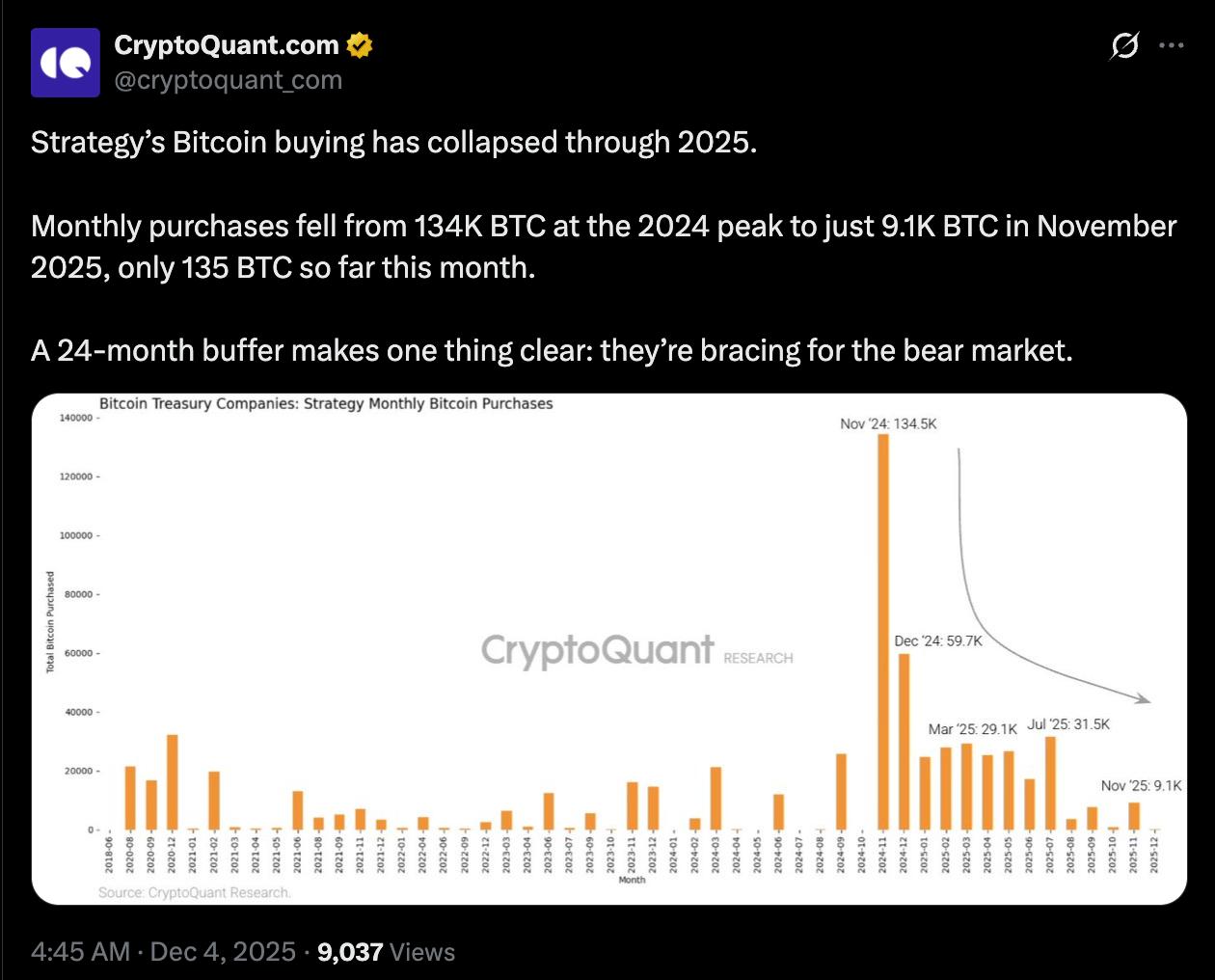

A significant shift in corporate Bitcoin acquisition strategies is underway, as Strategy has drastically lowered its monthly BTC purchases to levels not observed since 2020. CryptoQuant reported that Strategy's buying activity plummeted from a high of 134,000 BTC at the close of 2024 to a mere 9,100 BTC in November. December's purchases have been even more subdued, with only 135 BTC acquired so far. This reduction indicates a defensive posture as the company prepares for potentially prolonged market pressure, a move closely monitored by traders who consider institutional accumulation a crucial market indicator.

