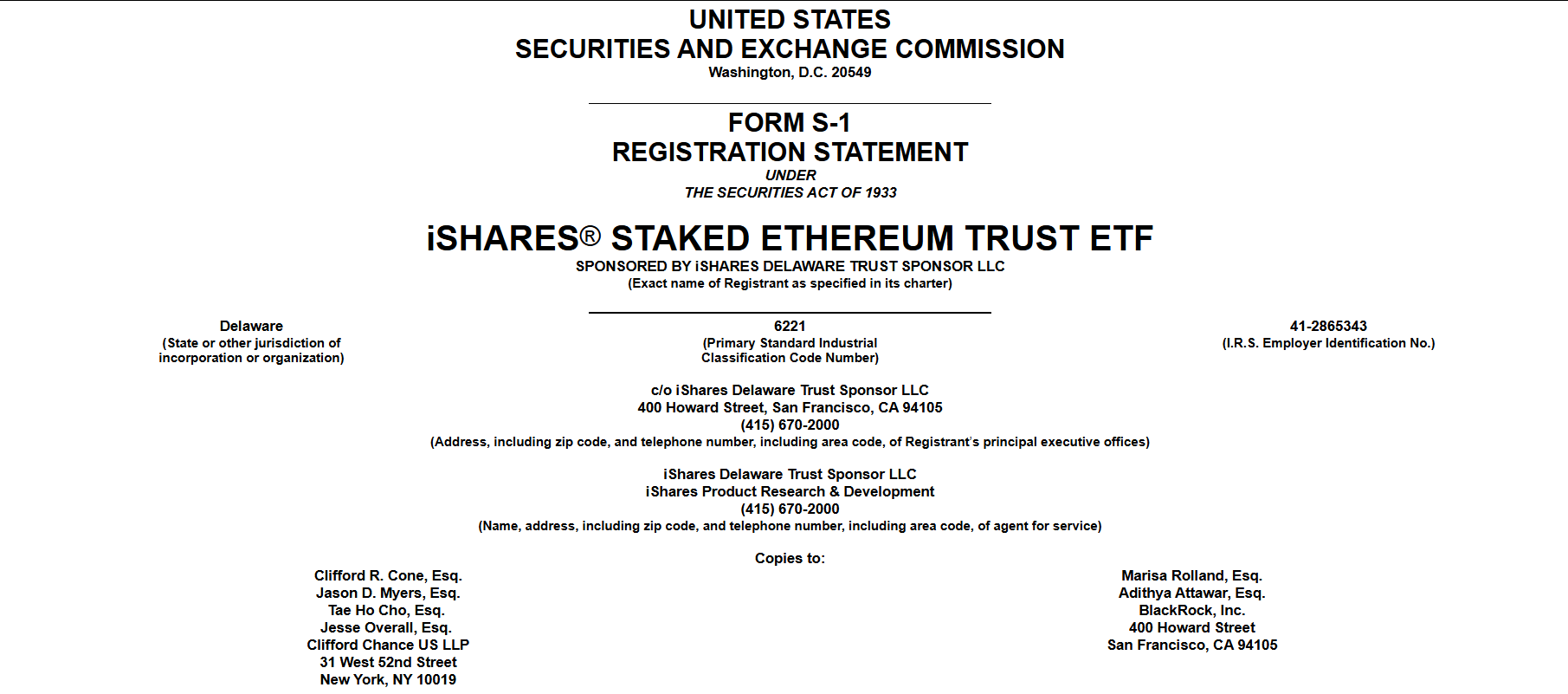

BlackRock’s application for a staked ETH ETF marked another major development of the day. The iShares Ethereum Staking Trust launch is introducing an ETH ETF with staking capabilities, countering initial objections by Gensler. The company, having filed an S-1 registration, is known for moving confidently only on steps it anticipates achieving, thus the success of this product seems probable.

The process will continue with the expected submission of a 19b-4 form. Named as iShares Ethereum Staking Trust (ETHB), this fund will debut after the release of ETHA in July 2024. Diverging from ETHA, which possesses $11 billion in ETH, the ETHB will not follow the staking model, likely causing withdrawals from the main ETH ETF during the transition from ETHA to ETHB. Annual staking returns of up to 5% are anticipated to be appealing to investors.