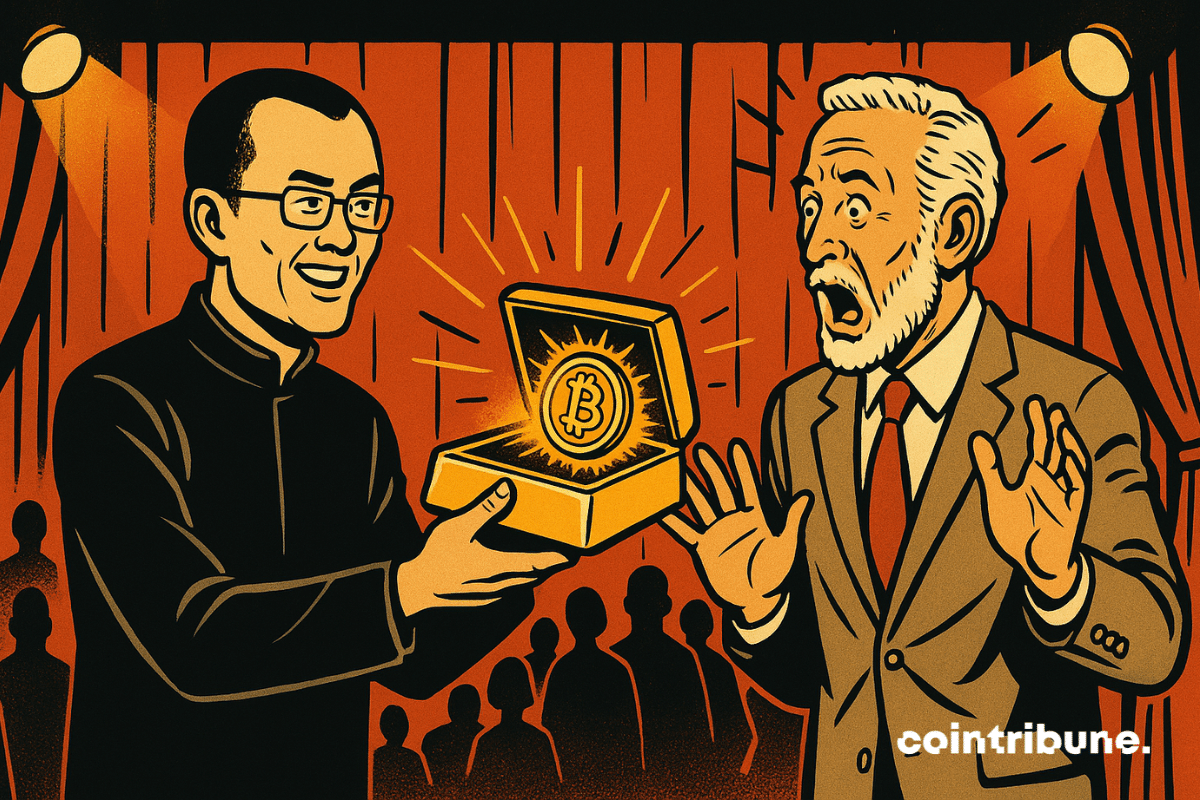

During Binance Blockchain Week, a live demonstration involving Peter Schiff and Changpeng Zhao (CZ) brought the long-standing debate between physical gold and Bitcoin into sharp focus. When challenged by CZ to authenticate a gold bar live, economist Peter Schiff's simple response, "I don't know," highlighted critical questions about asset verifiability in an increasingly decentralized and blockchain-oriented world.

In Brief

- •At Binance Blockchain Week, Peter Schiff was asked by CZ to authenticate a gold bar live.

- •Schiff's inability to confirm its authenticity and his response of "I don't know" elicited surprise and laughter from the audience.

- •This event reignited the discussion comparing physical gold and Bitcoin as stores of value.

- •CZ used the moment to emphasize Bitcoin's immediate verifiability, contrasting it with gold, even in its tokenized forms.

A Public Confrontation: Gold vs. Bitcoin on Stage

In a notable exchange during Binance Blockchain Week, Peter Schiff, a well-known economist and advocate for physical gold, found himself in an unexpected situation when challenged by Binance co-founder CZ. The interaction occurred amidst ongoing discussions about Bitcoin's performance relative to gold.

CZ presented Schiff with a 1,000-gram gold bar, inscribed with "Kyrgyzstan, 1,000 grams, fine gold, 999.9" and a serial number. He then posed a direct question: "Is it real gold?" Schiff's candid reply, "I don't know," drew laughter and applause from the predominantly Bitcoin-supporting audience.

Schiff's public discomfort was particularly striking given his active promotion of gold tokenization as a potential alternative to Bitcoin within DeFi environments. This live demonstration underscored several key differences between gold and Bitcoin concerning verifiable trust:

- •Bitcoin is instantly verifiable through cryptographic methods accessible to any user with a full node.

- •Authenticating a gold bar typically requires specialized, often costly or destructive, tools.

- •Gold relies on a centralized trust system involving custodians, issuers, and auditors.

- •Bitcoin operates without the need for trusted third parties for control, auditing, or transfers.

The exchange highlighted a fundamental debate about trust in assets. For CZ, the event served as an illustration of Bitcoin's advantage as a universally verifiable store of value. Earlier in October, CZ had expressed skepticism about tokenized gold, arguing that holders must trust the issuer, which directly led to this confrontation with Schiff.

Peter Schiff, however, continues to champion tokenized gold, believing it can combine the benefits of physical gold with blockchain technology. Despite this, the recent event appeared to expose a significant challenge: the verification of gold, even in a digital format, remains intrinsically linked to the physical asset and the entities that certify it.

The Structural Challenge of Instant Gold Verification

Schiff's hesitation on stage was not an isolated incident but reflected a known difficulty within the industry: verifying gold is a complex, expensive, and rarely instantaneous process.

According to the standards set by the London Bullion Market Association (LBMA), only "fire assaying"—a metal melting technique—can provide absolute certainty regarding the precious metal content. However, the LBMA notes that this method is destructive, as it requires melting a sample of the gold.

Alternative verification methods, such as XRF spectroscopy, ultrasound tests, or eddy current tests, are considered less conclusive or limited in their accuracy, particularly with thicker objects. The LBMA also indicates that none of these non-destructive tests currently offer a fully reliable solution.

This presents a significant point of contention between physical gold and Bitcoin. While tokenizing gold aims to facilitate its use in digital transactions, its value remains fundamentally dependent on the integrity and quality of the underlying physical asset. A token representing gold is only as valuable as the gold itself, provided it is securely stored and the issuing entity is trustworthy. This necessitates a chain of custody, regular audits, and a degree of centralization that diverges from the core principles of blockchain technology.

In contrast, Bitcoin's architecture is intrinsically verifiable and accessible to everyone through a full node or blockchain explorers. It does not require any third-party intermediaries, physical audits, or guarantees of immediate traceability through its cryptographic ledger.

The exchange between CZ and Peter Schiff underscores the ongoing friction between traditional financial systems and the innovations emerging from DeFi. While gold continues to hold significant cultural and historical value, its verification process appears opaque when compared to the algorithmic transparency offered by Bitcoin. This contrast highlights evolving standards of trust in the digital economy.