While Strategy focuses on strengthening its reserves and addressing challenges related to its index eligibility, the broader market is actively seeking new avenues for growth. This reassessment is directing attention toward early-stage projects demonstrating measurable momentum. A prime example of this trend is the DeepSnitch AI price prediction, which is experiencing rapid growth, with its presale already raising over $666,000 at a price of $0.02629.

DeepSnitch AI Forecast Gains Attention as Strategy Scales Back Bitcoin Purchases

Strategy, recognized as the largest corporate holder of Bitcoin, has significantly curtailed its monthly BTC acquisitions, according to a detailed report from CryptoQuant. The data reveals a contraction from a peak of 134,000 BTC late in 2024 to 9,100 BTC in November. The current month's activity has seen only 135 BTC recorded, a trend that analysts interpret as a strategic preparation for an extended downturn in the cryptocurrency treasury market.

Despite the reduced pace, Strategy completed a substantial acquisition on November 17th, adding 8,178 BTC valued at approximately $835.5 million. The company's current holdings amount to 649,870 BTC, estimated to be worth around $58.7 billion. Furthermore, Strategy has established a cash reserve of $1.4 billion to manage dividend and debt obligations, with plans to expand this reserve to provide a 24-month buffer.

This defensive shift by a major player has redirected trader focus towards projects still in their growth phases, rather than companies prioritizing balance sheet consolidation. This redirection is contributing to the renewed interest in the DeepSnitch AI forecast, particularly as presale activity escalates while the broader market anticipates a slowdown in institutional accumulation.

DeepSnitch AI's Price Prediction Positions It as a Top Investment Choice for December 2025

DeepSnitch AI (DSNT): Long-Term Outlook Strengthens Amid Market Volatility

DeepSnitch AI is an advanced AI trading toolkit designed to provide users with direct, verifiable trading intelligence before market entry. Its suite of five AI agents meticulously analyzes contract age, developer activity, liquidity conditions, and on-chain behavior that often signals potential risks. This comprehensive approach aims to eliminate guesswork and empower users to make more informed decisions.

Traders are utilizing DeepSnitch AI to identify and avoid projects that could lead to capital depletion. This utility is a key driver behind the growing interest in the DeepSnitch AI price prediction, especially during a period characterized by defensive strategies from major financial entities.

The project's presale has already achieved significant traction, raising over $666,000 in Stage 2 at a price of $0.02629, marking a 70% increase. This early success is viewed as a strong indicator of developing demand ahead of the official launch. As investors increasingly seek tools with tangible utility, the DeepSnitch AI forecast is rapidly gaining prominence due to the project's emphasis on safety features beneficial in any market condition.

Two primary factors underpin the DSNT long-term outlook. Firstly, AI tokens with limited utility have historically demonstrated strong performance in previous market cycles. The potential for an AI token with demonstrable utility to perform even better is significant. Secondly, DeepSnitch AI offers continuous monitoring capabilities within Telegram, a platform with over one billion users, granting DeepSnitch AI access to a vast potential user base. These elements are shaping the ongoing DeepSnitch AI price prediction as buyers position themselves for the token's launch in January 2026.

