Deep Dive

1. Market Snapshot

Live price is $7.12, market cap $1.4B, circulating supply 196.48M, max supply 1B, and 24‑hour volume $302.4M (CoinMarketCap page above). Date launched: 25 Sep 2025. 24h / 7d / 30d moves: +19.94% / +2027.99% / +1339.25% per the exchange/CMC snapshot. Short technicals (latest completed bars): 7‑day SMA ≈ 7.03, EMA7 ≈ 7.00, RSI14 ≈ 66, MACD histogram slightly negative; pivot ~7.08 and Fibonacci retracements sit between 6.03–6.80 (technical snapshot on CMC).

What this means: price action is parabolic and volatile; bullish momentum is present but indicators (MACD histogram, RSI) suggest the move is mature and vulnerable to rapid profit‑taking.

2. Drivers and Recent Catalysts

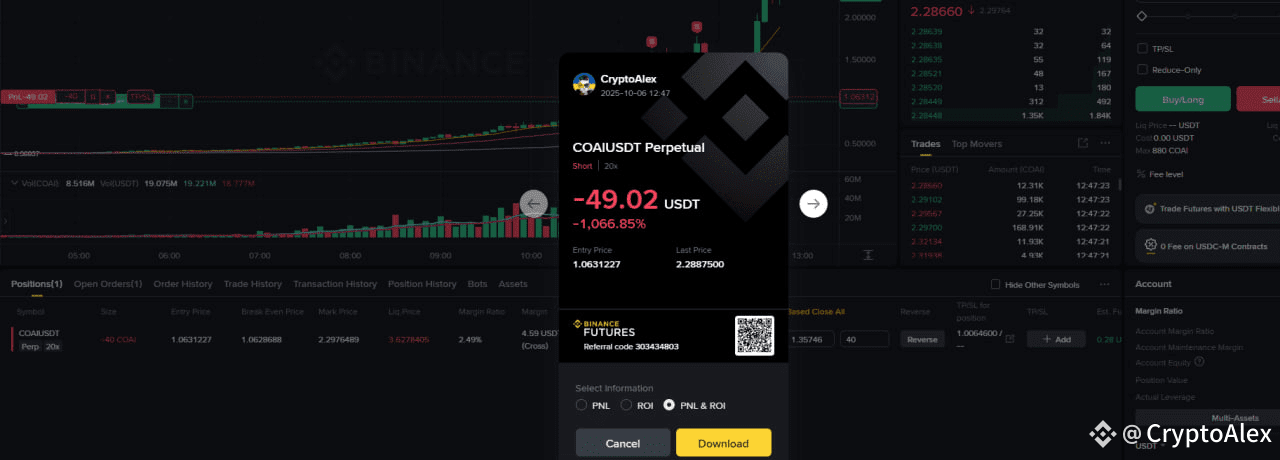

- •Exchange listings and product visibility appear to be the immediate catalysts. Coverage ties the Oct 6 rally to ByBit and Aster listings and to promotion on Binance Alpha, which increased access and leverage trading flows (crypto.news, CCN).

- •Narrative tailwinds: ChainOpera markets itself as a full‑stack AI agent platform (AI Terminal, developer tools, decentralized GPU/model marketplace), which aligned with a broader sector surge in AI tokens during early Oct 2025 (project site and press).

- •Liquidity: explosive volume spikes (hundreds of millions in 24h) fueled the run and compressed spreads on major venues, but also concentrates exit risk if flows reverse (press reporting and on‑exchange volumes).

Sources: reporting on the listing and rally (crypto.news) and independent coverage summarizing the run (CCN). What this means: listings + sector hype can create fast inflows and a short squeeze; these are real drivers but also short‑lived without sustained product‑level revenue or user‑spend.

3. Tokenomics, Supply & Risks

- •Tokenomics snapshot: max supply 1B, circulating ~196.48M; public docs/paper describe utility for agent payments and staging of on‑chain compute marketplaces (project whitepaper).

- •Unlocks / emissions: the public token metadata returned no large scheduled unlock entries in the token_unlocks result we fetched; users should still verify the project whitepaper and treasury schedules for off‑chain allocations (project paper link).

- •Governance & security flags: some press pieces and community threads raised past concerns (alleged scam address reports referenced in coverage). These were discussed in articles during the rally; I could not verify remediation status from the public docs alone.

- •FDV and concentration: third‑party reporting noted a Fully Diluted Valuation above $4B at peak, implying a large difference between market cap and FDV and potential dilution risk as non‑circulating tokens enter the market (TheBlock analysis).

What this means: tokenomics show asymmetric risk—strong current liquidity and price but possible future supply pressure if large allocations are unlocked or if concentrated holders sell.

Conclusion

ChainOpera AI (COAI) is a newly launched, high‑attention AI token that experienced a rapid, liquidity‑led rally after several exchange listings and strong AI sector momentum; the market now prices a large growth expectation (market cap ≈ $1.4B vs FDV > $4B). Monitor exchange liquidity, listing confirmations, and the project’s published token unlock/treasury schedule to gauge durability.Confidence: moderate — price and listing facts are well‑reported; longer‑term token distribution and the status of community allegations need primary‑source confirmation.