Pudgy Penguins (PENGU): Current Performance and Price Outlook

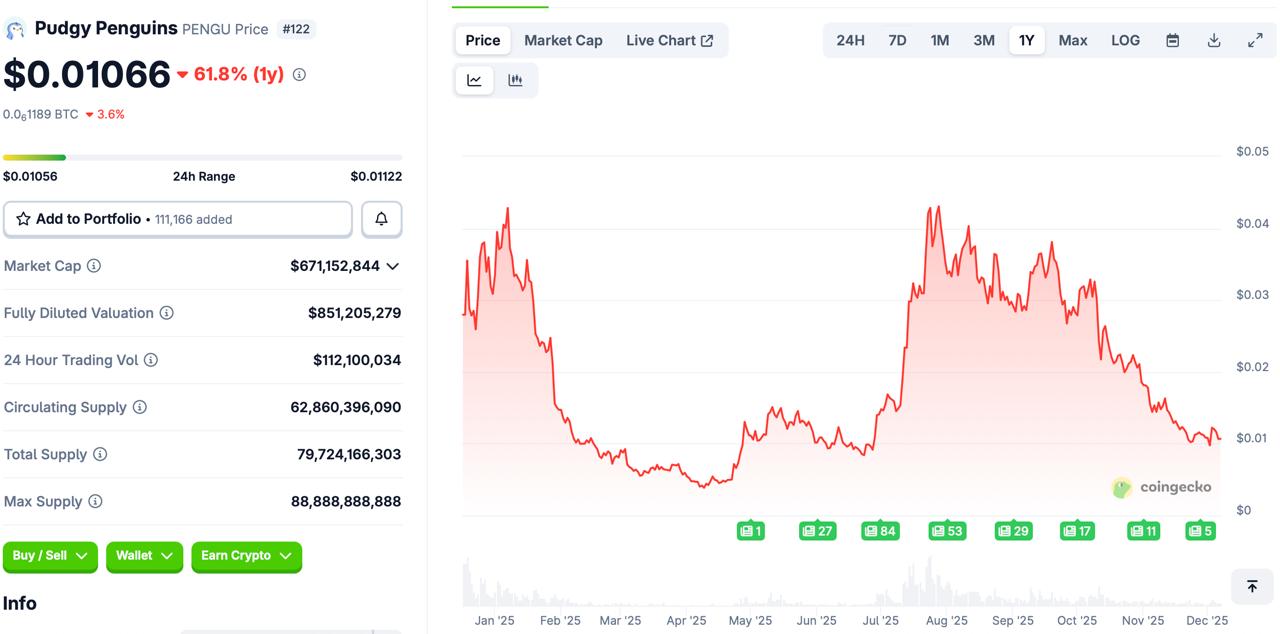

Pudgy Penguins (PENGU) has maintained a stable trading range near $0.01068 following a period of volatility. The token saw a 2.1% gain at the beginning of December, outperforming the broader market, though it lagged behind the stronger performance observed across the wider Ethereum ecosystem. The market capitalization stands at approximately $672 million, with a circulating supply exceeding 62 billion tokens.

Recent gains were partly attributed to new partnerships and increasing cultural visibility, which contributed to a 37% rally between December 1st and 2nd. However, this momentum has softened as large holders have reduced their positions and perpetual traders have shifted to net-short strategies. This creates a mixed outlook for the token's next move. PENGU remains significantly below its peak of $0.06845 from the previous year, suggesting a cautious near-term outlook, although community sentiment continues to trend positively.

A notable observation is that much of PENGU's potential upside may already be priced in, a contrast to smaller, early-stage tokens like those involved in the DeepSnitch AI price prediction.

PENGU: 1-Year Market Structure Analysis

The one-year chart for Pudgy Penguins' PENGU token illustrates a distinct cyclical pattern, marked by two significant distribution phases and extended periods of consolidation. Early in the year, the token traded within the $0.04–$0.05 range before experiencing a sharp decline that bottomed out around $0.01 in late Q1. This marked the formation of a broad accumulation base that persisted through April and May.

A robust mid-year breakout followed, propelling PENGU back toward the $0.03–$0.04 resistance region. However, multiple rejections in this area indicated substantial supply and weakening bullish momentum. From late summer through early autumn, the chart shows a series of lower highs, signifying progressive seller dominance and a transition into a sustained downtrend. By November, the price had retreated to the critical $0.01–$0.015 support zone, representing a full retracement of the mid-year rally. Trading volume during this decline remained relatively muted, suggesting gradual distribution rather than a capitulation event. Overall, PENGU's yearly structure indicates a market that has completed a full boom-and-bust cycle, with current levels representing long-term support but lacking a confirmed reversal pattern.

Pepe (PEPE): Firm Activity but Weak Momentum Compared to DeepSnitch AI’s Price Prediction

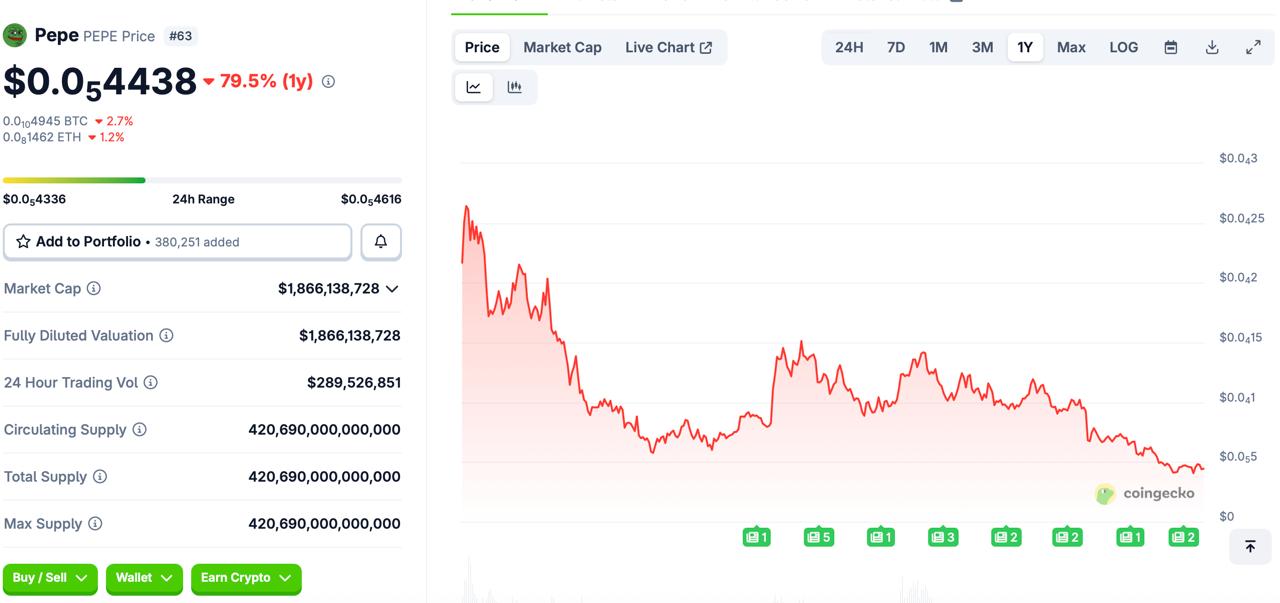

Pepe (PEPE) continues to exhibit activity within the meme-coin sector, trading near $0.0000044436 with a daily trading volume exceeding $289 million. The token experienced a decline of approximately 3% over the past week. Its market capitalization stands at $1.86 billion, with the entire supply already in circulation.

Recent reports highlight weakening momentum following an extended drawdown. Analysts have observed increasing exchange inflows and patterns that could prolong the decline, with some suggesting the token remains vulnerable after falling more than 80% from its peak last year. Despite this, community sentiment remains positive, and integration updates, such as support from Teller Lending Protocol, have helped stabilize short-term trading. For traders seeking substantial upside potential, such as 100x gains or more, exploring projects like DeepSnitch AI, whose presale momentum suggests significant future success, may be a more viable strategy.

PEPE – 1-Year Market Structure Analysis

The one-year chart for PEPE depicts a persistent macro downtrend, characterized by a consistent series of lower highs and lower lows that have driven the token from the $0.00043 region down toward the $0.000055 zone. Early in the year, PEPE attempted several relief rallies, but each upward movement failed to break its descending resistance structure, confirming continuous seller control.

By mid-year, the token entered a prolonged consolidation phase between approximately $0.00009 and $0.00013, indicating a temporary stabilization but not a true accumulation pattern. A brief breakout attempt late in the summer pushed the price back toward $0.00015, yet this move was quickly rejected, reinforcing a broader bearish market structure. Throughout autumn and into winter, PEPE's price gradually declined, losing key support levels and trending toward the lower boundary of its yearly range. Trading volume during this decline has remained relatively soft, suggesting a slow, structural unwind rather than a capitulation event. Overall, the chart illustrates a year defined by consistent downward pressure, with no confirmed reversal signals emerging from the current price action.

Verdict

DeepSnitch AI emerges as a compelling option in a market where major firms are adopting cautious strategies, and traders are actively seeking early-stage opportunities with growth potential.

With its presale currently at $666,000, even moderate demand can significantly influence pricing, a dynamic not available to large-cap tokens like PENGU and PEPE. The project's 70% rise thus far demonstrates clear interest building ahead of its launch.

Given the strength of the DeepSnitch AI price prediction, early investors are anticipating it to be a leading gainer in 2026.

FAQs

Is DeepSnitch AI a good investment?

Many view DeepSnitch AI as a strong early-stage opportunity due to its practical utility and continued traction in its presale. The rising DeepSnitch AI price prediction reflects investor interest in a project designed to facilitate better decision-making through clearer data analysis.

What is the best AI crypto prediction by 2030?

Forecasts vary, but several analysts predict that AI tokens with practical use cases will lead the sector. The DeepSnitch AI forecast stands out due to its combination of on-chain analysis tools and early growth potential.

Which AI can predict crypto prices?

While most tools offer trend indicators, few provide structured risk assessments. DeepSnitch AI's focus on contract and developer analysis directly supports the DSNT long-term outlook more effectively than simple price indicators.